Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Aug, 2022

By Thomas Mason

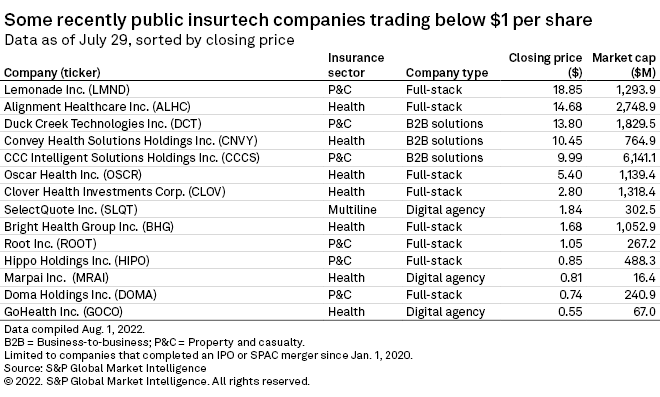

GoHealth Inc. and Hippo Holdings Inc. are considering reverse stock splits to prevent their stocks from being delisted, and we think a few other public insurance technology companies might do the same. This and other topics are explored in S&P Global Market Intelligence's 2022 U.S. Insurance Technology Market Report.

Reverse stock splits could buoy insurtech stock prices in the near term, but the long-term fate of some publicly traded insurtechs seems highly uncertain. Assuming investors remain bearish on growth stocks, a publicly traded insurtech startup's best bet might be to find a well-capitalized acquirer.

Private companies will likely stay private longer, attempting to wait out the downturn, and might consider sales as well. They might balk, however, at potential buyers not valuing them as highly as their venture capital investors.

GoHealth, a digital marketplace focusing on Medicare policies, received notice of potential delisting from the Nasdaq on May 25. Hippo, a full-stack company focused on homeowners insurance, said it received one from the NYSE on July 19. Both companies have seen their stocks hit hard since going public, and they are not alone. Doma Holdings Inc. and Marpai Inc. have also dipped below $1 per share multiple times and could face delisting notices if they continue to trade below $1 per share consecutively for 30 trading days.

Doma is a full-stack title insurer, and Marpai is a third-party administrator of self-funded health plans. Metromile Inc., a full-stack personal auto insurer, was trading below $1 per share, but full-stack homeowners insurer Lemonade Inc. acquired the company, rendering the delisting issue now moot.

Hippo will hold a special meeting of stockholders Aug. 31 to discuss a reverse stock split in the range of 1-for-20 to 1-for-30, the company said July 19. This would immediately boost the stock price anywhere from $17.00 per share to $25.50 per share, based on Hippo's July 29 closing price. Those ratios seem high relative to its special purpose acquisition company merger in April 2021, which implied a per-share price of $10.

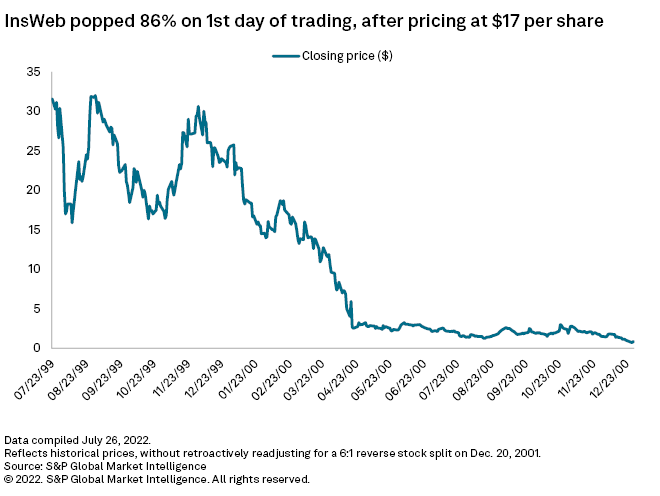

Reverse stock splits are generally not an encouraging sign for investors. But there is at least one historical precedent for the strategy keeping the company afloat: InsWeb. Founded in 1995, InsWeb was a pioneer in online insurance sales, operating a comparison-shopping site for a variety of lines. Like today's startups, InsWeb lined up big-name investors, including Japanese conglomerate SoftBank Group Corp., software maker Intuit Inc. and insurance carriers Nationwide Mutual Group and CNA Financial Corp.

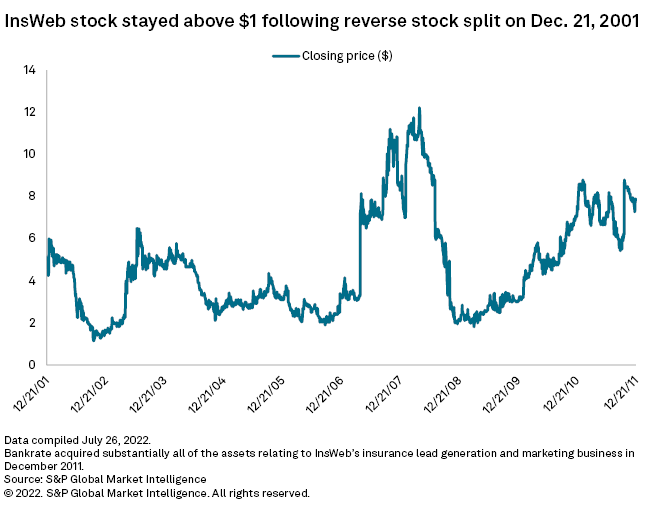

InsWeb completed an initial public offering July 23, 1999, with shares nearly doubling on the first day of trading. But by the end of 2000, its stock was below $1 per share as investors panicked over the sky-high valuations and lack of profitability of many tech companies. InsWeb did a 6:1 reverse stock split in December 2001, which pulled the stock back up to about $5 per share.

InsWeb remained independent for another decade, then struck a deal in December 2011: Bankrate Inc. agreed to pay $65 million for substantially all the assets of its lead generation and marketing business. This was a far cry from InsWeb's $886.2 million market cap at the end of 1999. But, to InsWeb's credit, the company managed to survive both the dot-com crash and the financial crisis of 2008 on its own.

At the same time, we think today's insurtech companies should try to line up well-capitalized buyers. As we have written about previously, Esurance Insurance Co. — another pioneer of online insurance sales — found an emergency buyer in October 2000. Folksamerica, a White Mountains Insurance Group Ltd. subsidiary, paid only $9 million for an 80% interest, then sold the company 11 years later to The Allstate Corp. in a $1 billion deal that also included brokerage Answer Financial.

Today's acquirers could buy many publicly traded insurtech companies for a discount. But a trio of private insurtechs have, curiously, seen their valuations increase of late. Coalition Inc., a San Francisco-based digital agency focused on cyberrisk, said July 8 that it raised a round valuing the company at $5 billion, a more than 40% increase from its $3.5 billion valuation in September 2021.

While Coalition might seem like an exception due to the growth of cyber insurance, there have been two other examples of valuations increasing. Berlin-based wefox Germany GmbH — a B2B platform that provides technology solutions to agents — said July 12 that its valuation increased to $4.5 billion from $3 billion in its latest funding round; Ethos Technologies Inc., a digital agency offering life insurance, said July 21, 2021, that its D-1 round valued the company at $2.7 billion, up from a $2 billion valuation in May 2021.

It is difficult to say what drives those private-company valuations higher. Some venture capital investors might think their portfolio companies are exceptional, public valuations will rebound by the time they exit or their portfolio companies can fetch a lofty price tag in a merger. Ultimately, private-company valuations are intangible, and there is no reason they must reflect public-company valuations.

But if venture capital firms want their portfolio companies to do an IPO, direct listing or SPAC merger, they will have a tough time convincing the public market that their valuations are realistic. Potential acquirers of insurtech companies might also be skeptical.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.