Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 24, 2023

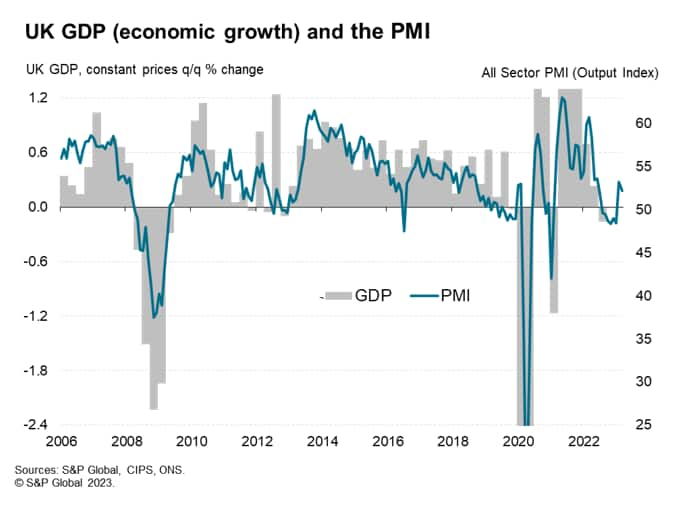

With the flash PMI surveys signalling a second month of rising output in March, the UK economy looks to have returned to growth in the first quarter. The surveys are broadly consistent with GDP growing at only a modest quarterly rate of 0.2%, but this represents a welcome expansion compared to the lack of growth seen in the second half of last year.

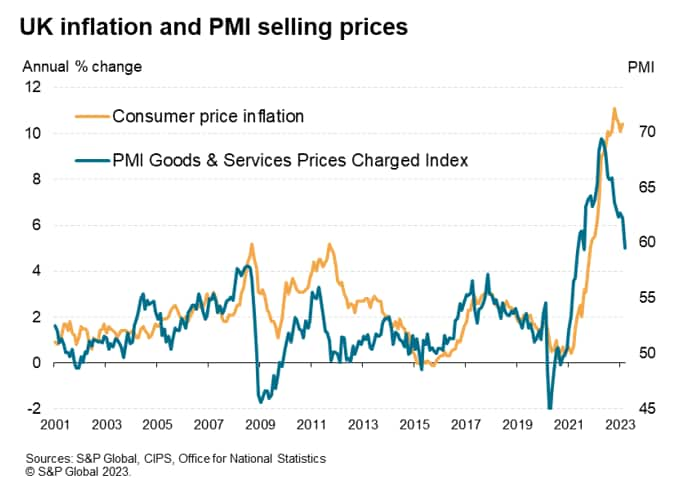

Further encouragement comes from new business growth accelerating further to the fastest since April of last year. More disappointingly, new orders growth was largely limited to the service sector and even here it seems that a lack of available staff meant this demand could not be fully met. The upshot of these constraints and labour shortages is of course more upward pressure on prices. Although the overall rate of inflation for goods and services has cooled further from the peaks seen in the spring of last year, in the immediate aftermath of the invasion of Ukraine, the rate of increase remains stubbornly higher than anything recorded by the survey in the two decades leading up to the pandemic.

However, the bigger picture is that the improvement in order book growth adds to signs that a near-term recession has been avoided, and an upturn in companies' expectations for the year ahead indicates that business sentiment has been little affected so far by the banking sector woes and that firms are more focused on growth possibilities.

UK business activity increased for a second successive month in March, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS, suggesting a modest growth revival after six months of continual decline prior to February. The composite PMI registered 52.2 according to the provisional data, down from 53.1 in February but nevertheless remaining above the 50.0 neutral level to indicate further expansion.

The latest reading is consistent with GDP growing at a quarterly rate of 0.2% after a 0.3% pace had been indicated for February. Coming on the heels of a modest decline in January, the PMI readings point to an economy growing in the first quarter by just under 0.2% after having stalled in the fourth quarter of last year and having contracted in the third quarter.

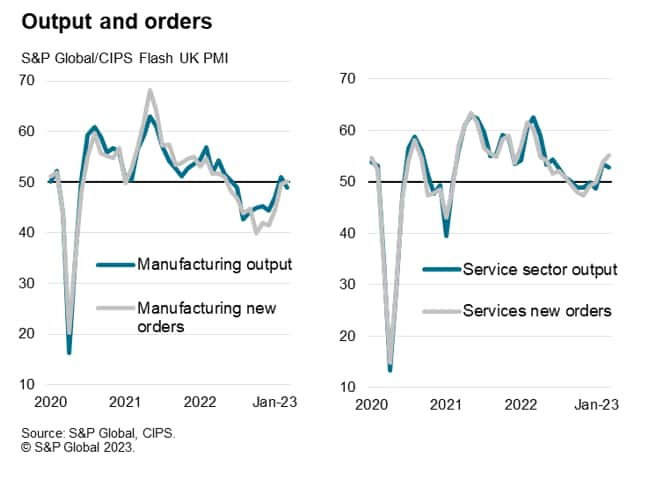

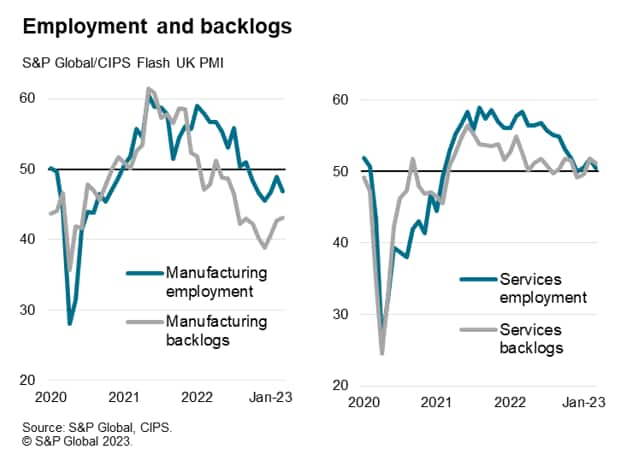

March's upturn was led by a second consecutive monthly expansion of service sector output, albeit with the rate of increase slipping from February despite an improved rate of new orders growth. Service providers suffered a lack of staff, which held back their ability to meet demand. Although employment rose across the service sector in March, the rise was only marginal and weaker than recorded in February. Backlogs of work consequently rose in the service sector for a second month in a row, underscoring the labour market constraint on the sector's expansion.

In manufacturing, the principal constraint on growth was a paucity of demand rather than a lack of workers. Output fell back into decline after having briefly returned to modest growth in February, as factories reported another steep drop in their backlogs of work. New orders rose only marginally in March, albeit signalling a welcome end to nine months of decline to suggest the downturn in demand may have halted, but stronger demand growth will likely be needed in the coming months to drive production growth.

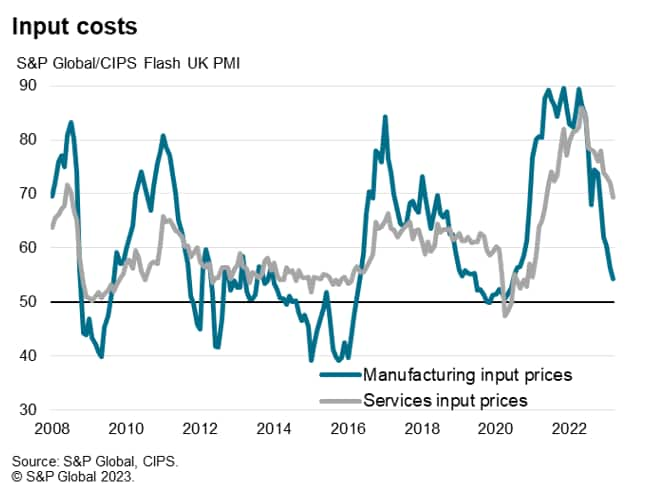

Cost divergences were also noteworthy across the sectors. Although slumping demand for raw materials and the steepest improvement in supplier delivery times since 2009 helped drive input cost inflation down in manufacturing, to the lowest since June 2020, service sector input cost inflation remained elevated, in part reflecting upward wage pressures.

Although the overall rate of service sector input cost inflation eased to the lowest for 22 months, unlike manufacturing it saw the rate of inflation continue to run at one of the highest levels seen in the survey's two-decade history.

The sustained upward pressure on costs fed through to higher prices charged for goods and services. While selling price inflation also cooled further from the peak seen in April of last year, the rate of increase remains highly elevated and indicative of consumer price inflation (CPI) running well above the Bank of England's 2% target in the near-term. However, the overall trajectory is one of slowing price increases, which should feed through to further CPI inflation moderation as the year proceeds.

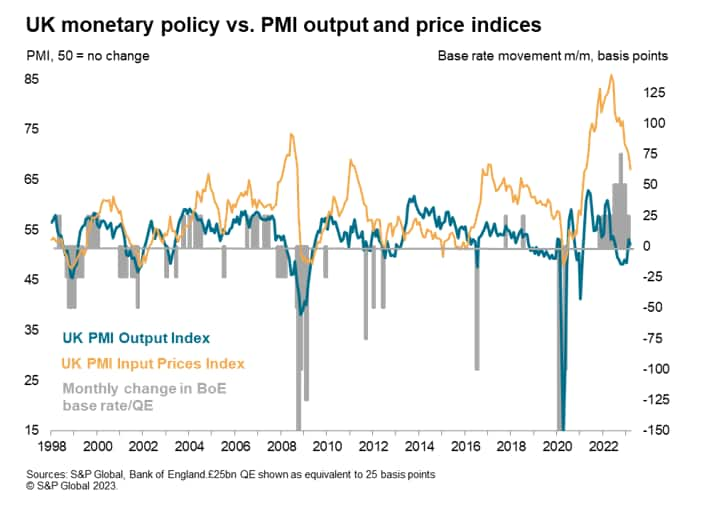

The survey findings added to the case for the Bank of England's 25 basis point rate hike rise in March, which took the Bank Rate to 4.25%, its highest since 2008. The strength of the service sector expansion, combined with evidence of wage growth feeding through to stubbornly high service sector cost growth, likely adds to chances of further rate hikes in the coming months, especially as the survey's future output expectations indices remained resilient, and even rose further in manufacturing, despite the recent banking sector uncertainty.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.