Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jan 04, 2022

Research Signals - December 2021

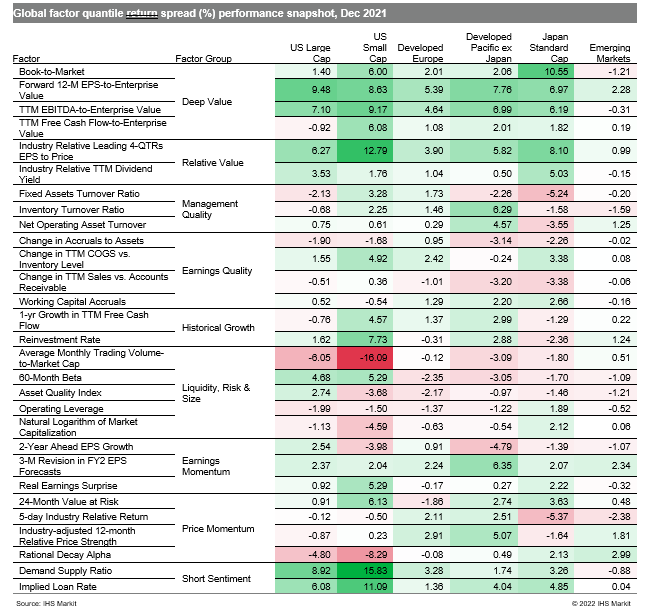

Two years into the pandemic, stocks posted another banner year, particularly in US and European markets, supported by both monetary and fiscal policy and strong corporate earnings. While the robust stock market recovery was unexpected at the beginning of the pandemic, heading into 2022, investors' resolve will be tested by potential economic restrictions from coronavirus variants and inflation. A regime shift in interest rates poses additional risks with many central banks moving toward tighter monetary policy, as value factors continue to fight for domination in several regional markets (Table 1).

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.