Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2019

By Tim Zawacki

Editor's note: Columbus Life Insurance Co. disclosed subsequent to the initial publication of this article that its original third-quarter statutory statement misstated direct premiums and considerations for certain business lines. The magnitude of the change reflected by the company's amended results produced a material impact on the U.S. life industry's ordinary individual annuity considerations for the third quarter and the year-to-date. The text and charts in this article have been adjusted as of 6:15 p.m. ET on Dec. 6, 2019, to remove Columbus Life from the industry aggregates for all prior periods, but the data is otherwise presented as it was available on Nov. 21, 2019.

A strategic shift by a company that has long ranked as the No. 1 U.S. variable annuity producer has positioned the life and annuity industry to exceed S&P Global Market Intelligence's full-year premium growth projections.

Direct ordinary individual annuity premiums and considerations at Jackson National Life Insurance Co. surged more than 52.7% year over year to $5.26 billion, their highest third-quarter level in seven years, due to sales growth in the company's fixed annuity products. The company's direct ordinary individual annuity considerations increased 15.1% on a year-to-date basis.

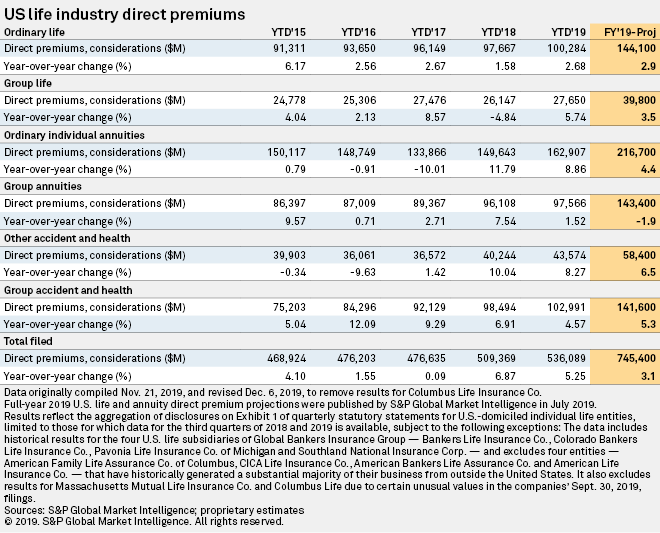

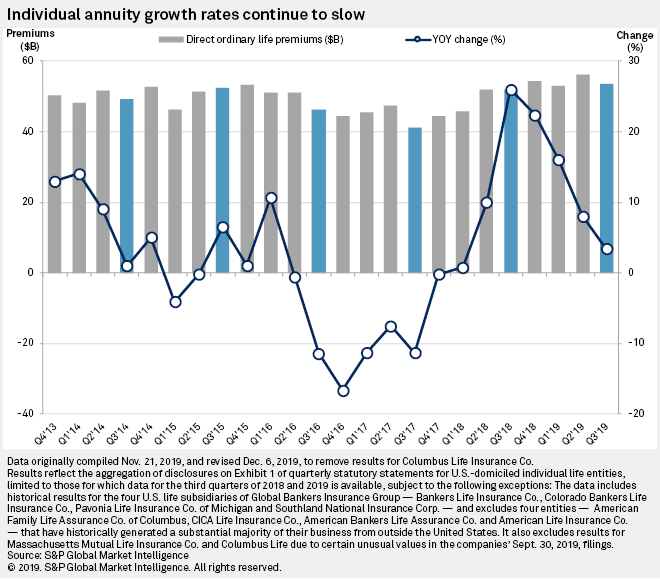

A preliminary analysis of the industry's results for the period ended Sept. 30 finds that direct ordinary individual annuity considerations increased 3.4% in the third quarter and 8.9% for the first nine months of 2019. The rate of change in the third quarter would have been modestly negative in Jackson National's absence, and the year-to-date growth rate would have totaled 8.4%. Across life, annuity and accident and health lines of business, U.S. life insurers generated growth in direct premiums and considerations of 4.5% for the quarter and 5.2% on a year-to-date basis.

S&P Global Market Intelligence issued projections in July that called for full-year 2019 growth of 4.4% in direct ordinary individual annuity considerations and 3.1% in overall life, annuity, and accident and health premiums and considerations. The projections contemplated a decline in ordinary individual annuity growth rates between 2018 and 2019 as the industry benefited in 2018 from unusually easy year-over-year comparisons and the final resolution of uncertainty surrounding the U.S. Labor Department's fiduciary rule. We anticipated that lower interest rates would present additional challenges in the second half of the year.

The results referenced in this article generally reflect the aggregation of disclosures on Exhibit 1 of quarterly statutory statements for those entities for which data for the third quarters of 2018 and 2019 is available. Consistent with the methodology employed in our projections, the results exclude four entities that have historically generated a substantial majority of their business from outside the United States. While third-quarter 2019 results are not expected to be available for all four Global Bankers Insurance Group LLC companies that were placed into rehabilitation earlier in the year, their historical data is included due to the substantial premium writings attributable to certain of them in the third quarter of 2018 and our having accounted for a likely dramatic decline in their writings in our projections. Massachusetts Mutual Life Insurance Co.'s results are excluded from the values referenced in this article due to unusual changes the company's year-to-date ordinary and group life premium volumes in its June 30 and Sept. 30 statutory filings about which a spokeswoman declined to comment. Columbus Life's results are also excluded.

Success in diversification

Jackson National retained its position as the No. 1 U.S. seller of variable annuities during the first three quarters of 2019, according to survey data compiled by the LIMRA Secure Retirement Institute, based on production of $11.01 billion for the period. It ranked as the No. 12 seller of fixed annuities with production of $3.34 billion, up from 16th in the first half of 2019.

Jackson National offers fixed index annuities under the MarketProtector brand and a range of fixed annuities that contain a variety of guarantee choices and benefit options, including its RateProtector product and MAX suite of annuities. As previously reported, the company is pursuing growth through both organic and inorganic means to increase diversification and to support its ability to generate cash on behalf of parent Prudential PLC. Extrapolating LIMRA survey data for the year-to-date periods ended June 30 and Sept. 30 to estimate third-quarter sales volumes, it appears that fixed annuities expanded to account for more than one-third of Jackson National's total annuity sales as compared with an estimated 4% in the same three-month stretch in 2018. Estimated fixed annuity sales of $1.97 billion in the quarter marked an increase of nearly 1,070% from the year-earlier period. The growth rate is lower, but still exponential, for the first three quarters of 2019 at 522% to $3.34 billion. The company's variable annuity sales fell by 8.1% for the quarter and 14.1% for the first nine months of the year, according to calculations based on LIMRA survey results.

Overall, LIMRA survey data show that variable annuity sales grew 6% in the third quarter while fixed annuity sales slipped 3% despite Jackson National's rapid expansion. The rate of decline in fixed annuity production would have exceeded 11% in the company's absence, according to estimates based on the survey results.

Even when incorporating Jackson National's outsized growth in statutory results, the downward trend in rates of ordinary individual annuity expansion persisted. The third quarter's growth rate was the slowest posted by the industry since the first quarter of 2018, and the absolute amount of third-quarter considerations of $53.57 billion marked a 4.7% sequential decline from the second quarter.

All else being equal, direct ordinary individual annuity considerations would be on pace to grow by just under 5% in full-year 2019 should they experience a comparable sequential decline between the third and fourth quarters.

Boom and bust for pension buyouts

Direct group annuity considerations staged something of a comeback in the third quarter after a relatively sluggish first half of 2019. Year-over-year growth of 6.3% in the third quarter to total direct considerations of $33.69 billion compared favorably to declines of 9.2% in the second quarter and 0.8% in the first half of 2018.

Athene Holding Ltd.'s Athene Annuity & Life Co. was almost entirely responsible for the third quarter's expansion as its group annuity considerations surged $1.96 billion to $2.43 billion. The company closed on a large transaction involving the transfer of the U.S. pension plan obligation of Bristol-Myers Squibb Co.

Pension risk-transfer deals are typically effected through the issuance of a single-premium group annuity contract, which can be quite large. As such, the business line is subject to particular volatility from quarter to quarter. The LIMRA Secure Retirement Institute's group annuity survey put sales of single-premium pension buyouts at $7.73 billion in the third quarter, up from $6.29 billion a year earlier. Buyouts rose 4.6% in the first three quarters of 2019, according to the survey.

Athene President William Wheeler said during a November conference call that the company's pension risk-transfer volume exceeded $5 billion on a year-to-date basis, which was nearly 2x its year-ago volume. At the same time, he cautioned, "While the fourth quarter is typically seasonally strong for [pension risk-transfer] and we're continuing to be active in bidding for new business, we expect activity will normalize in the near term coming off the third-quarter high."

The surge in group annuity writings at Athene offset a year-over-year decline in direct considerations in the business line for Prudential Insurance Co. of America of $2.08 billion to $2.33 billion. Prudential Financial Inc. did not close any pension risk-transfer deals in the third quarter, Vice Chairman Robert Falzon said during a November call. Lower interest rates also impacted plan funding levels, he added. But, he said, "the fourth quarter has started well, and we have a solid pipeline of pending transactions."

S&P Global Market Intelligence projected a full-year 2019 decline in direct group annuity considerations of 1.9%, reflecting in part a difficult comparison triggered by a second-quarter 2018 pension buyout transaction involving MetLife Inc. and FedEx Corp. There is also a challenging comparison looming in the fourth quarter as LIMRA survey data put pension buyout sales in the closing three months of 2018 at $10.49 billion. Were direct group annuity considerations to hold steady at the third quarter's level, it would imply a full-year decline in business volume of about 2.8%.

Growth accelerates, slows in other lines

Direct ordinary life premiums and considerations expanded 2.8% in the third quarter and 2.7% for the first nine months of 2019, not far removed from S&P Global Market Intelligence's projection for full-year growth of 2.9%. Year-to-date group life premium growth of 5.7% is tracking well ahead of the full-year projection for an increase of 3.5%. The quarterly and year-to-date growth rates in the ordinary and group life business compare quite favorably to much more sluggish results in the respective year-earlier periods.

Year-to-date growth rates in the other and group accident and health lines trended in the inverse direction, declining to 8.3% and 4.6%, respectively, from 10% and 6.9%. S&P Global Market Intelligence projected full-year growth rates of 6.5% in other accident and health and 5.3% in group accident and health.