Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 02, 2023

By Rajiv Biswas

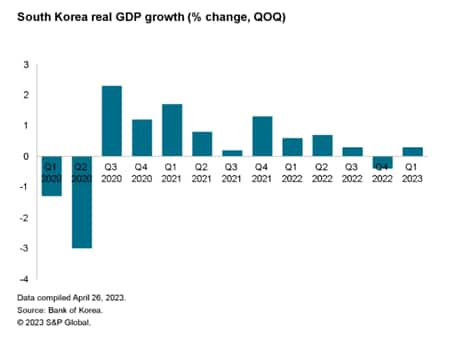

The South Korean economy returned to positive economic growth in the first quarter of 2023, albeit at a modest pace of 0.3% quarter-on-quarter. This followed a contraction in GDP of 0.4% quarter-on-quarter (q/q) in the fourth quarter of 2022. South Korea is expected to face continuing economic headwinds during 2023, due to the impact of weak exports and the cumulative transmission effects of monetary policy tightening by the Bank of Korea during 2022.

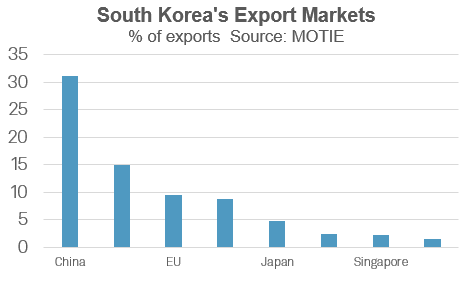

Weak economic growth in the US and the European Union (EU) remain a key downside risk for South Korea's manufacturing export sector in 2023. However, this is expected to be mitigated by improving exports to Mainland China, as economic growth strengthens during 2023 due to the easing of COVID-19 restrictions.

South Korea's real GDP grew at a pace of 0.3% quarter over quarter in the first quarter of 2023, showing a return to moderate positive growth after contracting by 0.4% quarter over quarter in the fourth quarter of 2022. On a year-over-year basis, real GDP growth slowed to an increase of 0.8% year over year in the first quarter of 2023, compared with 1.4% year over year in the fourth quarter of 2022.

The resumption of positive growth was helped by a rebound in private consumption, which grew by 0.5% quarter over quarter, after having declined by 0.6% quarter over quarter in the fourth quarter of 2022. Private consumption was up 4.5% year over year in the first quarter of 2023, while government consumption rose by 3.9% year over year.

Exports of goods and services also improved, growing by 3.8% quarter on quarter, after having declined by 4.6% quarter over quarter in the fourth quarter of 2022. Imports also grew in the first quarter of 2023, rising by 3.5% quarter over quarter, after having fallen by 3.7% quarter over quarter in the fourth quarter of 2022.

On an industry sector basis, manufacturing output rose by 2.6% quarter over quarter in the first quarter of 2023, after three consecutive quarters of quarter over quarter declines in manufacturing output. The construction sector also posted positive growth of 1.8% quarter over quarter in the first quarter of 2023. However, the services sector recorded a small contraction of 0.2% quarter over quarter in the first quarter of 2023. Compared with a year ago, manufacturing output fell by 3.3% year over year in the first quarter of 2023, while services output rose by 3.2% year over year and construction output rose by 5.1% year over year.

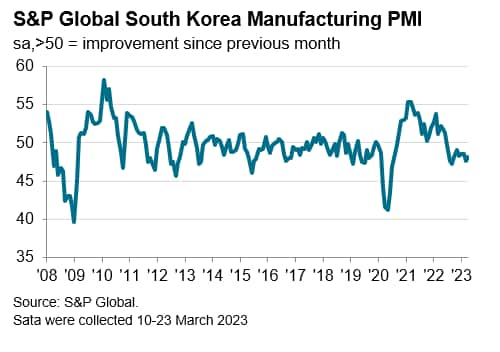

The seasonally adjusted S&P Global South Korea Manufacturing Purchasing Managers' Index (PMI) dipped from 48.5 in February to 47.6 in March, remaining well below the 50.0 no-change mark, to signal continued contractionary conditions in South Korea's manufacturing sector. The March PMI data indicated an eleventh consecutive monthly decrease in output at South Korean manufacturers. Panel members largely attributed the decline to muted domestic and external demand conditions.

At the same time, manufacturing companies registered a quicker reduction in new orders that was the fastest for three months. A number of firms mentioned that sustained economic weakness and weak client confidence had placed downward pressure on sales.

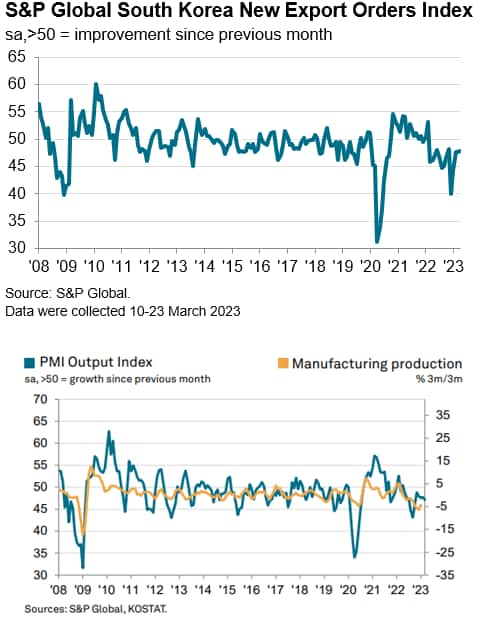

During the second half of 2022, moderating economic growth in mainland China due to the impact of pandemic-related restrictive measures on domestic demand had been an important factor contributing to weaker external demand for South Korean exports, since mainland China is South Korea's largest export market. In calendar year 2022, South Korean exports to mainland China fell by 4.4% y/y, having deteriorated considerably in late 2022 and early 2023. Merchandise exports have remained weak in early 2023, declining by 13.6% y/y in March 2023, mainly as a result of continued contraction in exports of semiconductors and displays.

As the US and EU are also among South Korea's largest export markets, weakening economic growth in the US and EU since mid-2022 has also become a negative factor for South Korea's manufacturing export sector. However, easing of COVID-19 restrictions is expected to result in strengthening domestic demand in mainland China as 2023 progresses, which should help to support a rebound in South Korean exports to that key market.

Receding supply chain pressures fed through to moderating input costs in the latest survey period, with operating expenses rising at the weakest pace since December 2020. According to firms surveyed, falling international oil prices helped to alleviate some pressure on costs.

In terms of prices, both input cost and output price inflation accelerated and remained historically sharp according to the latest PMI survey. Inflation across a range of inputs was mentioned by survey members, with specific mentions of rising raw material prices and weakness in the won. As such, firms continued to partially pass increased input costs to their clients in the form of higher selling prices, which rose at a moderate pace.

South Korean CPI inflation rose significantly during 2022, largely reflecting the impact of the Russia-Ukraine war on global commodity prices, particularly for oil and gas. The annual average CPI inflation rate of 5.1% for 2022 compares with an average CPI inflation rate of 2.5 percent in 2021. The 2022 average CPI inflation rate was the highest annual average since 2011.

Due to the upturn in inflation pressures during 2022, the Bank of Korea (BOK), South Korea's central bank, tightened monetary policy seven times in 2022, lifting the Base Rate to 3.25%. At its January meeting, the Monetary Policy Board of the BOK decided to raise the Base Rate by a further 25bps, raising the Base Rate to 3.50%. This has brought total cumulative tightening to 300 basis points (bps) since August 2021. This has impacted domestic demand, with household lending having continued to decrease owing to rising interest rates and falling prices in the residential property market.

In early 2023, there have been signs of easing inflation pressures. South Korea's headline CPI inflation rate moderated to 4.2% year-on-year (y/y) in March 2023, compared with 4.8% y/y in February. The Monetary Policy Board of the Bank of Korea decided at its 11th April meeting to leave the Base Rate unchanged at 3.50%. In its April Monetary Policy Decision, the Monetary Policy Board assessed that consumer price inflation will continue to moderate and decline to the 3% range from the second quarter of 2023, reflecting base year effects from the sharp rises in global oil prices in 2022 as well as weakening pressures from the demand side.

The recent rebound of the Korean won against the USD has also helped to somewhat mitigate the upside risks to inflation. The KRW had depreciated from 1,189 against the USD on 1st January 2022 to 1,428 by 12th October 2022, but has since appreciated to 1,337 by 26th April 2023.

The electronics manufacturing industry is an important part of the manufacturing export sector for South Korea which is one of the world's leading exporters of electronics products to key markets such as the US, China and EU. As Vietnam is an important production hub for South Korean electronics multinationals such as Samsung and LG for a wide range of electronics products such as mobile phones, Vietnam is also a key export market for South Korean electronics components.

Exports of South Korea's information and communications technology (ICT) goods for calendar year 2022 amounted to USD 233 billion, up 2.5% y/y and accounting for 34.1 percent of South Korea's total merchandise exports. However, deteriorating global economic conditions through the course of 2022 resulted in weaker ICT exports in late 2022, with ICT exports in December 2022 down 23.6% y/y.

South Korea's ICT exports have remained weak in early 2023. South Korea's Ministry of Trade, Industry and Energy trade data showed that South Korea's exports of ICT goods in March 2023 were USD 15.8 billion, down 32.2 percent year-on-year. Semiconductors exports fell by 33.9 % y/y to USD 8.7 billion, with exports of system chips down 18.4% y/y to USD 3.6 billion and memory chip exports down 44.3% y/y to USD 4.6 billion.

The downturn in South Korea's ICT exports reflects the slowdown in the global electronics industry since mid-2022. The headline seasonally adjusted S&P Global Electronics PMI fell from 51.4 in February to 48.4 in March to signal a renewed deterioration in operating conditions across the global electronics manufacturing sector. A solid decline in order book volumes drove the latest downturn and contributed to the eighth fall in output in the past nine months.

New orders placed with global electronics producers fell for the eighth time in nine months during March. The reduction was solid overall and often attributed to weak demand conditions in the US, Europe and China. As a result of weak demand, average supplier delivery times shortened to the greatest extent since December 2001, as subdued input demand reduced pressure on suppliers and logistics capacity.

South Korean GDP growth is forecast to moderate from 2.6% in 2022 to 1.6% in 2023, according to the latest forecast by S&P Global Market Intelligence.

South Korea's export sector, which accounts for an estimated 38% of GDP, is expected to face continuing headwinds during 2023 due weak growth in the US and EU and the slowdown in the global electronics cycle.

Due to the upturn in inflation pressures since late 2021, the Bank of Korea has tightened monetary policy by 300 bps since August 2021, including a 25bp which has lifted the Base Rate to 3.50%. Higher policy rates have also resulted in a cooling property market, with South Korean apartment prices estimated to have declined by 4.7% y/y in 2022 according to the Real Estate Board.

Inflationary pressures remain an important risk to the near-term outlook. This reflects a number of factors, including higher input prices and supply chain disruptions, which have contributed to rising input price inflation pressures.

Over the medium-term outlook, South Korean exports are expected to grow at a rapid pace, helped by the sustained strong growth of intra-regional trade within APAC, as China, India and ASEAN continue to be among the world's fastest-growing emerging markets. South Korea's strong competitive advantage in exporting key electronics products, notably semiconductors and displays, as well as autos and auto parts, are expected to be an important positive factor underpinning export growth.

The rapid growth of South Korean exports is also expected to be strengthened by the APAC regional trade liberalization architecture. This includes the large recent RCEP multilateral trade agreement and major bilateral FTAs. The RCEP trade deal, which South Korea has ratified, entered into effect from 1st January 2022 for the first ten ratifying members, and from 1st February 2022 for South Korea.

An important macroeconomic risk to the South Korean economy over the medium to long-term outlook continues to be from the high level of household debt as a share of disposable income. This has risen to 206% by 2021, the fifth highest amongst all OECD countries. A key factor driving this debt ratio higher has been large mortgage lending flows for residential property purchases. Such a high household debt ratio creates macroeconomic vulnerability to significant monetary policy tightening, with Bank of Korea rate hikes during 2021-23 having increased financial pressures on highly leveraged households.

Managing the energy transition towards renewable energy is also a key policy priority for South Korea. South Korea has already been at the forefront globally in planning initiatives to develop hydrogen as a key future fuel source for domestic power generation.

Among South Korea's greatest economic challenges will be long-term demographic ageing, which will have severe implications for South Korea's economy and society. The number of seniors aged 65 or over has already reached 16.5% of the population and by 2025 is projected to rise to 20% of the population. Meanwhile the working age population (aged 15 to 64) is declining as a share of the total population, from 71.4% in 2021 to a projected 55.7% by 2041.

Demographic ageing has already contributed to the moderation of South Korea's potential GDP growth rate from around 7% per year in the mid-1990s to around 2.5% per year by 2021. South Korea's potential growth rate could drop to a range of around 1% to 1.5% per year by 2050 due to demographic ageing.

Consequently, structural reforms to increase the potential growth rate will be a key policy priority over the medium term. These reforms would include policy changes to lift the labour force participation rate, improve services sector productivity, accelerate digitalization and further boost the adoption of industrial automation.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.