Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 03, 2021

Research Signals - October 2021

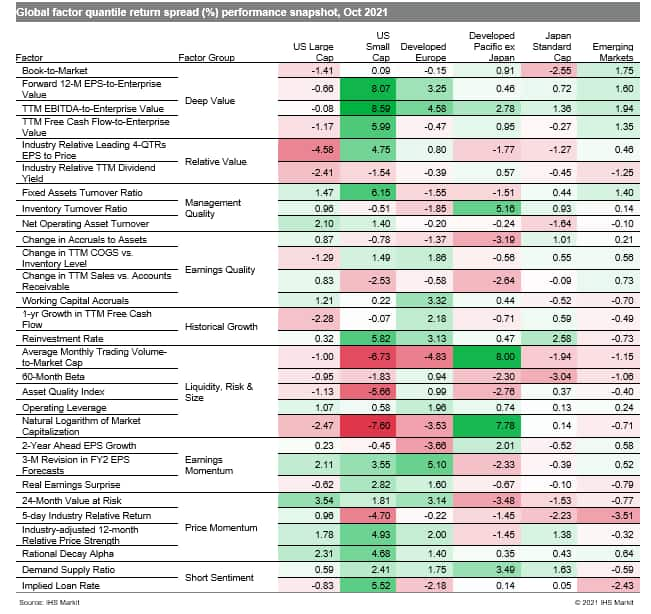

Global manufacturing growth continues to be stymied by supplier delays and stalling export trade, according to the J.P.Morgan Global Manufacturing PMI. However, fears of rising inflation and continued supply chain disruptions were not able to trick markets in October, a month historically associated with stock market crashes, as investors in the US, developed Europe and Japan were treated to a strong finish to the month. Furthermore, an overview of factor performance for the month (Table 1) unmasked a tendency towards high momentum shares, though with some variation across regions and capitalization ranges.

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.