Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Oct, 2016 | 16:15

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

AT&T Inc.'s $100 billion bid for Time Warner Inc. could set off a bevy of M&A activity in the cable network sector

After decades of being out of favor, vertical integration is back in vogue. AT&T Inc.'s $100 billion bid for Time Warner Inc. could set off a bevy of M&A activity in the cable network sector, which has been extremely dry since Comcast Corp. bought a controlling interest in NBCUniversal Media LLC.

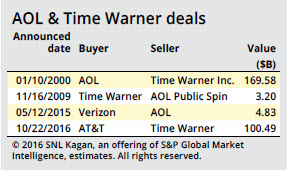

Following AOL Inc.'s disastrous combination with Time Warner in 2001, vertical integration became a dirty word, with many investors failing to believe in the term "synergy." However, Verizon Communications Inc. bought AOL in 2015 and is set to buy Yahoo! Inc. AT&T paired with DIRECTV Group Holdings LLC in 2015, and more deals are likely to come.

Time Warner's $170 billion deal for AOL was a precursor to the dot-com bust, and we have come full circle with one of the bastions of old media merging with one of the giants of content, which owns CNN, HBO and Warner Bros.

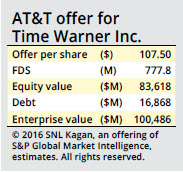

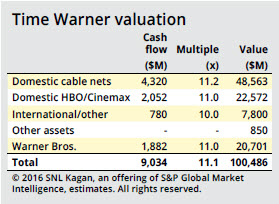

The deal comes in at $107.50 per share of Time Warner, half in cash and half in stock. We estimate the deal at roughly 11x 2017 EBITDA. It's far from the 20x cash flow in the AOL/Time Warner deal, but it's a fair price given the beating many cable network owners have taken from investors recently.

Investors, however, are skeptical of the deal, perhaps fearing regulatory scrutiny. Shares of Time Warner Inc. traded below $90/share after the deal was announced. Donald Trump said he would nix the deal if he becomes president.

Time Warner recognized almost a decade after their deal was done with AOL that it was a bust. Corporate culture at the two companies clashed, and in 2009, Time Warner (now in the driver's seat) announced it would spin off AOL.

The two companies combined were worth $365 billion when the deal was announced. However, former AOL CFO Mike Kelly found it difficult to squeeze out the $1 billion in promised synergies, and many investors fled.

Investment bankers are no doubt working around the clock to see how they can counter the AT&T offer, but with a break-up fee of close to $2 billion, it will be hard to get another buyer to come up with a higher bid. 21st Century Fox Inc. offered $85/share, but that was two years ago in a completely different era.

Apple Inc., Alphabet Inc. and 21st Century Fox are said to be eager to bid on the entertainment behemoth, but may go after a different target now that the price has gone so high.

AT&T will likely have to give up its investment grade credit rating and cut its dividend to get a deal done, but it may be worth the pain as the company moves into the future, sheds elderly dividend seekers, and grabs a new shareholder base that is less risk averse.

AT&T now holds the position of being the top deal maker in the sector with its most recent announcement of the No. 1 cable network deal of all time and its acquisition in 1998 of the Liberty Media Corp. assets, which have since been spun out into a different company.