Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jul, 2023

By Zuhaib Gull

Half of the largest US banks would need to raise capital if changes that regulators have been reportedly considering go into effect.

Regulators have been considering capital changes for the largest banks, and the recent failures of three regional banks have expanded the universe of banks they will target. In an effort to gauge how two rumored regulatory changes would affect the industry, S&P Global Market Intelligence conducted an analysis examining banks' capital positions if the potential changes were adopted.

Recent failures of three regional banks could push regulators to subject institutions with more than $100 billion in assets to tougher capital rules, such as the inclusion of unrealized losses and gains on available-for-sale securities and an overall 20% boost to common equity Tier 1 (CET1) requirements. While regulators are hoping to improve industry safety and soundness, such potential changes could require some regional banks to raise more capital. The changes would also reduce banks' ability to return capital to shareholders through share buybacks and dividends.

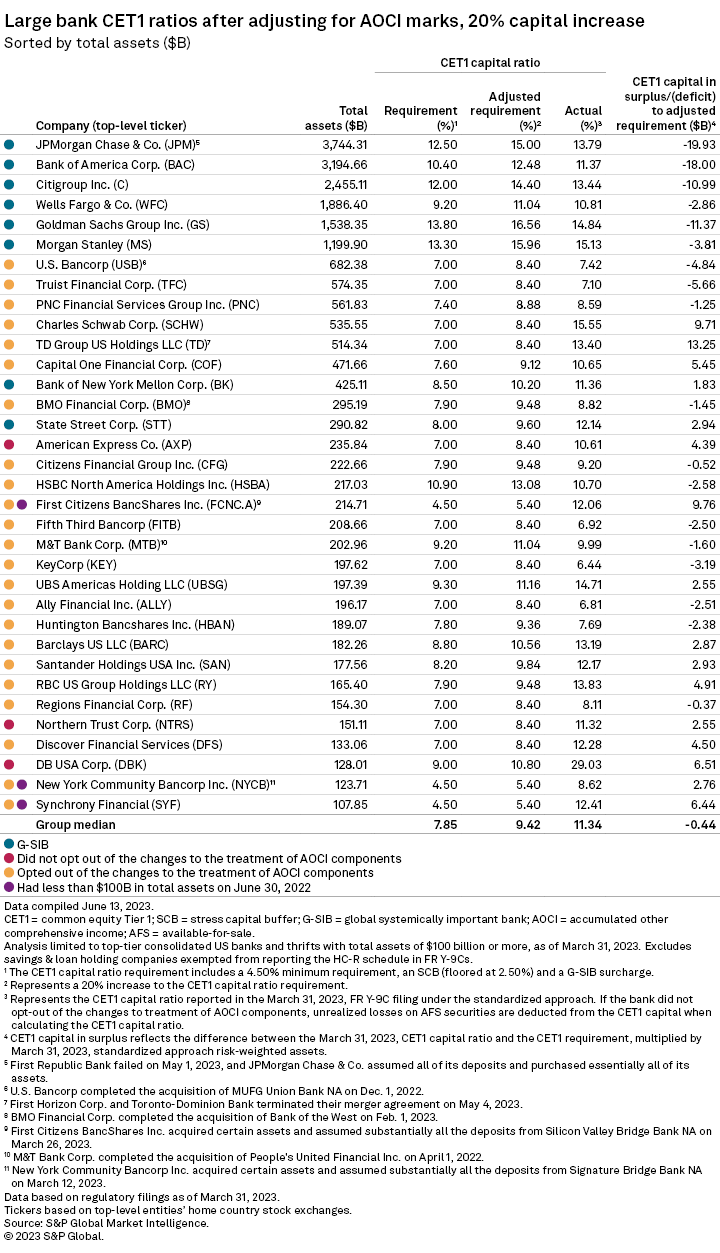

One potential change is a 20% increase to the largest banks' CET1 capital ratio requirements for banks with more than $100 billion in assets, according to a June report from The Wall Street Journal.

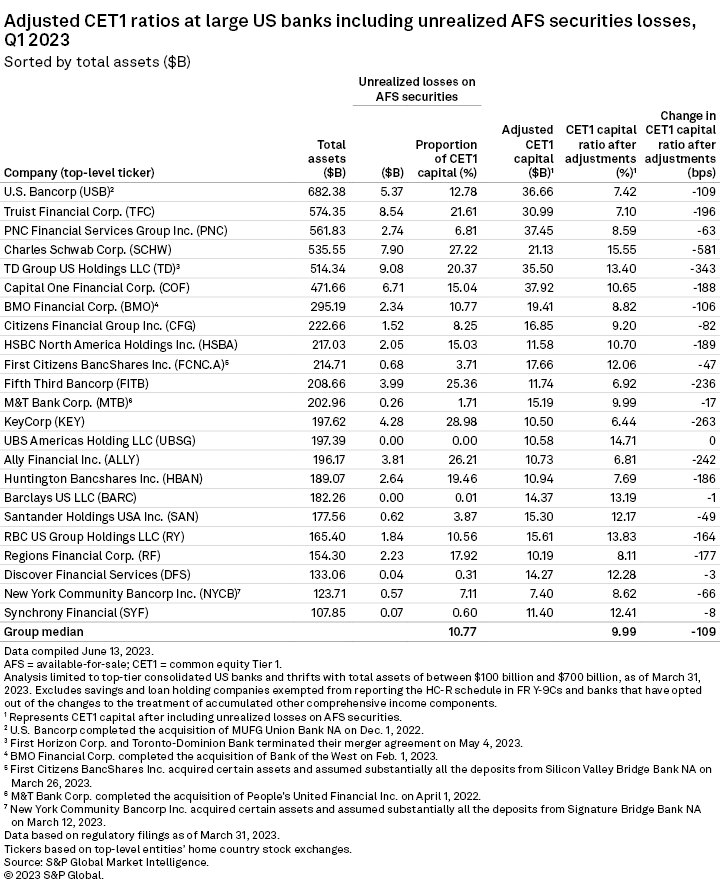

Regulators are also mulling requiring the inclusion of unrealized losses and gains on available-for-sale (AFS) securities in capital ratios for banks with $100 billion to $700 billion in assets, also according to The Wall Street Journal. During a June 22 speech, Federal Deposit Insurance Corp. Chairman Martin Gruenberg voiced support for requiring banks with more than $100 billion in assets to include unrealized losses and gains on AFS securities in capital ratios. Currently, only global systemically important banks are required to take those marks against their capital ratios, while other banks can opt-out from having accumulated other comprehensive income impact their capital.

If both of those changes were effective, at least 18 banks with $100 billion-plus asset totals would need to add more capital, according to a Market Intelligence analysis of first-quarter data from 34 institutions.

Among those, Bank of America Corp.'s CET1 capital would be $18.00 billion below a potential 20% increase to its current CET1 ratio requirement, as the higher target would move its requirement to 12.48% and the company had a CET1 ratio of 11.37% as of March 31. JPMorgan Chase & Co. would be about $19.93 billion below the 20% higher CET1 ratio, as the higher target would move its requirement to 15.00% and the company had a CET1 ratio of 13.79% as of March 31.

As a group, the 34 banks with more than $100 billion in assets have a median CET1 ratio requirement of 7.85%, and a potential 20% boost would raise that to a 9.42% median. The group's first-quarter median CET1 ratio including unrealized loss on AFS securities of 11.34% would be above the new median requirement, as some banks would still have a surplus even with a 20% increase and the inclusion of unrealized losses on AFS securities. TD Group US Holdings LLC would be $13.25 billion over its new requirement, and The Charles Schwab Corp. would be $9.71 billion over.

Realizing securities marks

Just the potential inclusion of unrealized losses and gains on AFS securities, excluding a potential 20% increase to CET1 requirements, would negatively impact most regional banks' CET1 ratios. Given that most banks' bond books are underwater due to higher interest rates, all but one bank with between $100 billion and $700 billion in assets would see a downward revision of its current CET1 ratio if AFS losses were included.

Such a rule change would reduce those banks' current CET1 capital ratios by 109 basis points, pushing banks such as KeyCorp, Fifth Third Bancorp and Huntington Bancshares Inc. below their current requirements, according to a Market Intelligence analysis.

Some experts believe that not including the unrealized losses in the capital ratios contributed to the troubles that led to the banking turmoil earlier in 2023. In his speech, Gruenberg said that if Silicon Valley Bank were required to recognize its unrealized securities losses in its capital, the company "might have averted the loss of market confidence and the liquidity run; that is because there would have been more capital held against these assets."

Impact of tougher requirements

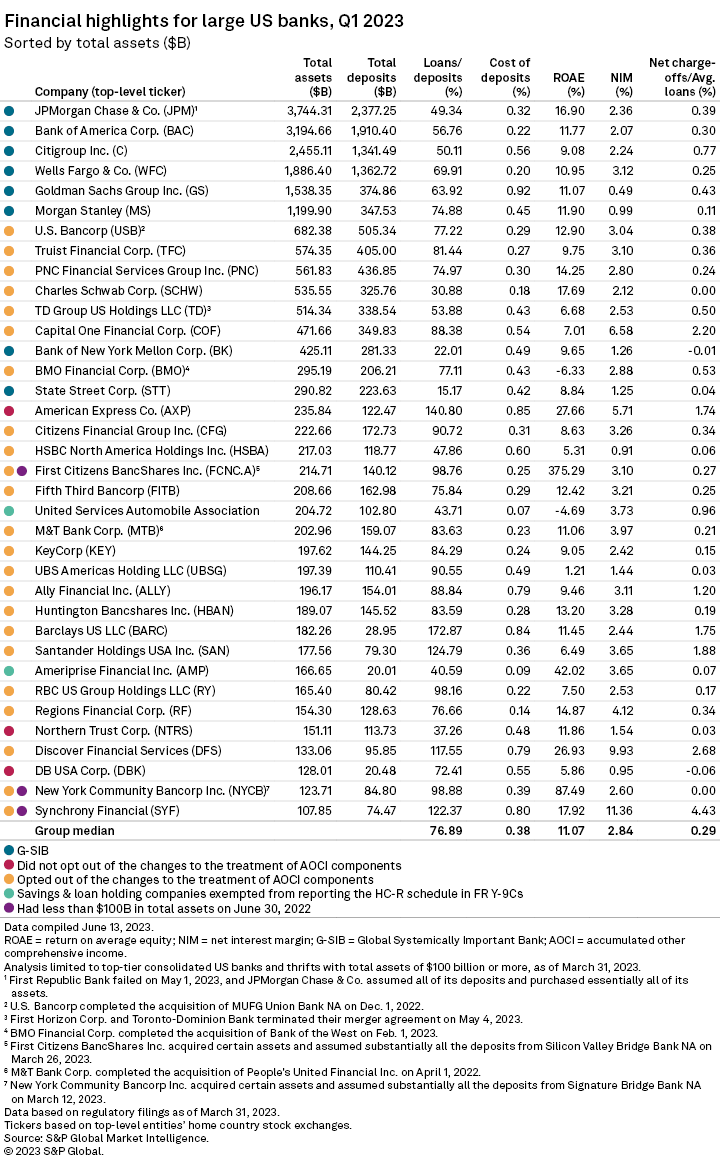

While regulators hope to improve safety and soundness, the changes could affect shareholder returns. Bank stocks have already faced significant pressure in 2023, falling close to 21%. But some members of the sell-side community believe that the industry's passage of the stress tests could alleviate concerns over the strength of the bank balance sheets in the face of a downturn.

Still, they acknowledged that banks' capital return plans, through dividends and repurchase activity, would be a factor in future performance. Most banks did not increase their dividends and announced limited repurchase activity, given economic uncertainty.

Analysts have also suggested that higher capital requirements in the future would decrease capital returns post-implementation. The requirements that regulators are reportedly considering would force some large banks to "reduce buyback activity or take other steps to boost capital ratios over time to ensure compliance, highlighting a real risk to buybacks," Compass Point analyst David Rochester wrote in a June 12 report.

To prepare for such changes, a number of regional banks are hoarding capital now. Still, banks would likely have years to comply, as any potential rule changes will take time to go through the proposal, comment and finalization stages.

"Implementation and phase-in periods" will be the only relief for these banks, as regulators "are pushing toward the more punitive end of the spectrum and the corresponding focus on banks over $250B has shifted to banks over $100B," Isaac Boltansky, managing director and director of policy research at BTIG, wrote in a June 10 note.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.