Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Mar, 2017 | 14:30

By Eric Turner

Highlights

On Deck Capital Inc. is unlikely to be tempted by a takeout offer from privately held competitor Kabbage, but a combination of the two digital lenders couldmake strategic sense.

On Deck Capital Inc. is unlikely to be tempted by a takeout offer from privately held competitor Kabbage, but a combination of the two digital lenders could make strategic sense.

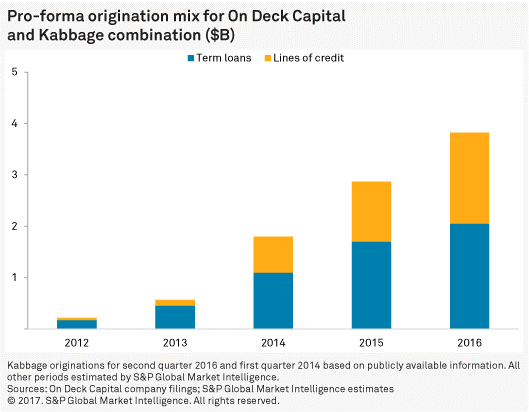

Citing unnamed sources, Reuters reported on March 22 that Atlanta-based Kabbage is in talks to raise “a few hundred million dollars” in equity funding for the purpose of acquisitions and is considering New York-based On Deck Capital as a target. This sent On Deck's stock soaring as high as 10.9% during trading on March 23. A combination of these two companies would create the largest digital lender focused on small and medium enterprises in the U.S., with an estimated combined 2016 loan origination amount of $3.82 billion.

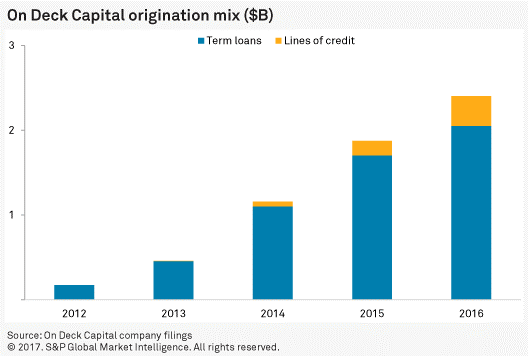

While a few years ago this would have seemed like an odd pairing, recent changes to On Deck's business model have moved it closer to Kabbage. On Deck itself has had a tough time as a publicly traded company, with shares falling about 80% since its IPO. The company has struggled to rework its business strategy and create a clear path for profitability, despite growing annual originations from an estimated $15.9 million in 2008 to $2.40 billion in 2016.

We see multiple benefits for a combined entity, although it is unlikely that the companies could reach a mutually agreeable price.

Complimentary product offerings

On Deck Capital launched its lending business in 2007 with small and medium enterprise (SME) term loans. It has recently focused on growing its line of credit business, which launched in 2013. Adding Kabbage’s expertise in the line of credit business to On Deck's early success in the product would create a more diversified source of originations for a combined company.

The companies generally target the same market, and both use a mix of online advertising, direct mailing and referral partners to generate business. A combined entity would mean not only a larger existing client base, but also the ability to decrease customer acquisition costs.

Efficiencies in funding costs

The two companies are more alike now than they were only a few years ago. While Kabbage has historically held loans on the balance sheet and used cash from credit facilities and securitizations to fund originations, On Deck has offered loans to third-party investors through a marketplace, in addition to holding loans on the balance sheet. Marketplace sales were strong in 2015, but a decline in the premiums the company could get from loans sold and the variability of the business pushed On Deck to cut back on this segment in 2016, a trend it plans to continue in the future. Holding loans on the balance sheet provides more stable revenue and can help to bolster earnings.

To that end, both lenders now focus on borrowing from large banks through credit facilities or on obtaining funding through securitizations. A combined entity could likely achieve lower funding costs. On Deck has already been able to reduce its cost of funding while increasing capacity over time as originations grew and existing facilities were renewed or extended.

Continuing along this path, a combined platform could increase margins, boost earnings and even offer more competitive terms to borrowers.

Bolstering partnership strategies

Partnerships with traditional banks have become a big focus for both companies. While On Deck is known for its partnership with JPMorgan Chase & Co., Kabbage has long been in the partnership game, with banks such as ING Groep NV, Bank of Nova Scotia and Santander UK Plc on its roster.

By leveraging their existing technology to develop white-label solutions for banks, both companies have found a new source of higher-margin revenue. A combination of what are arguably the most advanced underwriting systems in the SME lending space would only accelerate licensing deals, which could eventually become a significant portion of revenue.

Valuation would be the sticking point

While there has been minimal M&A activity in the digital lending space against which to benchmark a potential deal, Kabbage would likely need to offer a significant premium to On Deck shareholders.

Based on S&P Global Market Intelligence calculations as of March 23, 2017, the enterprise value of On Deck stood at $291.7 million excluding debt held for funding loans, which includes credit facilities that would likely roll over to a combined entity. While it is feasible from this perspective that Kabbage could acquire On Deck if it were to raise $300 million in a new equity round, as has been reported, there is little chance that On Deck would agree to a sale price that low.#learnMoreAbout("sector-intelligence-1")On Deck's December 2014 IPO, at the peak of digital lending hype, valued the company at $1.3 billion. While the business today is likely not worth that amount — its current market capitalization is less than $350 million — it is hard to see a scenario where management would sell. OnDeck has been working on profitability by focusing on cost reductions and holding loans through the balance sheet. Many issues it faced in the past, such as the variability of fees from marketplace sales, are likely in the rear view.

Management clearly views 2017 as an inflection point for On Deck. During the fourth-quarter 2016 earnings call, management forecast fiscal 2017 adjusted EBITDA between $5 million and $15 million, up from adjusted EBITDA of negative $59.7 million in fiscal 2016.

Systems integration could be painful, but fruitful

Integration challenges can be particularly pronounced for technology companies, where software is the unique edge used to compete. On Deck's and Kabbage's proprietary software systems assign credit scores to borrowers using thousands of data points. Developing these models has been labor- and capital-intensive for both companies, and they are likely attached to what they see as the best way to judge creditworthiness. Beyond that, integrating the back-end processing, APIs and model assumptions would be laborious, even if both teams agreed on the best path.

But the benefits of a merged underwriting model could be significant. Beyond the benefit of the teams' collective knowledge, specifically in the area of risk, their existing data pools would lead to a better understanding of the borrower. Each company maintains unique data points and relationships with data providers, such as the UPS shipping data utilized by Kabbage. By increasing the available inputs for a unified model, a combined platform could make better lending decisions and reduce risk.

However unlikely, a Kabbage/On Deck combo would create a dominant player in the SME digital lending space with a strong product mix, lower cost of capital, and what could be the sector's most innovative underwriting model.