Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2017 | 10:00

Highlights

This year has seen the two most expensive fiber network deals since 2015, with the premium being driven by the critical role small cells have in 4G densification efforts and in the upcoming 5G build.

The following post comes from Kagan, a media research group within S&P Global Market Intelligence. To learn more about this research, please request a call.

This year has seen the two most expensive fiber network deals since 2015, with the premium being driven by the critical role small cells have in 4G densification efforts and in the upcoming 5G build. Unlike traditional pole towers, small cells are normally only placed where existing fiber network lines run, with some exceptions made for microwave backhaul.

At $221,875 per fiber mile, Crown Castle International Corp.'s July 18 deal to acquire 32,000 miles of fiber optic network from LTS Group Holdings LLC, or Lightower, is the second-most expensive fiber network deal, according to data from Kagan, a media research group within S&P Global Market Intelligence. The most expensive

Crown Castle indicated that it is paying 13.7x expected adjusted EBITDA for Lightower's assets, which are primarily in the Northeast, including New York,

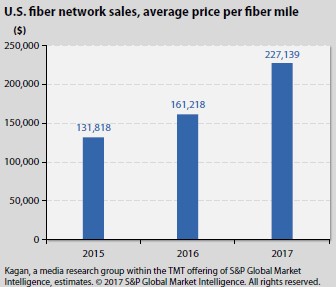

Overall, average U.S. value per fiber optic mile passed has grown at a 31% CAGR since 2015 from $131,818 per mile in 2015 to an average of $227,139 per mile for the two deals so far in 2017. Across all seven deals in our analysis, average fiber deal value is $166,743 per mile.

Crown Castle is the most likely suitor of fiber networks and is behind four of the seven large fiber deals we have tracked since 2015.

Crown's aggressive acquisitions come as little surprise considering the company's

Its closest competitors, SBA Communications Corp. and American Tower Corp., have taken a more delicate approach to small cells, and over the years have been more likely to expand outside the U.S. For instance, while 100% of Crown Castle's assets are now U.S.-only after it shed its Australian towers, SBA's international towers as a percentage of total towers owned has grown from 8% in the first quarter of 2012 to 39% in the first quarter of 2017. American Tower has grown its international towers as a percentage of total towers owned

Both approaches have their appeal; however, small cell margins reported by Crown Castle are slimmer than pole-style tower margins. Crown Castle's traditional towers logged an operating profit margin of 63% in the first quarter, compared to 51%