Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2017 | 14:15

The following post comes from Kagan, a media research group within S&P Global Market Intelligence. To learn more about this research, please request a call.

While fiber has already overtaken DSL as the largest fixed-broadband platform in the world, this is far from the case in Latin America and the Caribbean, or LAC, where only 35.2% of households are connected to fixed-broadband networks, and a mere 7.1% of connected households use last-mile fiber. Kagan, a media research group within S&P Global Market Intelligence, estimates DSL will remain the dominant fixed-broadband platform in the region over the next 10 years, with fiber growing to reach 12.0% of connected households in 2025. Globally, we estimate fiber connections account for 43.2% of fixed-broadband subscribers in 2016, largely due to China's FTTx expansion efforts.

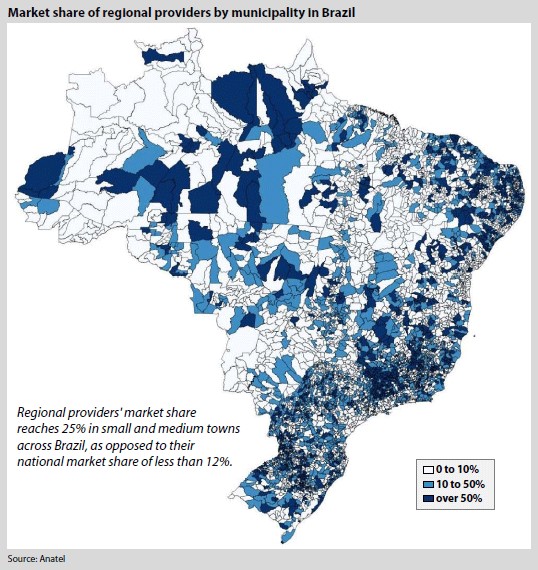

Speaking at the Broadband Latin America conference in Rio de Janeiro on April 26, small internet service provider, or ISP, associations Abranet, Abrint, and Redetelesul all stressed regional providers' leadership in broadband and fiber expansion in Brazil. According to recent data from the country's telecom regulator, Anatel, smaller operators represented 57.6% of net additions for fixed internet services in the 12 months prior to first quarter 2017 and 41.3% of fiber net additions. And this may just be a small part of the true contribution of regional ISPs to expanding broadband access in Brazil, as many smaller operators may underreport subscriber data in order to maintain tax benefits for small businesses.

"This was a development particular to Brazil where, due to the lack of network-sharing policies, dial-up service providers began building their own broadband networks in order to continue offering services in regions where incumbents were not present, initially using unlicensed wireless spectrum and eventually building out fiber networks," said Eduardo Neger, Law Studies Council Director of the Brazilian Internet Association, or Abranet.

Rogério Mendes, representative of the Brazilian Association of Internet and Telecommunications Providers, or Abrint, which represents over 700 regional providers, lauded the recent spectrum auction held by the Brazilian government, which gave smaller operators the opportunity to bid for local frequency blocks, as opposed to the usual approach, which focused on national coverage that only the larger wireless telcos could afford.

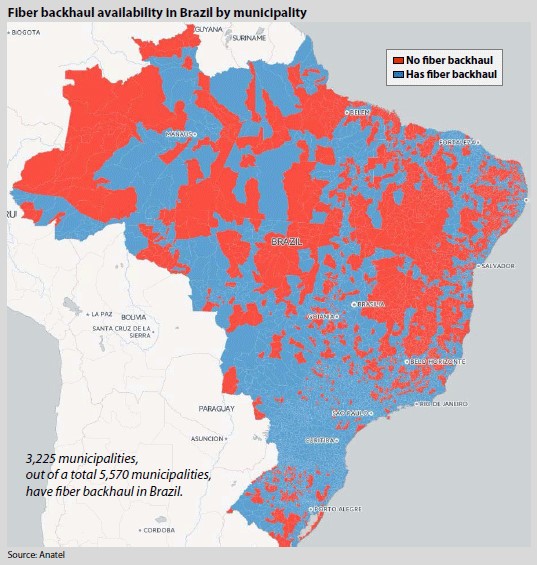

Neger explained that these networks were built without any external financing, using the companies' own resources, as smaller providers have difficulty accessing credit in order to further expand their networks, as their only asset, the networks themselves, can't be used as collateral. Rosauro Baretta, president of the ISP association of the state of Paraná, or Redetelesul, pointed out that, while his state is the only one in the country fully covered by fiber backhaul (see map below) — with some municipalities having up to three competing networks — many of these networks are still unlit due to the limited investment capacity of regional providers.

Fiber not the only solution

Speakers at the conference were also quick to point out that fiber is not the only solution for making broadband more accessible and affordable in Latin America and the Caribbean. This was the theme of the regional edition of the Broadband World Series event, which was held in parallel to conferences discussing wireless technologies, such as very small aperture terminals, or VSATs, LTE, and upcoming 5G developments, as well as network virtualization and the Internet of Things.

"The future is not fiber-to-the-home, but fiber-to-the-cell-site," said José Otero, LAC director for wireless association 5G Americas, stressing the importance of wireless technologies to expand coverage in the Latin American region. Otero also pointed out the lack of local content in the region, which is essential to drive demand for broadband services: "30% to 40% of national broadband plans in Latin America only consider infrastructure, but not e-learning, e-health, e-government or telecommuting."

Sandro Barros, General Director at satellite operator O3b Networks Ltd., presented the company's business as "fiber in the sky." By using a constellation of medium Earth orbit satellites with high-throughput Ka-band steerable beams, O3b Networks can provide fiber-level backhaul to remote regions, helping to remove the entry barrier for regional providers. "ISPs in the state of Amazonas began to report growth rates of 400% after becoming our clients."

Otero also lauded efforts in the oft-forgotten Central American and Caribbean regions, with broadband development in advanced economies rivaled in some markets, such as Barbados, where 85% of subscribers are on FTTH, or Belize, one of the first countries in the region to offer LTE-Advanced wireless services despite having only one subsea cable connection. This was expanded on by the COO of the Telecommunications Bureau of Curaçao, Giovanni King, who pointed out that uncertainty in the region after a series of mergers and acquisitions significantly reduced wholesale-market competition for access to subsea cables.

Public policy

King also outlined the Curaçao regulator's innovative approach to broadband policy, which hopes to promote more efficient investments in network expansion for the region by encouraging providers to compete at the service level rather than the infrastructure level.

Presenting the several initiatives the Brazilian federal government is implementing in order to drive broadband expansion in the country, Artur Coimbra, broadband director for the Ministry of Science, Technology, Innovation and Communications, or MCTIC, mentioned the long-promised creation of a fund to help regional providers access credit, the Fundo Garantidor de Infraestrutura. However, most of the Brazilian government's policies continue to focus on larger telcos, rather than the smaller players.

Coimbra also stressed the difficulty of implementing telecommunications services tax breaks, as these require negotiation with state governments.

Global Multichannel is a service of Kagan, a group within S&P Global Market Intelligence's TMT offering.