Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Financial Services — 6 Jan, 2018

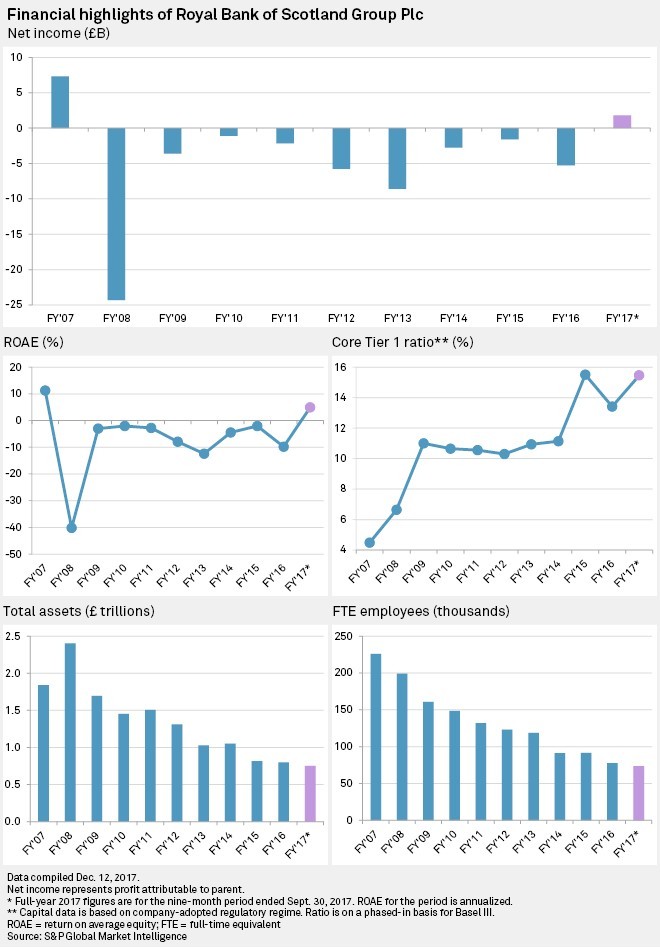

Nearly 10 years after its rescue from the brink of collapse with a £45 billion government bailout, Royal Bank of Scotland Group Plc's vital signs have finally started to improve.

The bank booked profits in each of the first three quarters of 2017, the first time it had done so since 2014 (though it still said it expected to book a 10th consecutive full-year loss), and it passed a particularly grueling Bank of England stress test in November 2017, which pronounced it fit to survive a severe financial crisis. Analysts now say RBS' turnaround efforts are starting to bear fruit and that its pared-down, U.K.-focused core business is as solid as that of any competitor.

Yet the bank's core business alone does not tell the full story.

'Significant progress'

RBS today is a very different bank compared to the global giant with total assets of £1.9 trillion that almost imploded following its takeover, as part of a consortium, of ABN AMRO Group NV in 2007 in a €72 billion deal that eventually landed the Dutch target and two of the three acquirers — RBS and the former Fortis — in state hands. RBS has long since shelved its plans for global dominance and is in the middle of a five-year restructuring plan instigated by CEO Ross McEwan in 2014, which has seen it pull back from overseas markets and scale down investment banking in favor of returning to its roots as a consumer-focused bank in the U.K. and Ireland.

The bank reached a milestone in November 2017 with the closure of its so-called bad bank, a unit set up shortly after the 2008 rescue that ran up losses of £50 billion as it off-loaded toxic loans and unwanted assets ranging from a fleet of aircraft in China to a burial ground in the deep south of the U.S.

Joseph Dickerson, a managing director at Jefferies International, said in an interview that the fundamentals of RBS are now relatively solid.

""Most of the business can now be considered 'core',"" he said. ""National Westminster Bank Plc is as good as any of the U.K. high street utility banks.""

RBS bought retail banking stalwart NatWest in 2000 in a £21 billion hostile takeover.

Ian Gordon, a London-based banking analyst at Investec, agreed with this assessment.

""Underlying RBS — which, admittedly, is sometimes quite hard to see — has made significant progress,"" he said.

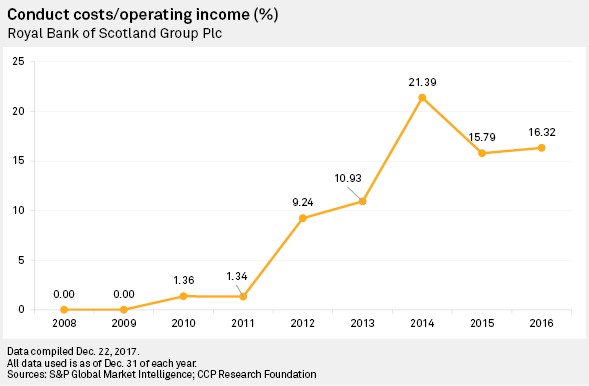

Once RBS settles with the U.S. Department of Justice over its pre-crisis role in the subprime mortgage market — at an expected cost of up to $12 billion — its restructuring can be ""considered complete,"" Dickerson added.

'RBS should be allowed to swim or sink'

That settlement is then expected to pave the way for the government to restart the privatization of 73% state-owned RBS, which it has said it plans to do by the end of the 2018-2019 fiscal year — although a U.K. government office noted in November that a sale at then-current market prices would imply a loss of around £26.2 billion.

McEwan said in December 2017 that the bank's capital position was strong enough to withstand the Justice Department fine, and although likely to be hefty, the penalty does not represent an ""existential threat"" to RBS, according to Diego Zulaga, head of financial services and tech policy at the Institute of Economic Affairs, a free-market think tank.

Zulaga added in an interview that the proposed sale timeline is ""economically realistic"" and said the best option for both the U.K. taxpayer and the government is to off-load the remaining shares ""at the earliest opportunity.""

""Arguments that the price is too low are fallacious since we cannot predict what it will be like in the future, and today's price anyway captures all future expected cash flows,"" he said. ""The government shouldn't be in the retail and investment banking business — it should let RBS free to compete and serve customers. RBS' consistent underperformance since the bailout is at least in part due to the absence of proper market discipline and incentives which come from government ownership. RBS should be allowed to swim or sink like all other banks.""

But even a clean break from taxpayer ownership and progress on restructuring will not be enough to banish the ghosts of the financial crisis, according to Dominic Lindley, director of policy at New City Agenda, a London-based think tank whose focuses include increasing the ""social value"" of financial services.

""For many years to come, RBS will still be associated with the worst combinations of greed and incompetence which led to the financial crisis,"" he said. ""It will take a generation to change the culture at RBS and for it to put the financial crisis behind it. We have to face up to the fact that after the extra interest we have paid on the money we borrowed to bail out RBS, taxpayers will never get all of their money back.""

One issue that will continue to weigh heavily on RBS for some time is the legacy of the Global Restructuring Group — a business unit created to handle struggling small businesses. RBS has come under fire for its treatment of small-business customers in the now-defunct GRG, which some critics say was incentivized to push viable businesses into insolvency, and the U.K. Financial Conduct Authority is facing criticism for declining to publish the findings of a report that it commissioned into RBS' handling of some 6,000 clients who ended up in the GRG.

""Even now, with the scandal in how it treated small businesses in its Global Restructuring Group, RBS is yet to face up to the scale of its misconduct and the impact on ruined businesses and livelihoods,"" Lindley said.