Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 23, 2023

Early PMI survey data for August signal a renewed contraction of the UK economy, as an increasingly severe manufacturing downturn is accompanied by a further faltering of the service sector's spring revival.

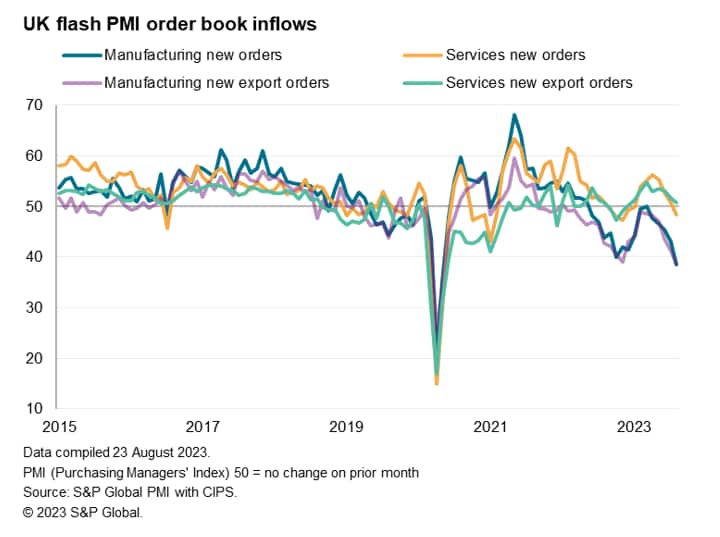

Companies are reporting reduced orders for goods and services as demand is increasingly hit by the cost-of-living crisis, higher interest rates, export losses and concerns about the economic outlook.

One upside is that the deteriorating demand environment has curbed companies' pricing power, resulting in a further cooling of inflationary pressures. A further pull-back in hiring also indicates that the labour market is losing steam, which should feed through to lower wage pressures.

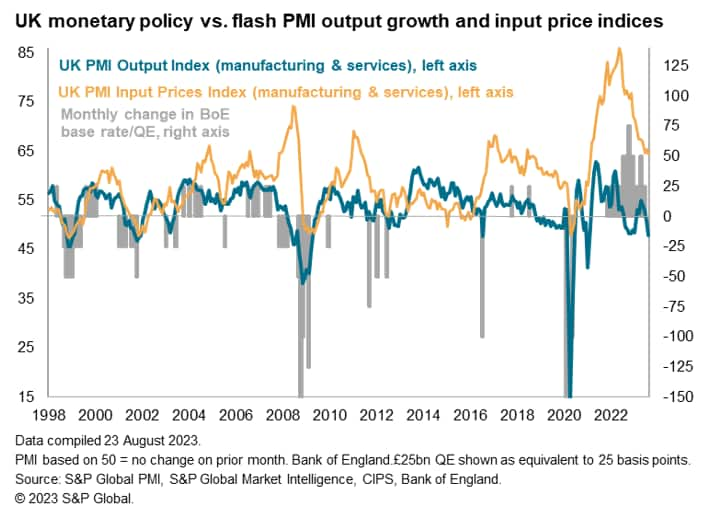

Inflation therefore looks set to continue to moderate in the months ahead, but the survey data indicate that the fight against inflation appears to be carrying a heavy cost in terms of heightened recession risks. Although further rate hikes by the Bank of England look inevitable, the bar to policy tightening looks set to rise as signs build of the economy contracting and the headline rate of inflation continues to cool.

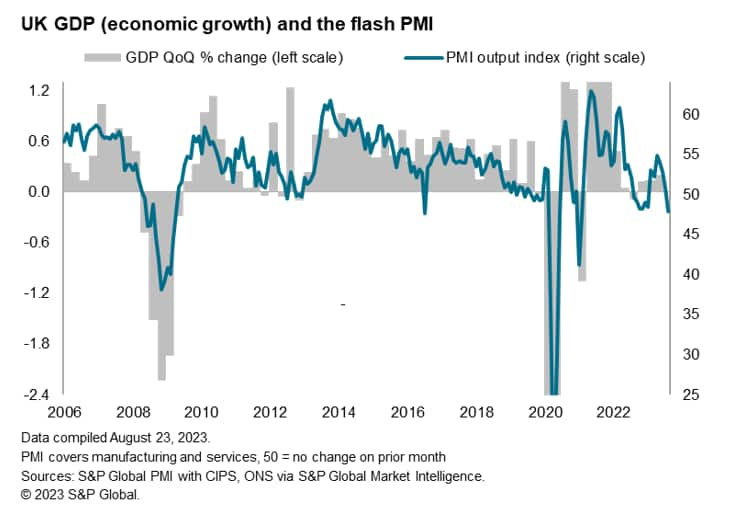

UK business activity contracted in August, ending a six-month period of expansion. At 47.9 in August, down from 50.8 in July, the headline seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index posted below the neutral 50.0 threshold for the first time since January.

The latest reading was the lowest since January 2021 and is broadly indicative of gross domestic product (GDP) declining at a quarterly rate of 0.3% in August. So far in the third quarter, the PMI data for July and August combined are consistent with GDP declining by 0.2%.

The survey data therefore suggest that the revival of economic growth in the second quarter, which had been correctly anticipated by the PMI and which saw GDP rise by 0.2%, has faltered, with an economic downturn in the third quarter now looking likely.

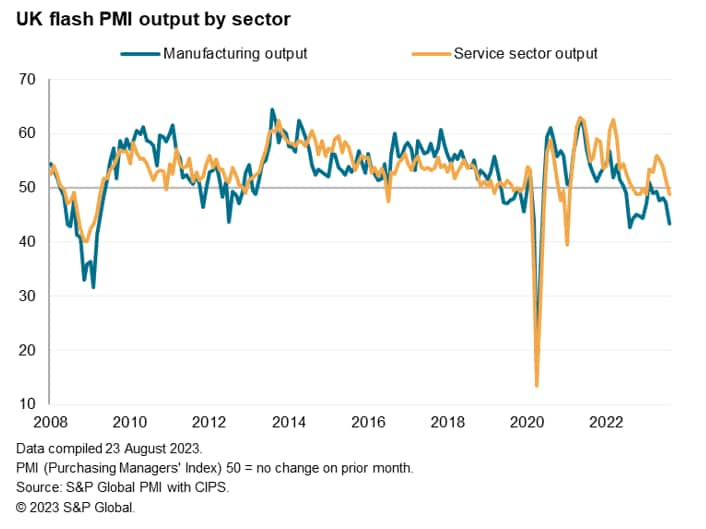

Lower levels of activity were recorded in both the manufacturing and service sectors during August. The service sector output decline was only marginal, but nonetheless the joint-fastest for 31 months (equalling the fall seen in January) and especially significant as this sector had been the driving force of the economic expansion seen in the second quarter.

Previously strong performances for financial services and consumer-facing services such as hotels and restaurants have shown signs of fading in the third quarter, accompanied by an increasingly steep decline in demand for business services.

Manufacturers meanwhile experienced a sharp and accelerated fall in production volumes, which extends the current period of decline to six months. To put the current plight of UK manufacturing in perspective, the decline in factory orders in August was the sharpest since 2009 barring the initial COVID-19 lockdown months. The resulting fall in output was also among the largest seen since the global financial crisis.

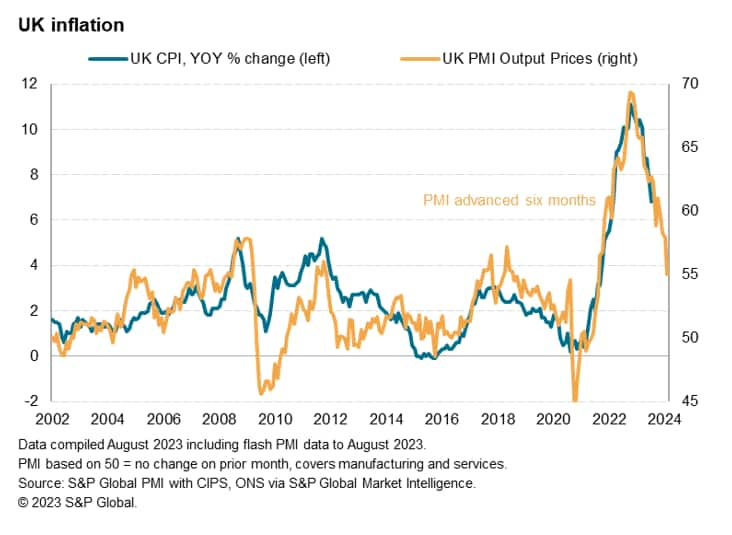

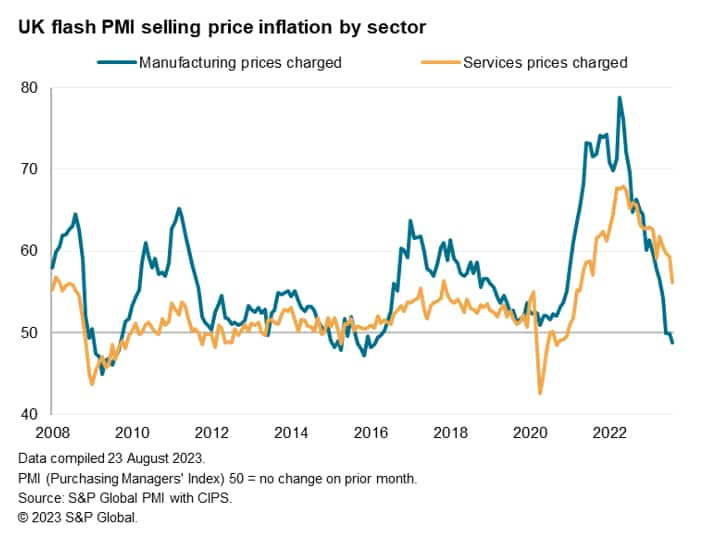

Inflationary pressures continued to moderate in August, with input costs rising at the slowest pace for two-and-a-half years. Average prices charged by UK private sector companies also increased at the softest rate since February 2021. Survey respondents suggested that they had adjusted their pricing strategies in response to weaker demand and falling input cost inflation. Average prices charged for goods at the factory gate fell at the sharpest rate since February 2016 and there was a notable downshifting in service sector selling price inflation to the lowest since April 2021.

The latest increase in average selling prices for goods and services is broadly indicative of consumer price inflation dipping below 4% at the turn of the year, given the survey's approximate six-month lead on annual percent changes in consumer prices.

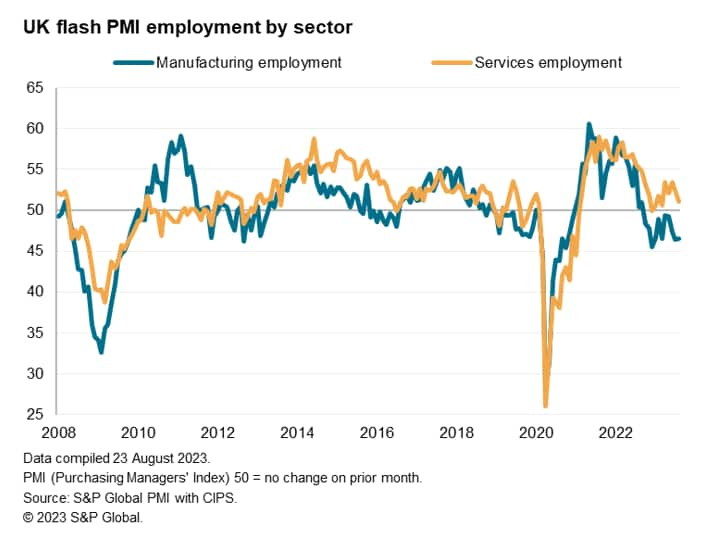

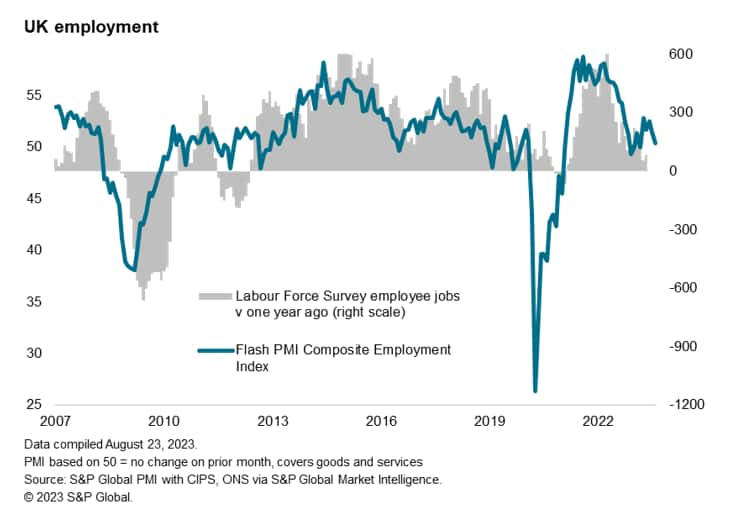

Although the survey found some stickiness of both input cost and selling price inflation linked to persistent wage pressures, August saw further signs of the labour market cooling.

Reports of excess capacity contributed to another round of job shedding in the manufacturing sector, while the spring resurgence in service sector hiring continued to fade, resulting in the smallest jobs gain in the sector since March.

Measured overall, private sector employment consequently rose only slightly and at the slowest pace for five months.

The flash August PMI data follow a further 25 basis point hike in interest rates by the Bank of England earlier in the month. The latest rise takes the main policy rate to 5.25%, its highest since 2008.

However, in the light of the latest survey data, further rate hikes have become harder to justify.

A key concern will be the persistent elevated readings for input cost inflation from the PMI surveys, which have held broadly static at a level well above the survey's long run average over the past three months. Much of this persistent input cost inflation is attributed by survey respondents to higher wage pressures.

On the other hand, the survey's selling price gauges continued to moderate in August, and are now indicative of consumer price inflation falling below 4% in the coming months. These reduced price pressures in part reflect greater difficulties in passing higher costs on to customers in the face of deteriorating demand conditions. Companies' order books are now contracting at a rate rarely seen over the survey's 30-year history, which is likely to weaken economic growth - and therefore pricing power - further in the coming months. As far as wage pressures are concerned, the survey points to a cooling of the labour market which should help moderate the recent rise in staff costs.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location