Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Mar 08, 2022

Research Signals - February 2022

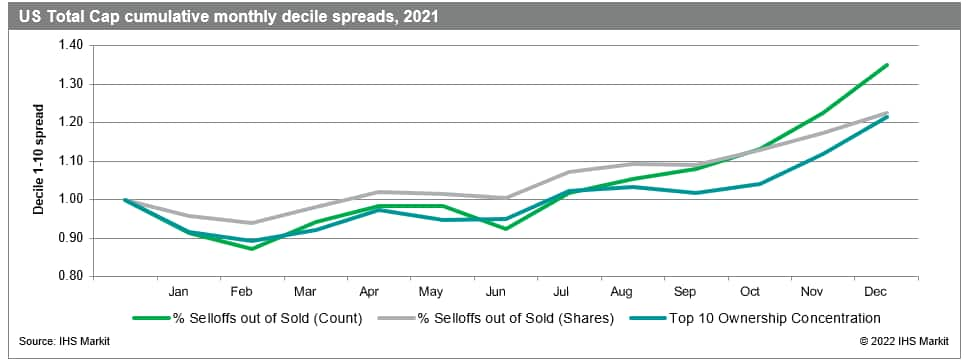

We recently reviewed 2021 key drivers of factor performance across the core Research Signals Factor Library. However, we are constantly in search of alternative sources of alpha using both IHS Markit proprietary datasets and other unique data from our partners to extend our factor suite beyond the traditional array of technical and financial statement-based signals. 2021 was a wild year that saw markets set all-time highs, despite the headwinds of speculative mania by retail investors across notable highly shorted stocks, a flurry of SPAC issuance, ongoing waves of COVID-19 and its variants, supply chain disruptions and historically high inflation in the second half. With that backdrop, we now review performance of several alternative factors - institutional ownership and social media sentiment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.