Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jul, 2017 | 15:45

Highlights

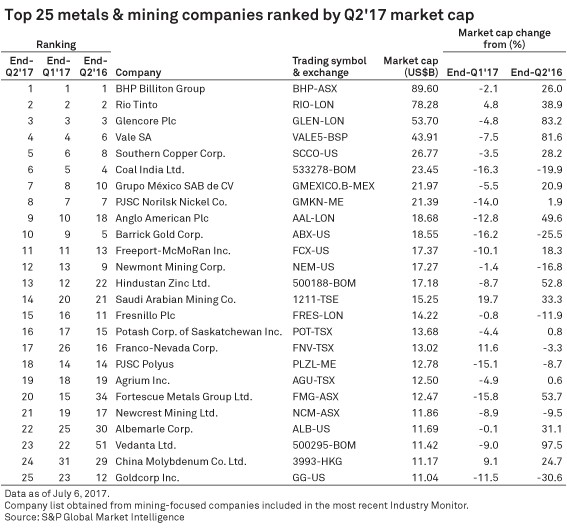

In Q2 2017, the 25 largest metals and mining companies lost 5in market value, and nine of the top 10 companies suffered a fall in market capitalization over the quarter.

After the encouraging first quarter of 2017, the world's leading metals and mining companies suffered a retreat in market value during the second period. The top 25 companies were worth an aggregate US$599.3 billion, representing a 5% decline in market value compared with the previous quarter. However, looking at the same period a year ago, when the aggregate value was under US$496.2 billion, there has been a 21% increase.

The individual rankings were relatively stable in the June 2017 quarter, with 17 of the top 25 metals and mining companies staying in the same place or moving only one ranking position. Only two new companies joined this peer group, and just four companies saw an increase in their market capitalization. Of the latter, Saudi Arabian Mining Co., or Ma'aden, rose 20% over three months to US$15.25 billion, which was the largest increase in the top 25. The company also had the third-highest jump in the market cap rankings, rising six places to 14. In May, Ma'aden announced the signing of two separate memorandums of understanding, with Alcoa Corp. and Mosaic Co., to help further develop their joint venture assets.

Franco-Nevada Corp. reclaimed a spot in the top 25 metals and mining companies. It sits in 17th place, with a market cap of US$13.02 billion, which is up nine places from the March 2017 quarter, but down one place from the same period a year ago. The gold-focused royalty and streaming company has once again increased its dividends after positive results from the March 2017 quarter, with new sales and revenue records set.

China Molybdenum Co. Ltd. and Rio Tinto rounded out the market cap increases for the June quarter at 9% and 5%, respectively. China Molybdenum was another new entry to the top 25, with a rank of 31 in the March 2017 quarter, and 29 at the end of June 2016.

The top four company rankings remained the same in the June quarter, with BHP Billiton Group, Rio Tinto, Glencore Plc and Vale SA filling the places. However, the fifth spot is now held by Southern Copper Corp.with a market value of US$26.77 billion, replacing Coal India Ltd., which moves to sixth place at US$23.45 billion. Both companies experienced a decrease in their market cap of 4% and 16%, respectively. Coal India tied with Barrick Gold Corp. in having the largest decline in market cap of the top 25 companies.

Recent developments include Coal India's June announcement to shutter 37 loss-making mines in fiscal 2017-2018. Barrick is a major shareholder (63.95%) in Acacia Mining plc, which owns two Tanzanian gold mines, Bulyanhulu and Buzwagi, where the government has implemented a ban on mineral concentrate exports. So far in July, Acacia has launched arbitration and Tanzania has passed amendments to laws affecting mine ownership and royalties.

Fortescue Metals Group Ltd. and PJSC Polyus suffered the largest drop in the rankings, with Fortescue falling five spots to 20, with a market cap of US$12.47 billion, and Polyus falling four places to 18, coming in at US$12.78 billion. S&P Global Market Intelligence senior commodity analyst Maximilian Court said Fortescue will face difficulties as China plans to switch to higher-grade iron ore products for the country's steel mills. This analysis comes on the heels of lower iron ore shipments and increasing costs reported by the company for the March 2017 quarter.