Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Segment — 13 Mar, 2018

Technology, Media & Telecom

By Jessica Fuk

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence. To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

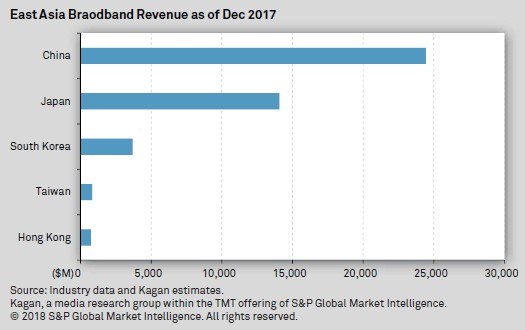

The East Asian region covers some of the world's largest and most well-developed fixed broadband markets including China, Japan, South Korea, Hong Kong, and Taiwan. China leads the world's fixed broadband market in terms of subscriber numbers, reporting 350.4 million subscribers and subscription revenue of $24.4 billion as of year-end 2017.

Kagan, a media research group within S&P Global Market Intelligence, forecasts China will maintain its leadership with 494.8 million subscribers generating revenue of $48.5 billion by 2027. Despite its size, China's average blended monthly average revenue per user at $6.29 was the lowest among the five countries as of year-end 2017, while China Mobile Ltd. reported the lowest basic tier price in the region at $4.20 per month. The country's broadband ARPU is expected to grow as the market saturates with a penetration rate of 96.6% by 2027.

Japan leads the region with the highest blended monthly ARPU of $29.84 as of year-end 2017. KDDI Corp. and J:COM, the country's third- and fourth-largest broadband operators in terms of subscriber numbers, reported the region's highest basic tier monthly prices at $33.90 and $26.60 respectively. While Japan's economic recovery remains on track, the country's fixed broadband ARPU is expected to grow steadily to reach $36 per month by 2027.

Japan is also the world's third-largest fixed broadband market after China and the United States, reporting 39.8 million subscribers and subscription revenue of $14.1 billion as of year-end 2017. The market is expected to reach 47.2 million subscribers with a revenue of $20.4 billion by 2027. There is still room for the country to drive subscriber growth as its fixed broadband penetration rate remained at a relatively low level of 74.1% as of year-end 2017. The growth of fiber networks will accelerate saturation of the fixed broadband market, with service penetration to reach 88% by 2027.

South Korea and Hong Kong are at the world's forefront in terms of broadband penetration levels. As of year-end 2017, our analysis indicated a 98.1% penetration for South Korea and a 93.6% penetration for Hong Kong. While both markets are well-developed and mature, the focus will continue to be on driving ARPU growth through upgrading subscribers from DSL and cable to fiber connections and from basic fiber plans to premium, such as the Giga internet plans that have been the priority of the South Korean operators.

Having said that, fierce competition in South Korea prevents the country's operators from raising prices to a larger extent in order to retain subscribers and drive subscriber growth. The country's average blended ARPU, while fluctuating somewhat, has remained at more or less the same level over the last 10 years. The average blended monthly ARPU was $16.36 at year-end 2008 as compared to $16.14 at year-end 2017. In the coming 10 years, we estimate that South Korea’s ARPU will increase slowly to reach $19 per month by 2027, given the increased demand for higher-speed broadband stimulated by the growth of over-the-top and value-added services, such as those associated with the internet of things.

Hong Kong reported the region's second-highest average blended ARPU after Japan at $26.05 per month as of year-end 2017. Hong Kong's major operators PCCW Ltd. and HKBN Ltd. offer the region's third and fourth most expensive basic tier packages at $24.14 and $21.83 per month respectively. The two operators, which also offer the fastest broadband connection in Hong Kong, are expected to maintain their leading positions and contribute to the market's average blended ARPU growth to reach $30.84 per month by 2027.

Taiwan's broadband 67.8% penetration rate was the lowest among the five markets as of year-end 2017. The market's penetration rate dropped from 89.9% in 2015 as its regulator, the National Communications Commission, revised its calculation to include public wireless LAN subscribers under wireless broadband as of June 2016. Incumbent operator Chunghwa Telecom reported the fourth-lowest basic tier price in the region at $7.08 per month, while the market's average blended monthly ARPU was $11.71.

Chunghwa has been leading the market with its low price, high-speed fiber connections and its market share was reported at 64% as of year-end 2017. Its leading position is expected to be challenged by its cable competitors which are on track to complete digitization and quickly increase the speed of their internet services. While cable operators sustain their influential local presence and are eager to drive subscriber growth through tariff reductions, the market's ARPU is expected to grow marginally to reach $13.20 per month by 2027. Taiwanese subscribers have benefited from the affordable broadband prices due to the fierce competition in the market. Taiwan reported an affordability index of 0.3% based on the market's 2017 per capita gross national income purchasing power parity.