Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Feb 05, 2024

By Matt Chessum

A tough month for securities lending revenues but a great month for equity investors, as stock markets hit fresh highs.

After a bumpy start to the year, equity markets around the world continued to advance, reaching new highs before month end. In the US, the S&P 500 hit a record high after a two year wait. The market experienced strong momentum over the month as the benchmark index closed higher, marking new records, over five consecutive days. The release of positive Q4 earning reports and strong economic data, boosted investor confidence, which was subsequently reflected in equity market valuations. The Dow Jones Industrial Average and the NASDAQ 100 also closed at fresh all-time highs during the month, reflecting the robustness of the US economy.

Across Canada, the TSX60 finished the month in positive territory, as did most of the equity markets across Europe. Across the Asia Pacific equity markets, the focus remained on the Chinese economy with further pressures seen in its property sector, following the decision by a Hong Kong court to order the liquidation of Evergrande, one of China's largest property companies. Both the Heng Seng and the CSI 300 suffered heavy monthly losses as a result. The fall in equity valuations in the country expedited a further retreat by foreign investors in the country's markets as pessimism regarding China's stalling post COVID economy continued to grow.

Bitcoin was the star of the month after the SEC approved eleven, much anticipated, new Bitcoin ETFs. Before their launch, Bitcoin hit a price of over $47K which reflected the strong level of anticipation that investors were showing for these new funds. The price did lower over the month as investors took advantage of a more liquid and cost-effective way to invest in the cryptocurrency. The approval of these new funds is expected to pave the way for Bitcoin and other crypto currencies to enter into the mainstream investment arena, as asset managers look to broaden their ETF offerings across different crypto products.

The European Central Bank kicked off the 2024 interest rate meetings mid-way through month. Markets were hopeful for a greater degree of guidance on the timing of any rate cuts following the increase in market positioning seen throughout December. After leaving interest rates on hold, Christine Lagarde did offer some guidance, alluding to the potential for rate cuts in the summer if inflation trends continue to move in line with expectations.

The Federal reserve also decided to hold rates steady over the month after requiring greater confidence that inflation remains fully under control before cutting. The strong economy in the US continues to prove problematic for the central bank. It is unable to immediately lower rates as less restrictive policy in such a strong economic environment may run the risk of pushing inflation higher. Moving rates higher to slow economic growth and lower any further inflationary risks, however, may impact the success of the soft-landing scenario that the Fed has been chasing. During the press conference following the decision, Chair Powell said that looser policy is on the cards at some point in 2024 but such a move as early as March is unlikely.

Traders finally started to listen to the narrative being shared by central bankers as interest rate cut expectations started to lower. In the UK, traders lowered their expectations to one percentage point of cuts during 2024. This is far less than the 150bps of cuts priced in towards the end of 2023. The Bank of England, in line with its peers, also decided to hold rates steady over the month.

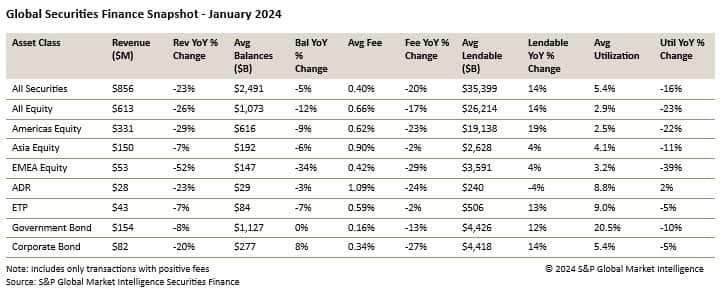

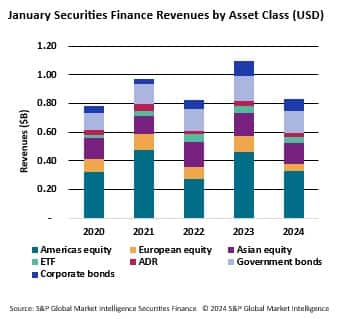

During the month of January, securities lending markets generated $856M in revenues. This was a decline of 23% YoY, following an exceptionally strong January during 2023. All major asset classes experienced a decline in YoY revenues. Across equities, revenues declined 26% YoY to $613M. The largest decline was seen across EMEA equities which continued to experience a deterioration (-52% YoY) in monthly revenues. Across the other markets, Americas equities revenues declined 26% YoY whilst Asian equities experienced the smallest decline of any region with a decline of 7% YoY. The fall in revenues was the result of lower average fees (-17% YoY) and lower balances (-12% YoY). Without the higher equity market valuations seen over the month (raising returns) January revenues are likely to have been closer to those seen during 2020 (circa 6% lower) when equity markets were spooked by the onset of the COVID pandemic.

Across the fixed income markets a similar situation was seen. Revenues from government bonds declined by 8% YoY to $154M and revenues from corporate bonds fell by 20% YoY to $82M. Balances remained flat YoY across government bonds and increased by 8% YoY across corporate bonds. A decline seen in average fees (-13% YoY government bonds and -27% YoY corporate bonds) started to impact underlying revenues. As rate cut expectations start to temper and volatility dissipates as a result, average borrowing fees are starting to decline. Those bonds in the maturity buckets that have been under pressure since the start of the rapid moves in interest rates are also experiencing less demand. Both revenues and average fees are starting to ease as a result. This is likely to remain a common theme throughout the year after both asset classes experienced an exceptional 2022 and 2023.

A slow start to the year is to be expected given the uncertainty regarding moves in interest rates, further surprises in economic data and recent increases in inflation data during December. The securities lending market may be suffering from too many unknown unknowns as market participants await further economic data, stronger guidance from central bankers and a possible market correction after the continued equity market rally that started in November.

SAVE THE DATE

The S&P Global Market Intelligence Securities Finance Forum will once again be taking place in London on the 16th May at One Moorgate Place EC2R 6EA. The forum will consist of an afternoon of discussion and insights from market experts, guided by the Securities Finance team. An official "save the date" will be sent in the coming weeks but we are looking forward to hosting an afternoon of lively discussion and topical debate with our clients, friends, and partners.

On the 26th of April we will be running an APAC Securities finance webinar. It will be taking place at 12:30 HK SAR and will feature insights from myself, our China Securities Lending expert Jason Yang and Stephen Howard the CEO of the Pan Asian Securities Lending Association. We will be running through a 2023 market review, making predictions for what the region might expect during 2024 and we will also be discussing what market participants can anticipate to hear at the upcoming PASLA conference which is taking place on Tuesday 5th March to Thursday, 7th March 2024 in Singapore.

If you would like to attend the webinar or register for the playback you can do so by clicking HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.