Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Sep 08, 2023

By Matt Chessum

H1 2023 recorded the second highest half year securities lending revenues to date. $7.02B was generated, $5.394B of which was produced by the lending of equities. During the first six months of the year, as during the past eighteen months in particular, the lending of US equities has been an important contributor to these overall revenue numbers (48% of H1 equity revenues).

The US economy has experienced a very eventful eighteen months. It has experienced everything from banking collapses, AI mania, a narrow equity rally - which has stated to broaden out, a potential US debt ceiling cliff edge and a predicted, but never materializing recession. Despite all of this uncertainty, securities lending markets in the US remained remarkably robust. Uncertainty can sometimes be a double-edged sword for the securities lending markets as confidence and conviction remains key to ensuring that the conditions remain optimal for trade execution. If these precise conditions do not exist, then investors tend to sit on the sidelines awaiting market signals that strengthen conviction and momentum. Luckily, for both lenders and borrowers, market conditions were ripe for a bumper H1, especially in the US.

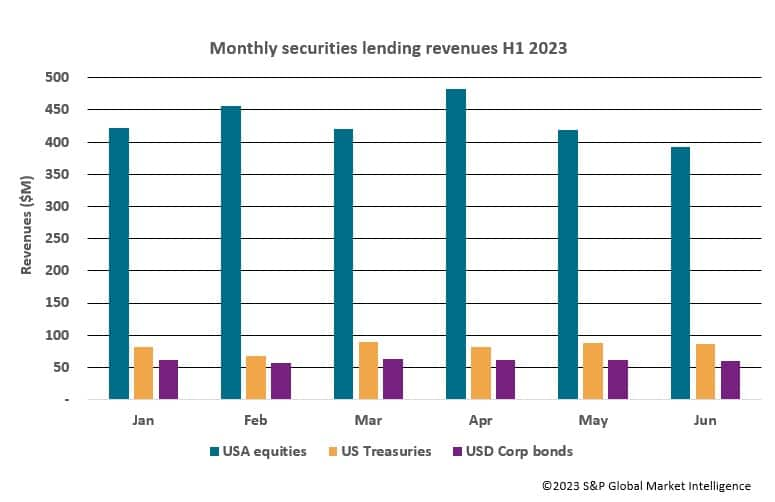

Over the six-month period, the lending of US equities generated an impressive $2.592B (Q1 $1.298B, Q2 $ 1.294B). This represents an increase YoY of 28% (H1 2022 $2.029B). When looking at the revenues produced over the period on a month-by-month basis, it's clear to see that there were three stand out months for US equities during H1. During January $421.8M was generated which represents a YoY increase of 84%, during February $456.9M was generated (+63.6% YoY) and during April $481.9M was generated (+43.5%). Over the six-month period, June was the only month that didn't exceed the previous year's revenues ($393M vs $466M -16% YoY). The average increase in revenues over the period was an impressive 35% YoY.

The momentum provided by the numerous market events that took place throughout H1 helped to cultivate an exceptionally healthy specials market in the US (at S&P Global Market intelligence, the specials market is defined by the lending of a security at a fee greater than 500bps). US equity specials generated $2.049B in revenues over the course of the first six months of the year. To put this in context, this represents a 44% increase on 2022 (H1 2022 $1.4B, H1 2021 $1.29B, H1 2020 $1.185B). Over the course of H1, the highest specials revenue generating month for US equities was April when just under $393M was generated. During this month, 77% of all US equity revenues were generated by specials trading. Over the six-month period, an average of 78% of all monthly revenues were generated by specials, accounting for 3.2% (average) of all balances. For lenders of these assets, as long as any recall risk is effectively managed, this market has been very good at producing exceptionally strong risk adjusted returns.

During the H1 period, all of the top ten highest generating equities (across all regions) were US listed assets. AMC outpaced all of the other names, generating in excess of the $450M alone. AMC generated more than the next four highest revenue generating names combined over the H1 period (Beyond Meat BYND $126.63M, Lucid Group Inc LCID $116.71M, Upstart Holdings Inc UPST $93.38M, Gamestop Corp GME $76.96M). US equities have dominated the top revenue earning tables for many quarters. As markets continue to climb in the region and valuations reach levels not seen for many months, it is likely that this will continue going forward. The strength of the stock market coupled with higher valuations is also likely to provide fertile ground for the reemergence of initial public offerings (IPOs) and an increase in corporate activity heading into Q3 and Q4. This is likely to drive volumes in the securities lending markets higher as investors look to source liquidity and exploit any pricing differentials that may be generated from a change in corporate structures.

Across the fixed income markets both USD-denominated corporate debt and US Treasuries also experienced a very fruitful H1. Over the six-month period, the lending of US treasuries generated $493.6M representing an enormous 202% increase YoY. Revenues surpassed $80M during every month of H1 except for February when $67.5M was generated. US Treasuries experienced strong demand over H1 due to persistent interest rate hiking by the Fed and the uncertainty experienced by the ongoing discussions regarding the US debt ceiling. Over the period, T-Bills expiring towards the X-date, the date at which the US treasury would potentially run out of money to pay its bills, traded special, helping to boost revenues. Short-dated Treasuries remained popular dominating the highest revenue generating government bond tables over both Q1 and Q2.

In the corporate bond markets, the lending of USD-denominated investment grade and non-investment grade corporate bonds soared. Revenues reached $363.7M over H1 which represented an increase of 123% YoY. Q1 saw an increase in revenues of 146% YoY ($180.8M) and Q2 experienced an increase of 104% YoY (182.9M). Despite the increase in revenues, average fees were lower during every month of H1, standing at an average of 47bps over the six-month period. Balances significantly increased YoY however which helped to push revenues higher (average YoY increase of 197% per month during H1). Corporate bonds continued to be affected by both changes in treasury yields, a lack of market liquidity, and some specials activity related to refinancing and company news was seen.

The latest World Flash report produced by S&P Global Market Intelligence states that heading into H2, despite resilience in US economic data and a disinflationary trend within the US economy, the leading indicators that remain consistent with an expansionary narrative are starting to lose momentum. It states that US hiking cycles have further to go as persistent inflation and resilience in labor markets are likely to compel to Fed to continue to tighten policy until it is convinced that inflation is back on target. It also states that recent disinflationary readings on US consumer data and producer prices are likely to be insufficient to sway policymakers from making two more 25bps hikes during 2023. Whilst consensus surrounding a soft landing for the US economy does appear to gather steam, it is not a forgone conclusion. Further uncertainty is likely to offer additional opportunities for both borrowers and lenders in the US. Securities lending revenues remain resilient and strong however and currently point towards all-time highs as we head into H2.

This article was first published on August 8th 2023 in Securities Finance Times Issue 333 based on the content provided by S&P Global Market Intelligence.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.