Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 04, 2022

By Matt Chessum

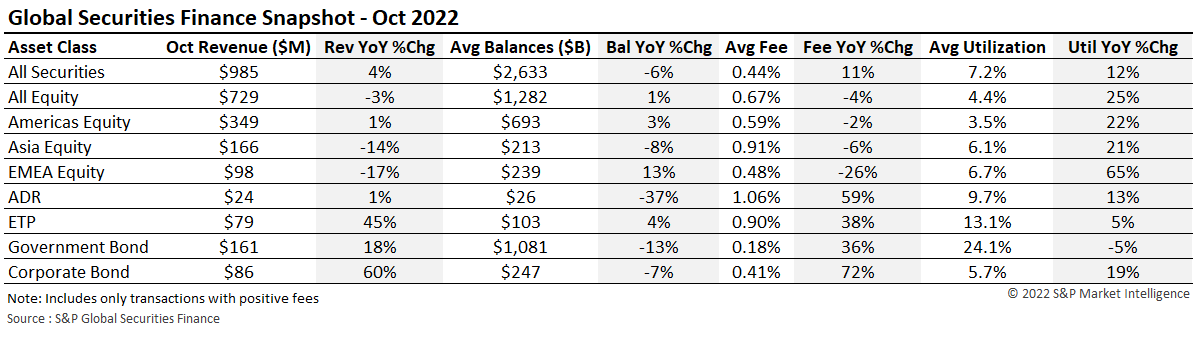

Securities finance revenues totalled $985m for the month of October. This is a 4% increase YoY and a decline of 4% MoM. Despite average fees increasing 11% and utilization increasing 12% YoY, the value of on loan balances fell 6% when compared with October 2021. Revenues were down across the majority of equity regions YoY with only Americas Equity seeing a 1% increase when compared with October 2021. ETP's and fixed income were the standout asset classes when looking at comparable YoY revenue increases. When compared MoM, revenues were very similar to those generated in September. Both asset classes are continuing their impressive year due to the hawkish monetary environment and the increased market volatility. Average fees for ETPs were 38% higher YoY at 90bps and corporate bond average fees continued to follow an upward trajectory, hitting a year high of 41bps. Government bond average fees remained flat when compared to September 2022 despite a 36% YoY increase. Average fees in Government bonds have increased 33% since January 2022.

ADRs continued to show a slight improvement when comparing their performance to the first half of the year. On loan balances remained steady MoM and despite average fees being 24% lower over the month, they remained significantly higher than those seen during Q1 (Q1 average fee 65bps).

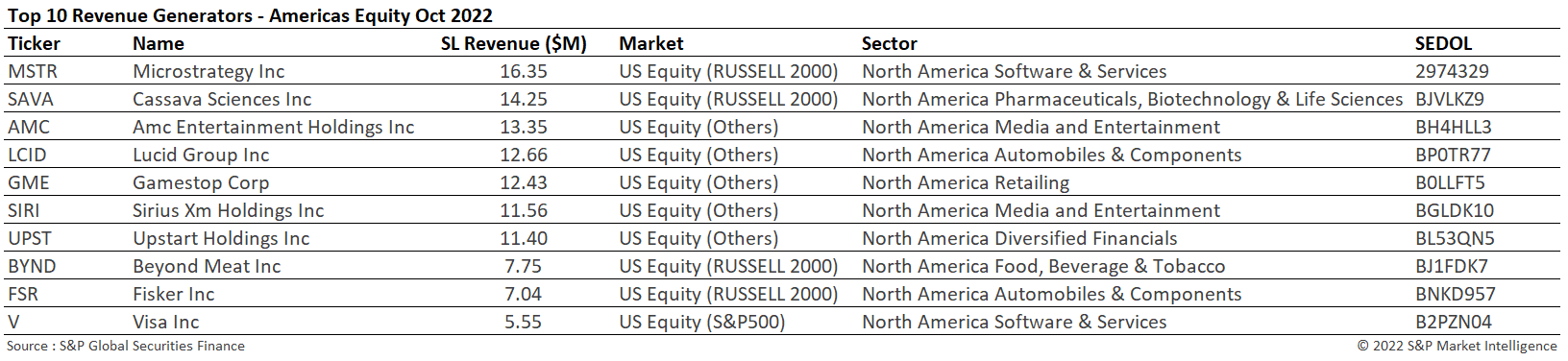

As was the case in September, Americas equities was the only equity market to see an increase in revenues when compared YoY. It remained the most significant market when comparing global equity market revenues contributing 35% of the "All Equity" number. Apart from average fees and revenues, all other metrics saw improvements when compared YoY. Americas equity balances increased 3% YoY (-1.5% MoM) and have remained robust throughout the year given the double digit falls in equity market valuations (as at the 1st November the S&P 500 was down 18.8%, Nasdaq was down 28.9% and the Russell 2000 was down 17.7% year to date). Average fees across Americas equities were down 2% YoY and 9% MoM however which contributed to the 7.5% decrease in revenues MoM ($377m Sep 22).

The top revenue generating stocks in the US equity market remained relatively unchanged when compared with the previous months. Collectively, the top ten borrows generated $112m in revenues for lenders, a fall of approximately 5% when compared to September's top ten earners, equating to just under 32% of the total monthly revenues. All of the names in the list generated lower revenues when compared to the previous month. The only noticeable change in the list is the addition of Microstrategy Inc (MSTR) as the highest revenue generating stock. MSTR's share price continued to fall over the course of the month and utilization grew. The company recently released full year results that failed to meet market expectations with their accounts reporting that the company is holding approximately $3bln worth of bitcoin in investments.

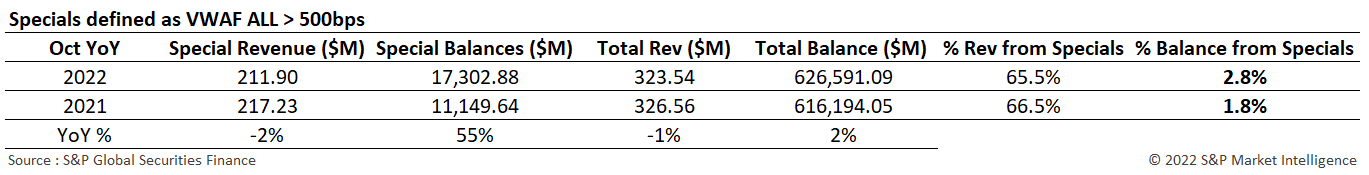

US equity specials revenue totalled $212m in October, a 2% YoY increase, (specials defined as greater than 500bps annualized fee). The marginal YoY decline in US equity specials revenue was driven by lower average fees for specials, while loan balances with fees greater than 500bps remained well above 2021 levels in October. The percentage of US equity loan balances with a fee greater than 500bps increased from 2% in October 2021 to 3% in October 2022. After a stellar Q3 for specials revenues, October returns declined slightly when compared with September as well as YoY (when compared with October 2021). Through October, US equity specials revenues are on pace to exceed 2021 by 35% YTD.

VWAF = Volume Weighted Average Fee

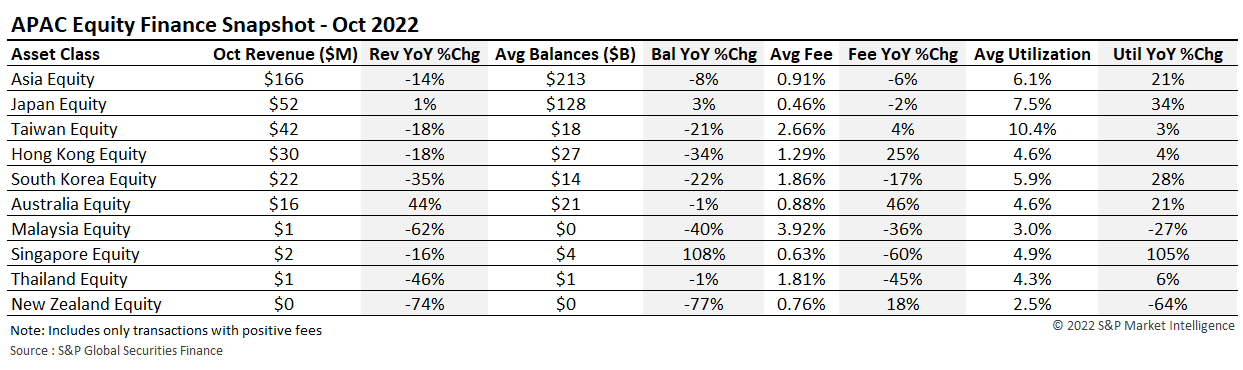

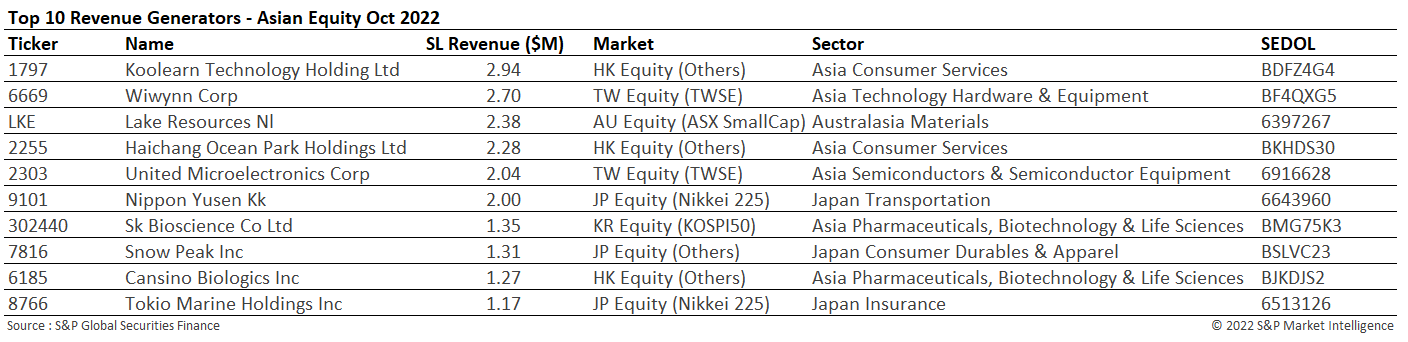

APAC equity generated revenues of $166m during the month of October. This is 14% lower when compared with October 2021 and 7% lower when compared MoM. Utilization across APAC equities has risen steadily over the year increasing from an average of 4.35% in January to 6.1% in October. Average fees were 91bps for APAC equities during the month of October. This is a decrease of 6% YoY and continues to decline steadily after hitting its peak of 104bps in July.

Japan remained the highest revenue generating market in APAC followed by Taiwan and Hong Kong. Australia continued to be the market to watch in APAC as revenues continued to improve YoY with a 44% increase. Average fees were 88bps (+46% YoY) and utilization showed a 21% increase YoY at a respectable 4.6%.

Taiwan revenues remained unchanged from September 2022, despite falling 18% YoY. Average fees fell MoM but increased YoY and average utilization nudged over 10% despite the news that short selling restrictions will be tightened as a result of the fall in stock prices and the increase in market volatility.

Hong Kong was the third largest contributor to revenues in the region accounting for 18% of the total. Hong Kong domiciled stocks appeared three times in the top ten list of highest revenue generators. Hong Kong equities continue to underperform due to the ongoing zero COVID policy and a reported lack of investor confidence in the region. Koolearn Technology Holding Ltd (1797 HK) was the highest revenue generating stock during the month. The stock remains under pressure since the Chinese Ministry of Education issued tougher regulations on the education sector, banning tutoring for profit in July. Despite the company diversifying its business model by launching a livestreaming e-commerce business in English, the company's share price rise is reported in the financial press to appear "frothy" and to not necessarily reflect the company's broader financial position.

South Korea (-35%), Malaysia (-62%) and Thailand (-46%) experienced sizeable declines in revenues when compared with October 2021. Average balances and fees followed this trend in all three jurisdictions.

The top ten revenue generators in Asia were reflective of the previous months. The semiconductor, consumer services and the transportation sectors remained popular borrows. Snow Peak Inc (7816 JP) was a new addition to the list during the month, generating $1.31m in securities finance revenues. The percentage of shares outstanding on loan has risen significantly since May in line with the decline seen in the company's share price. Benchmark lending fees peaked during the second half October but started to ease towards month end.

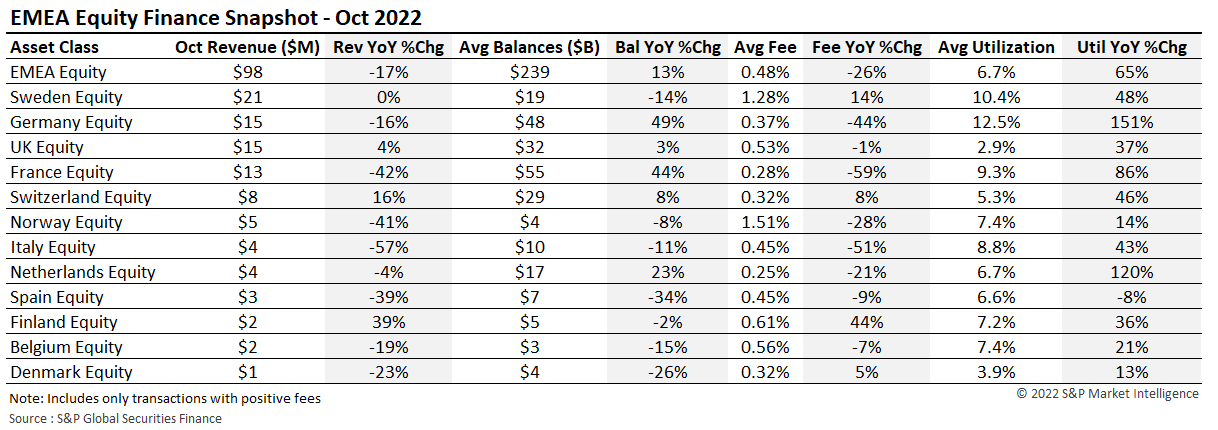

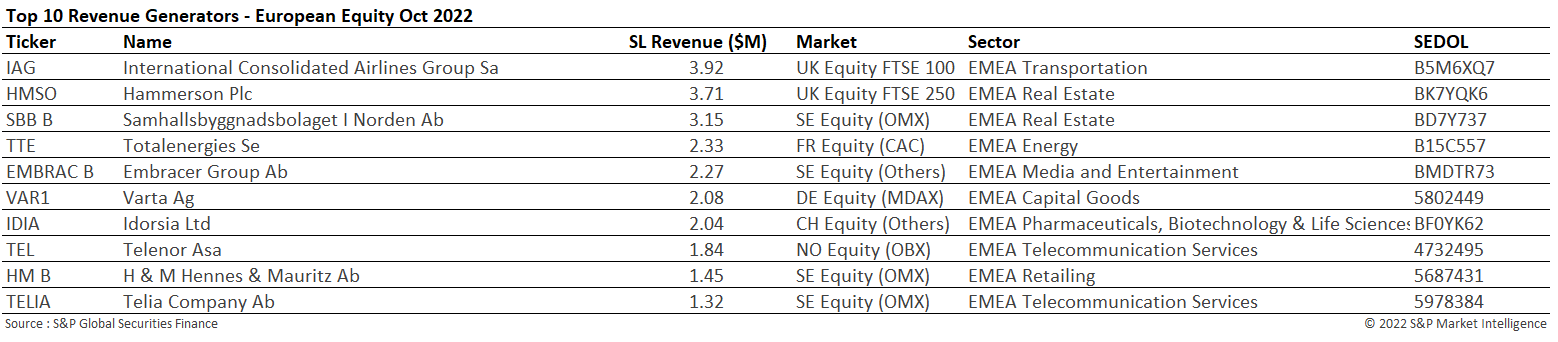

European equities generated $98m in revenues during October. This was an increase of 9% MoM and a decrease of 17% YoY. Balances and average utilization increased impressively YoY, increasing 13% and 65% respectively. On loan balances increased circa $5.8bln over the month which is likely to reflect the improvement in equity markets valuations following the downturns experienced during September. Average fees were 48bps during the month which was 1bps off the Q3 average but 26% lower YoY. At 6.7%, utilization during October was the third highest of the year following May and June.

Sweden was the highest revenue generating country during October over taking Germany which has led for most of the year. Average fees also hit a year high at 128bps and utilization hit double digits (10.4%), increasing on the previous month (9.3%). October was the highest revenue generating month of the year for the country so far this year. Revenues are 2.7 times higher than during January ($7.8m). As can be seen in the top ten revenue generator list, Sweden is very well represented. Samhallsbyggnadsolaget I Norden Ab (SBB B) remains under pressure as Real Estate across Europe is suffering from higher interest rates and a decrease in purchasing power as a result. Debt refinancing has also become more expensive because of central bank tightening. Embracer Group is another Swedish stock in the list. This companies share price has decreased circa 50% over the past year. Uncertainty regarding the new acquisitions, performance of recent game releases, and doubts surrounding recent acquisition synergies have put the stock's share price under pressure.

Despite balances increasing 44% and utilization increasing an impressive 86% YoY, revenues generated by French equities fell 42% YoY to $13m. In the UK, two specials IAG and HMSO generated a combined $7.6m which was 50% of the $15m generated over the month. Revenues, balances, and utilization all saw increases in the UK YoY. IAG, was the top revenue generator in Europe over the month as the company's struggles continue to be reflected in its share price which has fallen 35% since January. Caps on passenger numbers at the airline's main airport, Heathrow, and the impact of the current inflationary environment on personal finances and discretionary spending continues to weigh heavy on the company's share price. Hammerson was the second highest revenue generator over the month due to the recent Scrip dividend offering borrowers an imbedded optionality that can be monetised and valuable if corporate action elections are known in advance. Despite maintaining the highest utilization (+151% YoY) in any European market, German equities generated 16% less revenues during October 2022 than October 2021. Varta AG which has been the top European revenue generator for numerous months fell to sixth place during October. This was the lowest earning month for the stock since January. Throughout 2022 so far, Varta Ag has generated $46.3m in securities finance revenues.

Across the remaining European countries Switzerland and Finland were the only other countries to experience an increase in revenues YoY. Switzerland also saw an improvement in average balances, fees, and utilization. Idorsia Ltd (IDIA) generated $2m of the total $8m as can be seen below.

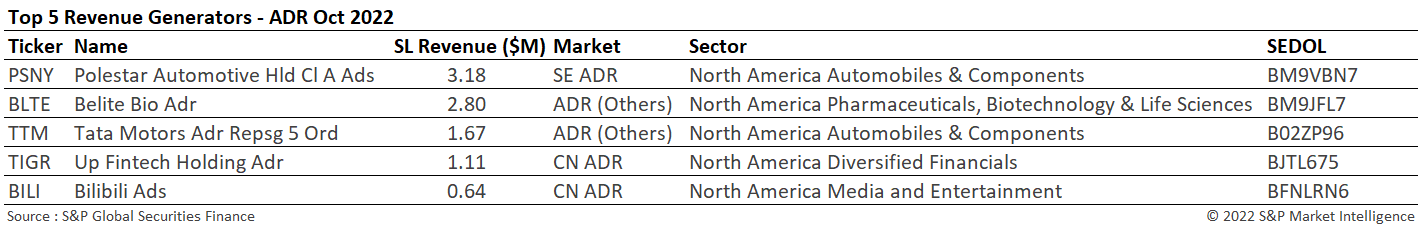

ADR revenues decreased MoM by 22% but increased YoY by 1% to $24m. Average fees continued to rise YoY but were down significantly when compared with August (-36%) and September (-24%). ADRs continue their volatile year as balances and revenues continue to fluctuate with very little consistency being shown month on month. Utilization grew over the month of October to 9.7% (+13% YoY and +5% MoM).

The top five revenue generatng stocks are common names in the ADR specials arena. Many have been covered in previous snapshots. The Automobile and Electric Vehicle sectors remain in focus along with Pharmaceutical and Entertainment stocks.

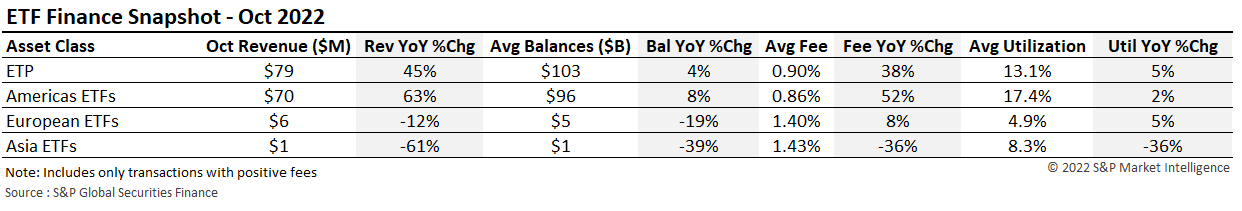

ETP revenues increased by 45% YoY to $79m. Average fees hit a year high of 90bps which is 38% higher YoY and a 6% increase MoM (85bps September). Utilization and average balances also increased when compared YoY with Utilization also increasing MoM. Americas ETFs dominated the revenue generation over the month. Utilization for Americas ETFs stands at an impressive 17.4%. Americas ETFs experienced their second-best month for revenue generation of the year (March was the best $74m). European ETFs however generated their lowest revenues of 2022 so far ($6m) despite balances rising 2% when compared with September.

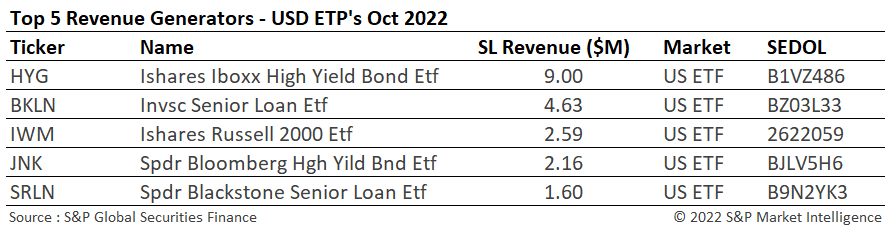

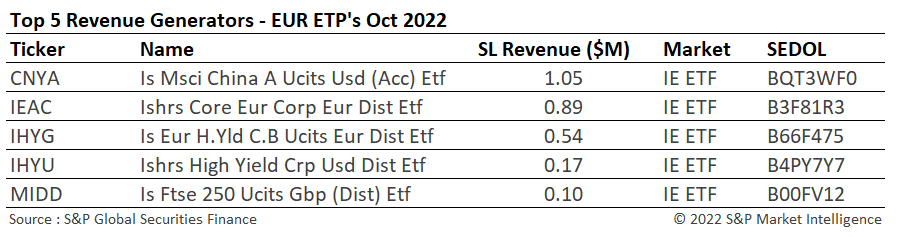

Given the continued market volatility and interest rate hikes, it's no surprise to see the ETFs in the US and Europe that continue to generate the highest revenues for their respective geographic sectors. High Yield continues to dominate with HYG continuing the lead. HYG has now generated circa $99m in securities finance revenues during 2022. Several equity index trackers also make an appearance including the iShares FTSE 250 and the iShares Russell 2000.

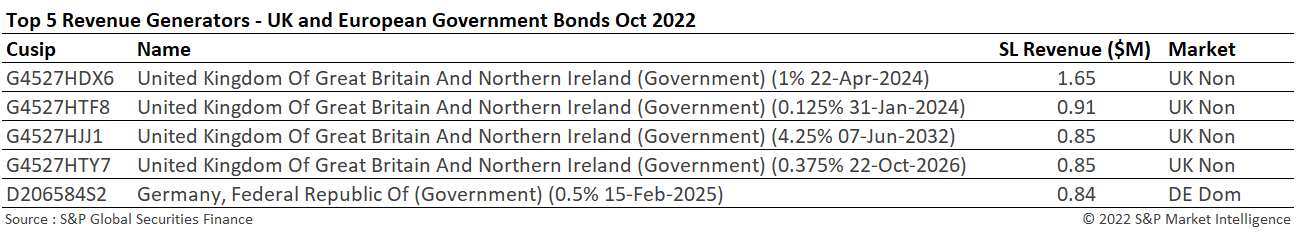

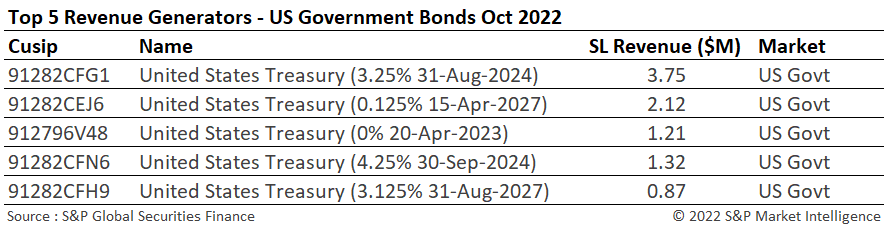

As Government bond markets stabilised over the month following a change of fiscal policy by the UK Government, yields started to fall from multi-year highs and talk of quantitative tightening recommenced. During October the asset class experienced its second highest revenue generating month of the year. Revenues of $161m were generated which was 18% higher than during October 2021 but 4% lower MoM. Average fees remained steady over the month at 18bps remaining flat when compared with September. Utilization declined both YoY and MoM.

Short-dated government bonds continued to dominate the top revenue generator tables which is unsurprising given the hawkish rate environment (ECB, BOE and US FED all recently raised rates again by 0.75%) and their sensitivity to immediate changes in monetary policy. In Europe, UK Gilts dominated the table with the German Bund 15/02/25 also making an appearance. ICMA recently warned of decreasing liquidity in the European repo markets, thus the appearance of more Euro Govies in this list heading into year-end would therefore not be surprising given the easing of market and political pressures on UK Gilts.

In the US the situation was very similar with short-dated treasuries seeing the highest revenues. As the Fed continues to hike and talk of any immediate easing or pivot is fading given the persistent inflation, job growth and the strong economic backdrop in the US little change is expected to be seen in the constituents of this list in the near to medium term.

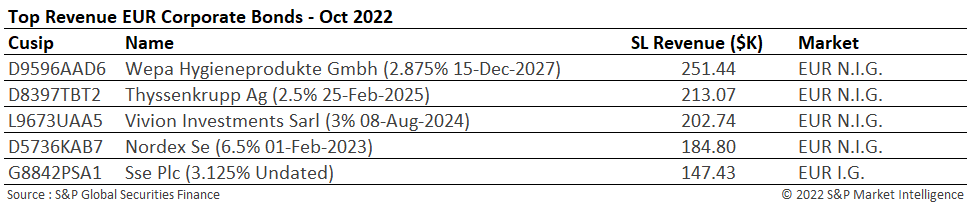

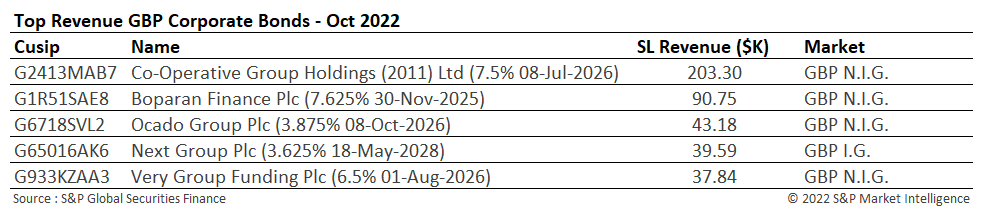

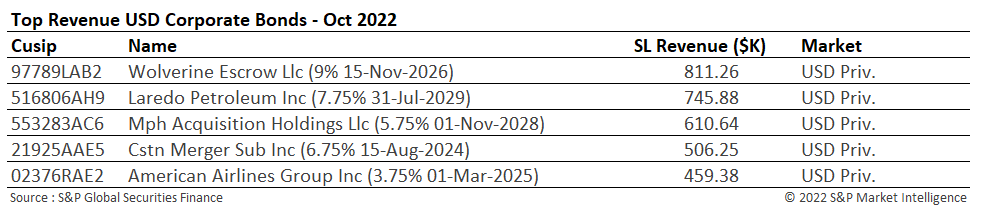

Corporate bonds experienced their best month of the year so far generating $86m in revenues which is an increase of 3% MoM. Average fees also hit a year high at an impressive 41bps which is an increase of 72% YoY. Utilization increased to 5.7% making corporate bonds the fourth most borrowed asset class after Government bonds, ADRs and ETPs.

Corporate bonds as an asset class are experiencing one of the worst years in recorded history for investment performance and this is unlikely to improve until any clear signs of a pivot (currently expected in 2023) and / or greater stabilization in longer dated yield curves is seen. As a direct result of falling prices, increasing yields and squeezes in liquidity, corporate bonds continue to be sourced by borrowers from securities lending programs for either directional, hedging or market making purposes. This situation is likely to continue as global benchmark interest rates continue to rise and volatility remains relatively high.

The top revenue generating bonds in the UK and Europe were mainly non-Investment grade with the UK top earners focused on retail and consumer discretionary sectors. In the US, private placements continued to generate the highest revenues.

Securities finance revenues for October remained robust given the market turmoil and the fall in equity and fixed income asset prices during September. Despite this, for the first time in seven months, securities finance revenues came in under the $1bln+ mark. American equities continued to dominate the revenue story for equities, driven by ongoing and well documented specials that continue to produce strong and reliable returns. ETPs, especially the US ETFs, continue to produce solid, steadfast returns and remain heavily borrowed.

Fixed income assets produced solid revenues with corporate bonds continuing their impressive run to achieve new year highs in both revenues and fees. As monetary policy remains focused on reducing inflation, the new norm of higher rates for longer, appears to sit well very with lenders despite the ongoing struggles for asset owners.

Posted 04 November 2022 by Matt Chessum, Director securities finance

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.