Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Nov, 2023

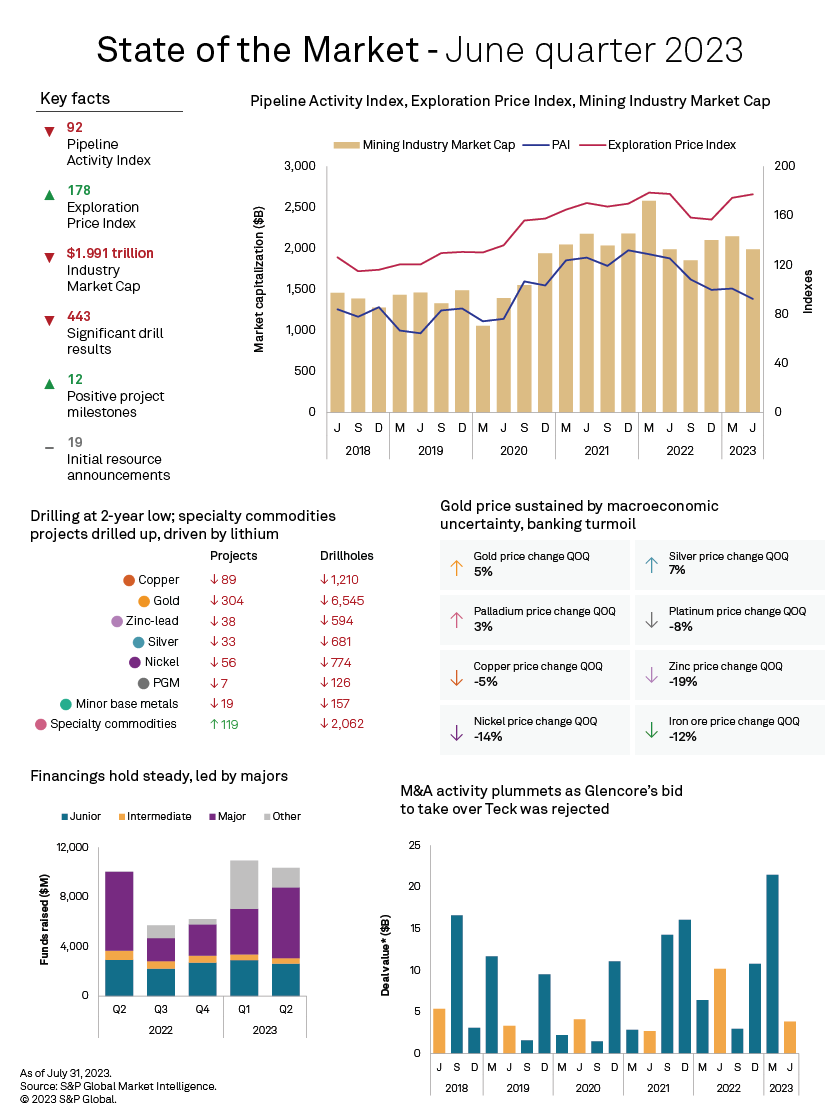

S&P Global Commodity Insights' State of the Market quarterly report highlights key trends and activity across the global metals and mining sector during the June quarter of 2023, which was characterized by several unfavorable macroeconomic events.

The June quarter 2023 marked a period of uncertainty for both global economies and the metals and mining sector. Amid high interest rates across many of the G7 economies, fears of demand suppression were tempered by unexpectedly firm economic indicators in the US — trends that continued into the September quarter. Market expectations regarding the pace of China's economic recovery fueled further equity market volatility, contributing to generally weaker metals prices. The US dollar softened during a brief period of optimism in the US at the end of June as the US Federal Reserve refrained from raising interest rates for the first time in 10 consecutive meetings, although this was trumped by stiffening macroeconomic headwinds, which soured sentiment and further weighed on metals prices.

The mining industry was lackluster, with many key metrics lower quarter over quarter, including S&P Global Market Intelligence's overall measure of the exploration sector, the Pipeline Activity Index. Positive outcomes mostly stemmed from specialty commodities, namely lithium, indicating the industry's efforts to keep up with electrification within the global energy transition. The number of drilled lithium projects was at an all-time high in the period, and the top two results were also for the battery metal, with the highest-value intercept located in Toronto Stock Exchange-listed Avalon Advanced Materials Inc.'s Separation Rapids late-stage asset in Ontario.

Financings also dropped slightly in the period, with funds raised by junior companies down 10% — yet another indication of waning equity market support for industry players that will, in turn, be less able and willing to invest in exploration, given its uncertain returns. M&A activity followed the same trend, plunging a whopping 82%, as Glencore PLC's $23 billion bid to acquire Teck Resources Ltd. was firmly rejected.

Similar trends of weak drilling activity and fundraising emerged in the September quarter, with commodities markets remaining pressured by the long-term hawkish outlooks for many major economies, led by the US.