Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Aug, 2022

By Thomas Mason

Introduction

As insurtech startups shift focus from growth to profitability, one of their common targets for expense reduction has been headcount. Sales and marketing could be next, as discussed in S&P Global Market Intelligence's 2022 U.S. Insurance Technology Market Report.

Insurtech stocks have taken a beating, causing startups to focus on profitability instead of supercharged revenue growth. Many companies, both public and private, have announced layoffs, and we expect advertising to be another target for cuts. This could be particularly troubling for startups that use a direct distribution model, which has traditionally relied heavily on advertising for customer acquisition. For the most part, we think insurtechs will leave tech spending alone. As the industry shakes out, however, companies might increasingly pick their spots.

Based on media reports, numerous startups across the insurtech industry have done layoffs in the past few months. We expect this trend to continue, as companies right-size their operations to meet the tempered growth expectations of investors.

Judging by public company disclosures, some insurtech companies boosted headcount significantly in 2021, possibly in response to consumers using digital channels more amid the pandemic. Full-stack homeowners insurer Lemonade Inc. nearly doubled its full-time equivalent employees, and GoHealth Inc., a digital marketplace for health insurance, recorded an increase of approximately 78%.

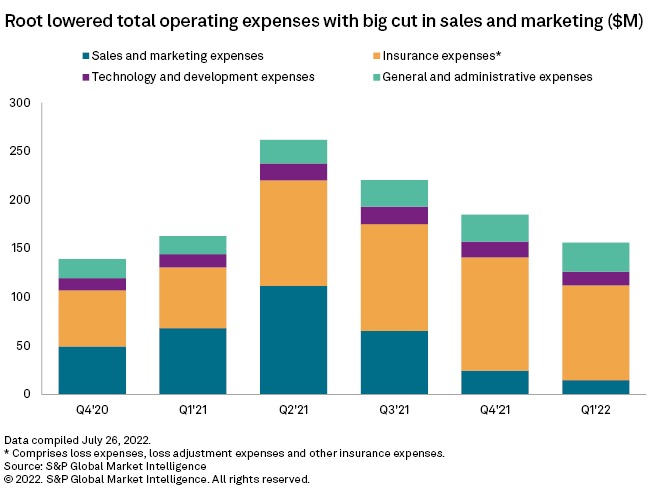

Another likely target for expense cuts, in our view, is sales and marketing. We anticipate insurtechs will pull back on their ad spending in 2022 and perhaps beyond. Root Inc., a full-stack personal auto insurtech that offers telematics, has already done so, slashing sales and marketing expenses by about 79% year over year in the first quarter of 2022.

Some of the biggest players in the personal auto insurance market have likewise been spending less on advertising, according to an analysis from S&P Global Market Intelligence in April. Based on statutory statements, GEICO Corp., State Farm Mutual Automobile Insurance Co. and The Progressive Corp. all reported lower advertising expenses in 2021 versus 2020. Progressive has, however, begun to increase activity in certain local markets where it believes it has achieved rate adequacy. The Allstate Corp. increased ad spend in 2021 but said Aug. 3 that it intended to cut back.

Legacy carriers pulling back would normally present an opportunity for insurtech startups to steal market share. But since insurtech startups are now intensely focused on profitability, we think many will cut back on ads, too. As they look for ways to reduce costs, marketing will likely stand out as an expense item that can be dialed back.

Like the publicly traded companies, private insurtech startups seem to be focusing on profitability as well. Ethos Technologies Inc., Next Insurance Inc. and Policygenius Inc., to name a few, are still private and have all reportedly announced layoffs. Private startups that raised venture capital will need to provide an exit for those investors at some point, which might be causing the startups to tighten their belts.

In the short term, we expect insurtechs will avoid cutting tech spending too much. Technology is often not the biggest expense item for publicly traded insurtech startups, and despite being a short-term expense, some tech investments can lower costs in the long run by automating processes and improving models. Insurtech companies likely also view tech spending as fundamental to their mission.

Longer term, though, we foresee some decline in tech spending due to industry consolidation. Companies will probably start to specialize in specific areas of the market, fortifying operations that align with the core focus and divesting ones that do not.

For instance, after acquiring personal auto insurtech Metromile Inc., Lemonade immediately divested Metromile's Enterprise Business Solutions unit, which provides claims automation and fraud detection to carriers. Lemonade found a buyer in EIS Group Inc., which specializes in enterprise software and cloud solutions for insurers. Assuming the trend plays out, other business-to-business insurtech companies, like Socotra Inc., Guidewire Software Inc. and Duck Creek Technologies Inc., should benefit from reduced competition.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.