Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 12, 2021

US equity investors' risk appetite has picked up in October from the one-year survey low seen in September, but remains subdued compared to earlier in the year as investors cite concerns over the political environment and perceive waning equity market support from monetary and fiscal policy.

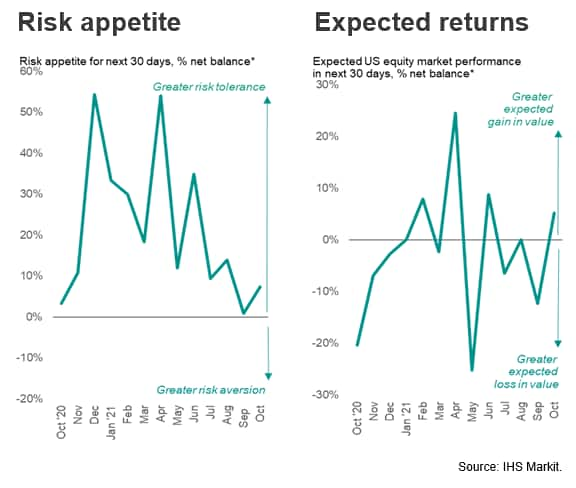

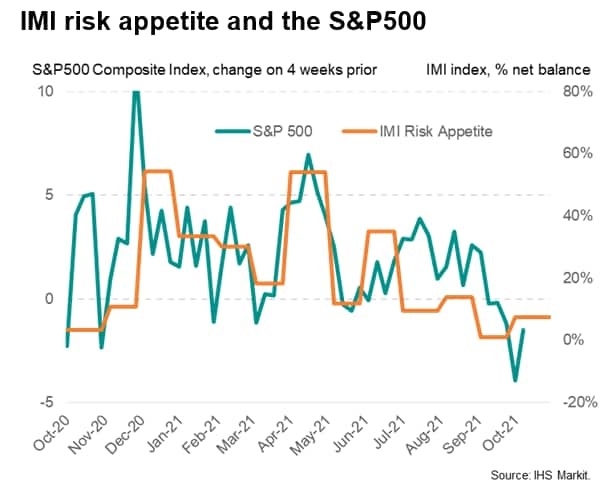

The Risk Appetite Index from IHS Markit's Markit's Investment Manager Index™ (IMI™) monthly survey, which is based on data from around 100 institutional investors, has risen to +7% in October from +1%, but that compares with a peak of +54% back in April to signal an ongoing cautious mood.

Some improvement in near-term returns is anticipated, however, boding well for the market heading into November. The survey's Expected Returns Index had fallen to -12% in September, presaging a period of US equity markets trending lower, but has now risen to +5%, its highest since June and meaning more investors see returns rising in the next 30 days than anticipate a decline.

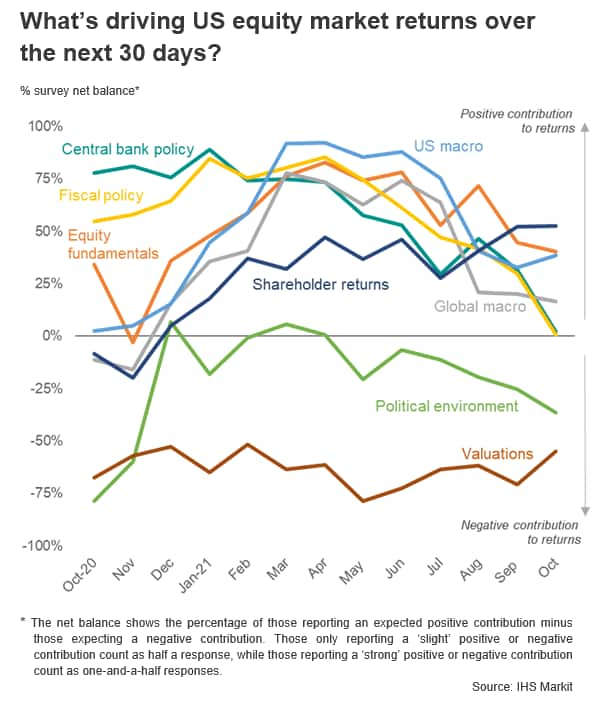

The improvement hints at investors taking advantage of lower prices, which is corroborated by signs of fewer concerns over valuations in the October survey. Despite easing, worries about valuations nevertheless remain the biggest perceived drag on the market in October, followed by the political environment, which has become more of a perceived detriment. Political concerns are linked to worries over the debt ceiling in the US, increased regulation and geopolitical uncertainty, notably in relation to China.

However, when comparing how the perceived drivers have changed over the past year, it is central bank policy that has seen the largest pull-back in sentiment, falling even further in October to hit a new survey low. Similarly, investor perceptions of how government fiscal policy can help drive the market have also fallen to a new survey low and - like monetary policy - is seen as providing only marginally positive support to US equities over the coming month.

Views on the extent to which the domestic and global macroeconomic environments will help drive market returns have likewise been pared back markedly compared to the strong contributions to returns seen earlier in the year.

Shareholder returns are meanwhile considered the strongest driver of the market over the coming 30 days for the second month running, followed by equity fundamentals.

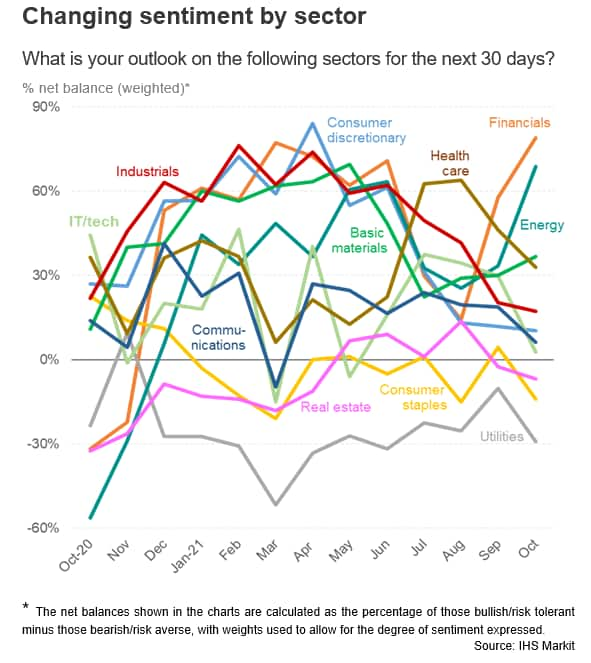

The positive views on shareholder returns, which hit a survey high in October, have played a role in driving financial stocks to the top of the sector preferences for the next 30 days, followed closely by energy names. The outlook for the latter has also been buoyed by recent surging spot prices for energy.

An easing of COVID-19 worries has, however, driven sentiment lower for healthcare and consumer staples.

The outlooks for industrials and consumer discretionary stocks have meanwhile fallen to the lowest yet recorded by the survey, in part reflecting ongoing concerns over supply chains and the macroeconomic outlook.

However, it was the tech sector which saw the biggest negative change in outlook in October compared to the prior survey, with sentiment down to the lowest since May.

Global perspectives

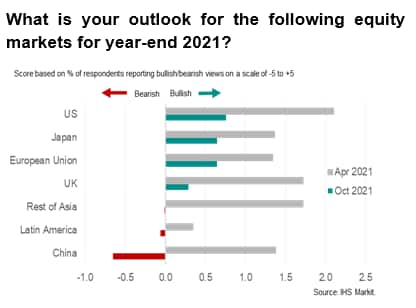

This subdued level of risk appetite evident in October compared to earlier in the year corresponds with a marked pull-back in investors' expectations of year-end equity market performance over the past six months. While the US is seen to be the best performing equity market in 2021, followed by Japan and the EU, sentiment towards all three has fallen compared to April. The UK market's expected performance has meanwhile slipped behind the other developed markets, while investment managers have now taken a bearish view towards China and, to lesser extents, Latin America and the rest of Asia.

The pull-back in year-end expectations for equities and recent rise in commodity prices means commodities have now overtaken equities as the broad asset class that investment managers are most bullish about, while survey respondents continue to hold bearish views towards corporate credit and sovereign debt.

For a copy of the full report and data, please contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location