Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Apr, 2017 | 09:15

By Eric Turner

Highlights

As tailwinds pick up for the U.K. digital lending industry, now is the time to embrace technological innovation in order to capture future growth opportunities.

Tailwinds are picking up for the U.K. digital lending sector, which has grown for over a decade into a diverse set of companies providing capital to consumers, small businesse,s and property investors.

While the U.K. government regulates and champions these lenders, their loan origination growth has trailed that of their U.S. peers. Smaller amounts of equity funding to build out technology and continued use of more human processes compared to U.S. digital lenders are some of the reasons for this divergence. Now is the time for U.K. platforms to embrace technological innovation in order to capture future growth opportunities.

Digital lending has its roots in the U.K., where peer-to-peer lending platform Zopa started offering personal loans in 2005. Since then, the U.K. peer-to-peer lending market has shifted to a marketplace model, while also adding platforms focused on small and medium-sized enterprise (SME) and property lending. Meanwhile, government support for the sector has been strong and a dedicated regulatory structure has been in place since 2014.

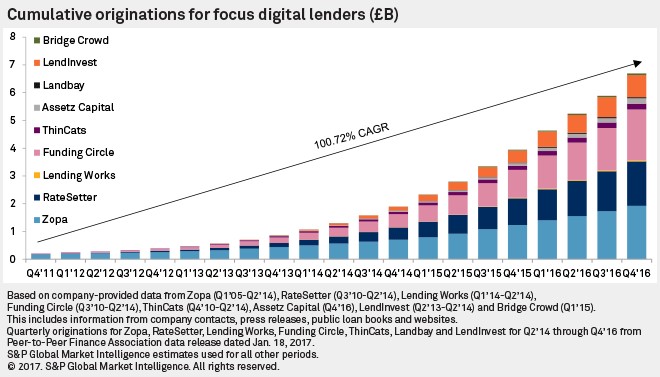

A new report by S&P Global Market Intelligence estimates that as of 2016 year-end, nine key digital lenders in the U.K. had originated £6.69 billion in loans since their respective inceptions. The nine largest platforms covered in our 2016 U.S. Digital Lending Landscape had originated the equivalent of £53.69 billion from their respective inceptions through the end of 2016.

U.K. digital lenders have not grown loan originations as fast as their U.S. counterparts, and areas of innovation have differed. While U.S. lenders have prioritized automated underwriting models, many U.K. platforms still rely on a human touch for making lending decisions. U.K. firms operate in a more regulated environment and have focused on developing innovative investment models and investor protections.

Using data from venture capital database Crunchbase, we see that as of the end of 2016, nine major U.S. digital lenders, excluding Square Inc.'s digital lending platform, had received $3.49 billion in equity funding. This allowed them to invest more in costly technological build-ups, while their U.K. peers had received only $470.6 million in equity funding through the same date.

We believe that digital lenders in the U.K. are poised for expanded growth, aided by new savings account options, continued regulatory and government support, and a proven ability to provide capital to small businesses despite Brexit-related uncertainties.

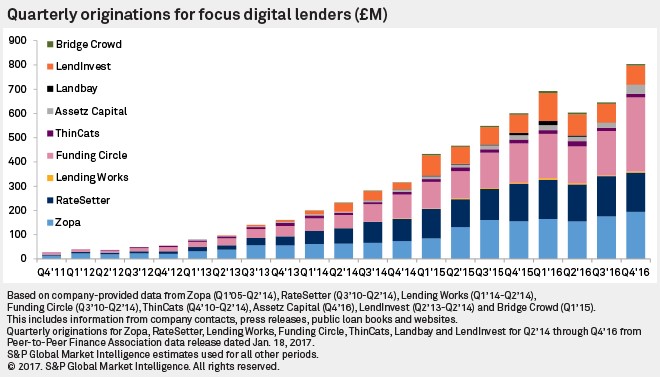

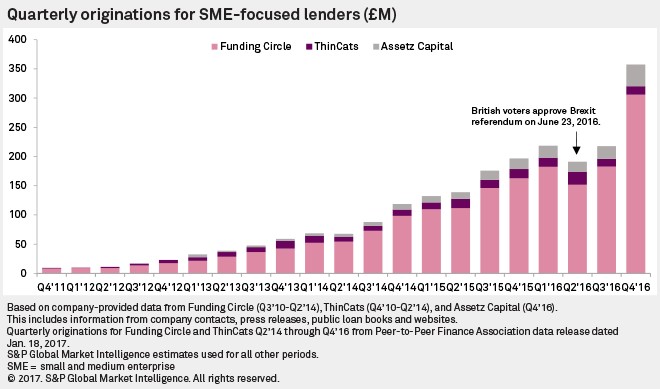

Quarterly originations reach an all-time high

In the fourth quarter of 2011, only four of the nine lenders in our report were originating loans. Total originations for that quarter came in at just £27.2 million. Quarterly originations for these nine lenders grew 33.79% year-over-year to £803.6 million in the fourth quarter of 2016. During the second quarter of 2016, originations dropped due to uncertainty related to Brexit, but rebounded in the third quarter and continued to grow.

New savings options offer tax advantaged accounts

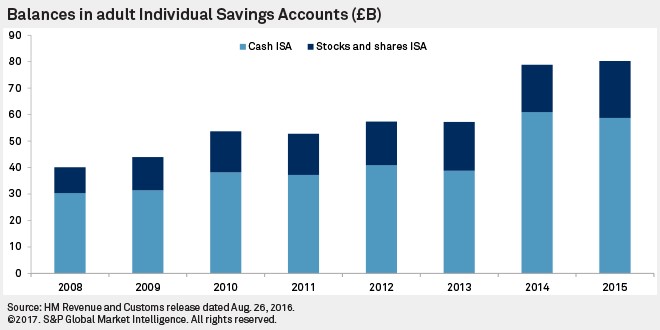

In April 2016, the Innovative Finance Individual Savings Account (IFISA) was introduced to U.K. retail investors as an addition to the longstanding cash ISA and stocks and shares ISA options. This account allows savers to invest up to £20,000 per year into approved marketplace lending platforms and collect returns tax-free. This represents an opportunity for marketplace lending platforms to capture a portion of the ISA market. Balances in cash ISA accounts, to which IFISA accounts could represent an attractive alternative, stood at £58.79 billion as of the end of 2015.

IFISA accounts can offer higher returns than cash ISAs, albeit with additional risk and no government guarantee. Pooled investment accounts, where a set return is paid to all investors based on the performance of all loans on the platform, will likely continue to be the structure for IFISAs.

Some digital lending platforms operating pooled accounts have introduced reserve funds, which are funded by a portion of fees charged to borrowers and aim to cover any missed payments or defaults. As of the time of this report, all of the platforms in our focus list that offer reserve funds have been able to cover all missed payments or borrower defaults.

Government support and regulation have boosted credibility

U.K. regulators and politicians have embraced digital lending as an alternative to traditional bank financing. Starting in 2012, a government program called the Business Finance Partnership started offering capital to Funding Circle Ltd. to facilitate loans to small and medium enterprises. This program was expanded and continued by the British Business Bank, and it grew to include other lenders such as RateSetter and MarketInvoice.

Additional support came from the Small Business, Enterprise and Employment Act of 2015, which required banks to refer borrowers they had turned down to a list of lending alternatives, such as digital lending platforms.

As government support grew, the digital lending industry became subject to specific regulation from the Financial Conduct Authority starting in April 2014. This set guidelines for operating what the FCA termed a loan-based crowdfunding platform. The FCA has continued to evaluate the industry to ensure responsible and prudent growth in the sector, and new regulations could be enacted later this year.

While complying with regulation is costly and time-consuming, for U.K. marketplace lenders it has added a layer of credibility from the perspective of both borrowers and investors.

Brexit headwinds have failed to slow lending

The U.K. started the official process of exiting the EU on March 29, 2017. This marks the start of a two-year negotiation period regarding important regulations and policies related to the flow of capital, people, goods and services between the U.K. and EU member nations.

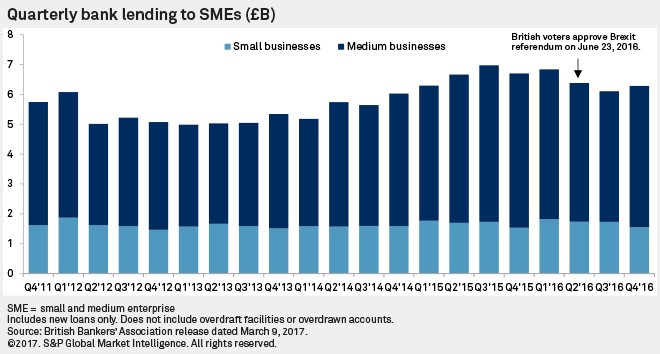

The Brexit referendum left many U.K. businesses unsure about how they will operate outside the EU. Banks have faced uncertainty about their regulatory environment and the prospects of their business customers.

Against that backdrop, new bank loans to SME customers fell in the second and third quarters of 2016. A slight sequential rebound in the fourth quarter still left new loan volumes below year-ago levels. The second quarter of 2016 marked the first year-over-year decline in new bank loans to SMEs since the third quarter of 2013, according to data from the British Bankers' Association.

Meanwhile digital lenders saw SME loan originations increase 23.9% year-over-year in the third quarter of 2016, followed by an 81.8% year-over-year jump to £357.5 million in the fourth quarter. Originations dipped sequentially in the second quarter of 2016 but rebounded in the third and fourth quarters of the year, likely due to business owners holding off on borrowing decisions until they got more clarity on the results of the Brexit referendum.

Technological growth will be needed to capitalize on these trends

Digital lenders in the U.K. could enjoy significant growth as new account options and continued political and regulatory support boost awareness of and participation in the industry. With these prospects on the horizon, digital lenders will need to invest in technology and automate some processes that humans currently handle.

The rapid growth of the U.S. digital lending sector shows the benefits of automated models, in which originations are constrained only by supply of capital and demand for loans. U.K. platforms that rely heavily on human interactions during the underwriting process may see themselves falling behind if demand for loans and investments outstrips their resources.

As of March 31, 2017, £1 was equivalent to $1.25. Loan origination figures for U.S. digital lenders were converted to British pounds based on average exchange rates for each quarter measured. Venture funding figures in British pounds were converted to U.S. dollars based on exchange rates of investment announcement dates.