Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jan 05, 2024

By Matt Chessum

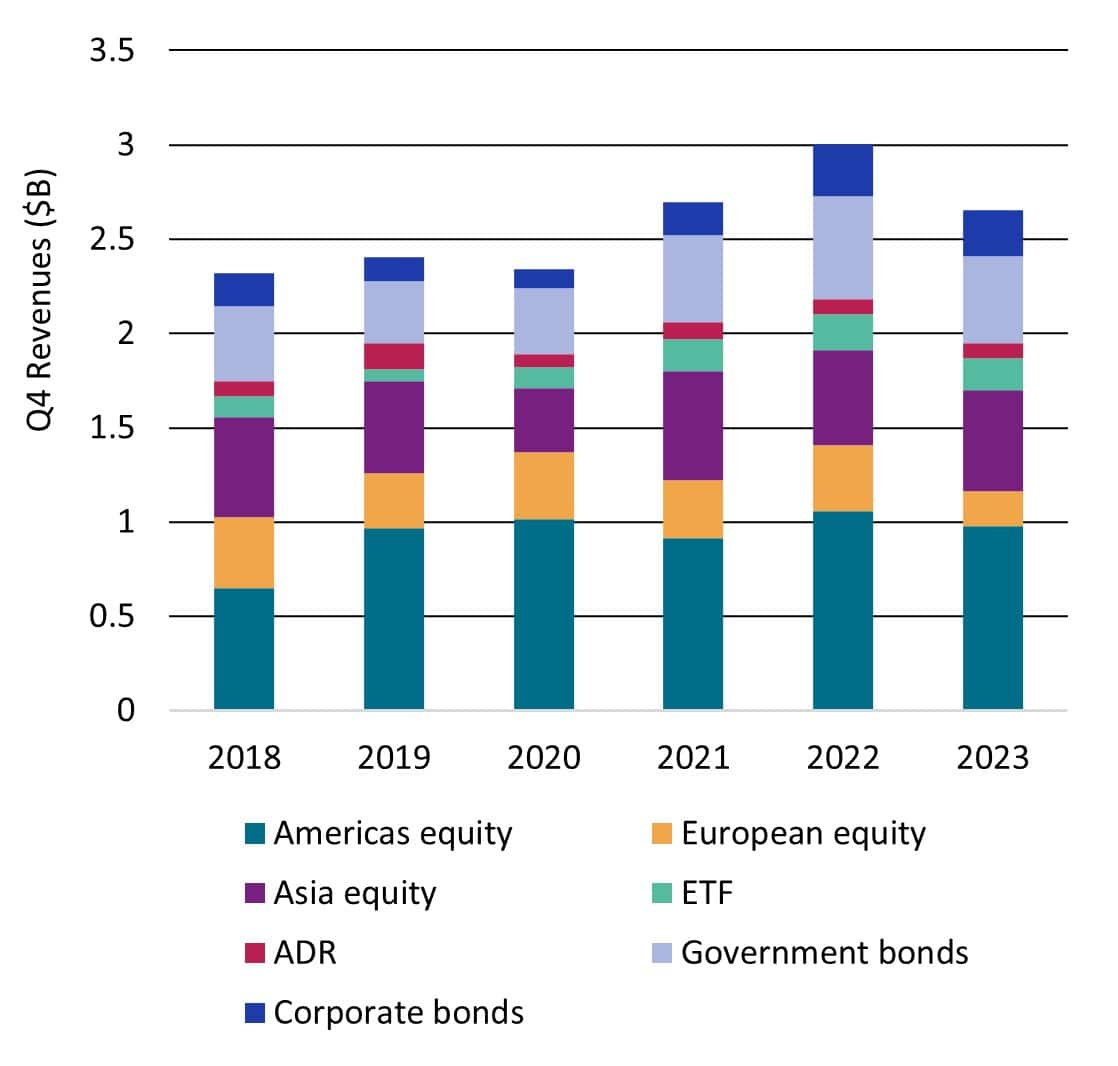

In the securities lending markets, revenues started to cool as $2.705B was generated. This marked an 11% decline YoY and a 14% decline QoQ. Large percentage decreases YoY were seen across both revenues and average fees after a volatile Q4 2022 worked to the benefit of securities lending market revenues.

Across equities, APAC was the standout region as revenues grew by 6% YoY. Strong growth in YoY returns across Japan, Taiwan, South Korea, and Malaysia helped push quarterly revenues higher YoY. Strong increases in average fees across these countries and a growth in balances in Japan, Hong Kong, Malaysia, and Thailand also helped to contribute to higher regional revenues. In the Americas YoY revenues declined by 8%. Revenues were pulled lower by USA equities (-9% YoY) as growth was seen across both Canada (+8% YoY) and Brazil (+7% YoY). Canada was the standout market in this region as average fees increased by 10% YoY. EMEA equities suffered one of their worst quarters on record as YoY revenues plummeted by 47%. All markets experienced declines apart from Denmark, Portugal, and Greece. Average fees and balances declined across many countries with some of the larger lending markets such as the UK and Sweden experiencing YoY declines in fees of more than 40%.

In the fixed income markets, following an impressive year for revenues, Q4 earnings started to decline YoY across both corporate and government bonds. Government bond revenues declined 11% YoY as a 27% YoY decline across EMEA government bond revenues weighed on performance. EMEA was a weak spot for the asset class as average fees declined by 24% YoY and balances fell by 3% YoY. Emerging market bonds also suffered during the quarter with a decline in revenues of 29% YoY and a decline in average fees of 16% YoY, balances also declined by 15% YoY. Activity across Americas government bonds was flat on Q4 2022 with a small YoY decline in revenues of 1%, balances increased by 1% YoY and average fees declined YoY by 2%.

Corporate bond revenues also declined YoY but this is to be expected after a stellar Q4 performance during 2022. Across conventional corporate bonds, revenues declined by 8% YoY and average fees declined by 14% YoY. Balances increased by 8% YoY, however, as moves in interest rate predictions made the asset class more volatile. Convertible bonds suffered the largest declines across the asset class with revenues decreasing 63% YoY to $7M.

Source: S&P Global Market Intelligence Securities Finance

© 2024 S&P Global Market Intelligence

Following an impressively strong first half of 2023, Q4 continued the trend of declining revenues and falling average fees, that was seen during Q3. This made Q4 the weakest quarter of the year in terms of performance. All asset classes suffered when compared YoY. As can be seen by the graph above, Q4 2022 was exceptional in terms of revenue generation, so it is important to keep these declines in context. A softening in activity is being seen across all assets, especially across EMEA. Heading into Q1 2024, this may change as markets remain sensitive and increasingly reactive to economic data - especially if it doesn't meet market expectations. Volatility is likely to increase in the first few months of 2024 which is likely to benefit securities lending markets further.

To download the full report please click on the button at the top of this page.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location