Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 17, 2023

By Ben Herzon and Lawrence Nelson

While last week was relatively light for data releases with direct implications for our GDP tracking, there were several noteworthy releases on inflation.

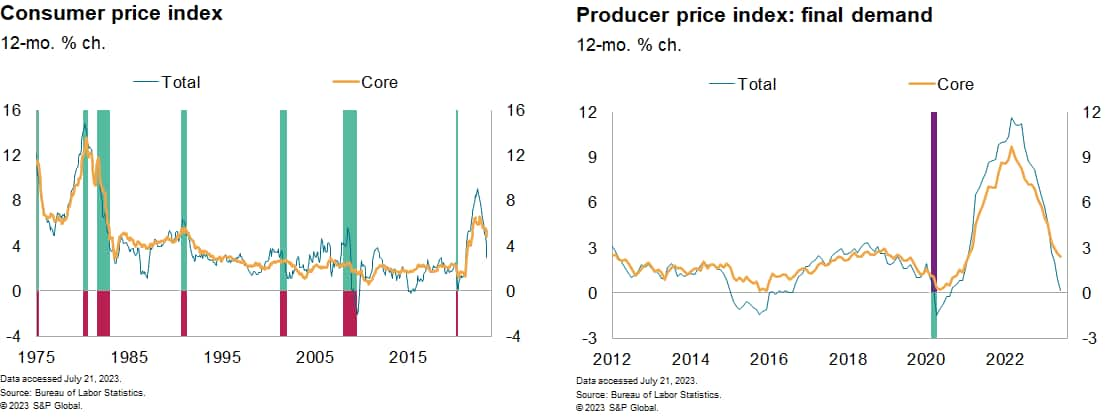

Consumer prices continued to moderate through June, with the 12-month change in the headline consumer price index easing to 3.0%, the lowest reading since March 2021 and well below the recent peak of 9.1% last June. The recent softening in the headline index in part reflects the softening in energy prices relative to peak prices last summer (the CPI for energy is down 16.7% from last June).

Excluding the effects of changes in food and energy prices, "core" consumer prices are also easing, although at a slower pace: The 12-month change in this measure dropped 0.5 percentage point in June to 4.8%, the lowest reading since October 2021. Based on our processing of the CPI data for June, we estimate that the core price index for personal consumption expenditures rose 0.2% in June and that its 12-month change edged down 0.1 percentage point to 4.5%.

Producer prices also continued to moderate through June, as did the prices of imports and exports. Short-term inflation expectations in the University of Michigan Consumer Sentiment Survey ticked higher in July, although they remain well below the peak early last year. Long-term inflation expectations also edged higher and remain within the range they have fluctuated within for the past 18 months.

A cool Fed

The Federal Open Market Committee (FOMC) will meet in a little under two weeks' time with their next policy decision to be announced July 26. The blackout period for communication from participants prior to that meeting began July 15, meaning they will not have had much time to communicate how they are reacting to this week's inflation data.

Although the news was generally good on the inflation front this week, policymakers have emphasized throughout this tightening cycle the importance of not overreacting to a single month's worth of data. This very sentiment has been expressed by those on the Committee we have heard from in the past couple days — President Mary Daly of the San Francisco Fed and Governor Christopher Waller. They will be wary of easing off the brake prematurely, as allowing inflation to re-emerge would ultimately require an even more punitive policy response than would otherwise be necessary.

We expect the FOMC to raise its policy rate by another 25 basis points at the upcoming July meeting, then skip again in September before hiking one last time by another 25 basis points in November, bringing the funds rate to a range of 5.50-5.75%. Rate cuts are unlikely to occur until late spring of 2024.

This week's economic releases:

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.