Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 28, 2023

By Ben Herzon and Lawrence Nelson

Federal Reserve Chair Jay Powell, in strong and direct language, reiterated the Fed's commitment to bring inflation down to its 2% target in his remarks to the annual monetary policy conference hosted by the Kansas City Fed at Jackson Hole, Wyoming. He concluded his speech with this quote: "We will keep at it until the job is done."

These comments came in a week that brought further evidence that growth is not cooling rapidly enough and, in Powell's words, "has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust." We raised our tracking estimate of third-quarter GDP growth at the end of last week. Above-trend growth would lead to further labor-market tightening, not the easing that is widely believed necessary to complete the job of reining in inflation. Something's got to give.

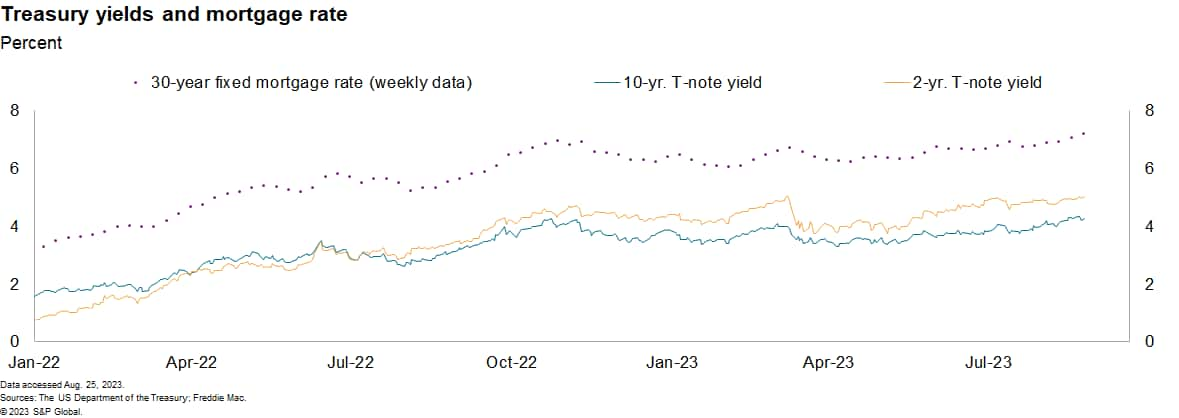

Powell noted that, "Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response." So, the risks remain tilted toward a further tightening of financial conditions. We expect another quarter-point tightening at the November policy meeting, but an earlier move at the September meeting is possible, and a further tightening cannot be ruled out. Financial markets edged in this direction this week. Financial futures have raised the odds to roughly 60% that coming out of the November policy meeting the Fed funds target range will have been raised at least 25 basis points. In recent weeks the 10-year Treasury note yield has jumped to roughly 4.25%, pushing the conventional 30-year mortgage rate to 7.23%, the highest in 22 years.

The rise in mortgage rates is definitely cooling housing markets. This is most evident in existing home sales, which are down about a third from the peak in 2022. New home construction and sales have fared better over the same period, but with construction financing costs high and rising, and mortgage rates at multi-decade highs, we expect new home construction to soften in the near-term. That will impart some drag to GDP growth. Consumer spending has surprised to the upside but higher loan rates on consumer durables, an expected slowing in employment gains, and a resumption of student loan payments constitute headwinds that we expect will slow consumer spending growth going forward.

Strength on the production side of the economy is keeping labor markets tight. Initial and continuing claims for unemployment insurance show little evidence of easing conditions. There have been improvements on the supply side of the market, as well as some evidence of softening demand. This has allowed wage gains to slow but to levels still well above a pace consistent with 2% inflation. After accounting for the uncertain lags from prior policy tightening to economic growth and inflation, it may still be likely that additional rate hikes will be necessary.

This week's economic releases:

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.