Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 19, 2021

Introduction - multilateral integration globally vs. regional integration

Post-WWII globalization is driven simultaneously by multilateral integration as well as the formation of regional trade agreements (RTAs). From an economic theory point of view, multilateral integration is the first best choice over regional integration (a second-best choice). WTO member states declare that RTAs should be complementary to, not a substitute for, the multilateral trading system.

An RTA is a treaty between two or more governments that define the rules of trade for all signatories which provide for better conditions than the general treatment and access to markets than a basic standard of the WTO (MFN clause). RTAs in the WTO are taken to mean any reciprocal trade agreement between two or more partners, not necessarily belonging to the same region (they do not have to be regional trade agreements as such and could thus span several regions or countries from totally different parts of the world).

The overriding principle of the GATT/WTO system is the principle of non-discrimination. RTAs are discriminatory but are however considered to be an exception to the principal rule and allowed if certain specific conditions are met. In general, RTAs should facilitate trade between parties but should by definition not raise trade barriers vis-à-vis third-parties and must cover a substantial part of the trade (rules on formation and operation of FTAs and CUs under Article XXIV of GATT, Enabling Clause on RTA and global arrangements of developing states as well as the provision of Article V of GATS).

Under the WTO rules, all new RTAs have to be notified to the WTO. In 2006 WTO member states agreed on a provisional mechanism to enhance the transparency of RTAs and understand their effects on the multilateral (global) system. Under its provisions, members notify the WTO about their RTAs, and these are discussed by the wider WTO membership based on a factual presentation prepared by the WTO Secretariat.

It is clear from the WTO and trade data in general, that RTAs are increasing in number and changing their nature (from simple bilateral preferential trade agreements (PTAs) to more complex multilateral free trade areas (FTAs)/custom unions (CUs) and further beyond the scope of standard tariff and border regulations to a compass a large scope of policy areas such as competition policy, government procurements, intellectual property rights (IPRs), structural policies, regional development and so on).

Fifty trade agreements were in force in 1990. There were more than 280 in 2017. As of 20 September 2020, 306 RTAs were in force (according to the WTO website) corresponding to 496 notifications from WTO members.

The current European Union is an example of an advanced deep integration block that started as a "shallow" agreement and then deepened and widened (extended to 27(28) the European States from the original six).

As such RTAs create both static effects on trade (classic trade creation, trade diversion, trade deflection, and trade expansion/contraction effects) but also lead to significant long-term dynamic effects.

The classic economic literature on regional integration agreements (RIAs) distinguishes free types of allocation effects (impact the static allocation of resources), accumulation effects (impact of the accumulation of factors of production and efficiency and thus growth prospects), and location effects (impact on location decisions of firms).

The origin of RCEP

The Regional Comprehensive Economic Partnership (RCEP) Agreement was signed on 15 November 2020 after a long negotiation period started back in 2012. The RCEP is a multilateral, regional agreement extending and deepening the free trade between the member states of the Association of Southeast Asian Nations (ASEAN) and its existing trade partners China, Japan, and South Korea (the so-called ASEAN Plus Three) as well as Australia and New Zealand.

ASEAN itself is a regional economic organization established on 8 August 1967 by five founding member states and then extended, now comprising ten countries in Southeast Asia. ASEAN member states are Indonesia, Philippines, Vietnam, Thailand, Myanmar, Malaysia, Cambodia, Laos, Singapore, and Brunei. East Timor and Papua New Guinea have the status of observers.

The ASEAN Free Trade Area (AFTA) was signed on 28 January 1992 in Singapore creating a trade block with FTA between the member states to increase ASEAN's competitive edge as a production base in the global economy through the elimination, within ASEAN, of tariffs and non-tariff barriers and to attract more foreign direct investment to ASEAN. The members introduced the Common Effective Preferential Tariff scheme, which established a phased schedule in 1992. Unlike the EU, AFTA did not apply a common external tariff on imported goods (is not a customs union).

ASEAN countries tried to expand the preferential trading arrangements in the region by forming other FTAs with neighboring economies. These included in particular: ASEAN-Australia-New Zealand Free Trade Area (AANZFTA), ASEAN-China Free Trade Area (ACFTA), ASEAN-Korea Free Trade Area (AKFTA) as well as ASEAN-India Free Trade Area (AIFTA) that came into effect on 1 January 2010 as well as ASEAN-Japan Comprehensive Economic Partnership (AJCEP) that went into effect earlier, on 1 December 2008.

The above created a complex system of trade agreements that required simplification and at the same time potential deepening of ties for the benefit of all parties involved. The so-called ASEAN Plus Three was the first attempt that embraced ASEAN and China, Japan, and South Korea. This was followed by an even larger East Asia Summit (EAS), which included in addition to India, Australia, and New Zealand (ASEAN Plus Six). This group acted as a prerequisite for a possible East Asia Community (with ambitions similar to the EEC/EU).

For the time being the discussions and then negotiations led to the signing of the RCEP Agreement by 15 out of 16 states of the ASEAN Plus Six group. RCEP is the first multilateral agreement to include China (mainland) and establishes the first free trade agreement between China and Japan, as well as Japan and South Korea.

Objectives of the RCEP Agreement

The objective of the RCEP Agreement is to establish a modern, comprehensive, high-quality, and mutually beneficial economic partnership that will facilitate the expansion of regional trade and investment and contribute to global economic growth and development.

The RCEP Agreement is declared to work alongside and support an open, inclusive, and rules-based multilateral trading system within the WTO. The objectives of the RCEP Agreement are thus in line with the WTO rules.

The RCEP agreement aims to complement WTO and extend it to areas not covered or go beyond its provisions. RCEP constitutes for sure a significant improvement and deepening of integration in the region in comparison to the prior system of ASEAN Plus One FTAs.

RCEP aims to strengthen the position of states within global value chains but also to build stronger and deeper regional value chains. Simultaneously RCEP aims to boost responsible and constructive competition between parties involved to drive overall productivity which is key to long-term competitiveness and economic growth.

Scope of RCEP Agreement

RCEP Agreement comprises 20 Chapters. The base chapters concentrate on trade in goods including rules of origin, customs procedures and trade facilitation, sanitary and phytosanitary measures, standards, technical regulations, and conformity assessment procedures as well as trade remedies. The agreement covers as well as trade-in services including specific provisions on financial services, telecommunication services, and temporary movement of natural persons (related to trade in services). Besides, the Agreement has provisions on investment, IPRs, electronic commerce, competition, SMEs, economic and technical cooperation, government procurement as well as legal and institutional areas including dispute settlement.

In terms of market access, the RCEP Agreement achieves liberalization in trade in goods and services as well as investments.

We have to note that the RCEP group is diverse with countries at a different level of development, different levels of sophistication of firms, and varying sizes. The signatories differ significantly in terms of economic needs. Taking this into account, the Agreement is supposed to be mutually beneficial to countries at a different level of development. Thus, it provides a certain level of flexibility and special provisions and treatment for Cambodia, Laos, Myanmar, and Vietnam and adds additional flexibility for the least developed states.

The diversity of the level of economic development of signatories, different levels of technological sophistication, as well as different political systems and institutional setups could create potential tensions within the block itself.

Ratification & potential extension of RCEP agreement

RCEP will enter into force following ratification by at least six ASEAN countries and three non-ASEAN signatory countries and it will take the effect 60 days after it has been ratified. The process of ratification can be lengthy and take several months, nonetheless, it should be completed in 2021.

It is worth to stress that RCEP is open for accession by other states 18 months after its entry into force. India, as an original negotiating state, could become an additional member thanks to its fast-track accession possibility. The accession of India would mean the introduction of the original plan of the ASEAN Plus Six.

India decided to opt-out of RCEP at this stage due to concerns over the potential of excessive imports in particular from China within the scheme of the current agreement that could endanger domestic industry and agricultural sectors. Indian entry into RCEP would thus require the introduction of extra safeguard measures and renegotiation of the terms by all parties involved.

The economic significance of RCEP

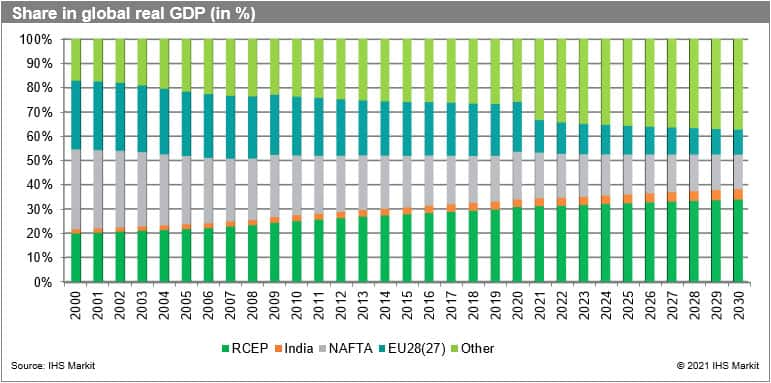

RCEP's countries account for about 29% (USD 25.8 trillion) of global gross domestic product and approx. 29% (2.3 billion) of the world's population.

The accession of India would significantly increase the shares to approx. 1/3 of global real GDP in 2020 and the share could increase by 5% to 2030 (according to IHS Markit Global Link Model). With India's access, the population of RCEP would go up to 3.65 billion people which is 47% of the world population.

Upon entry into force, RCEP will be the world's biggest FTA as measured by GDP—larger than the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the European Union (now weakened by 2020 Brexit of the UK), as well as NAFTA (now USMCA).

RCEP countries are responsible for roughly 25% of global trade in goods and services (USD 12.7 trillion).

In comparison to the rest of the world, most of the countries of RCEP dealt well with the escalating COVID-19 pandemic. Some RCEP countries are already growing strong. RCEP could give a further boost to the region's economy and increase its global significance.

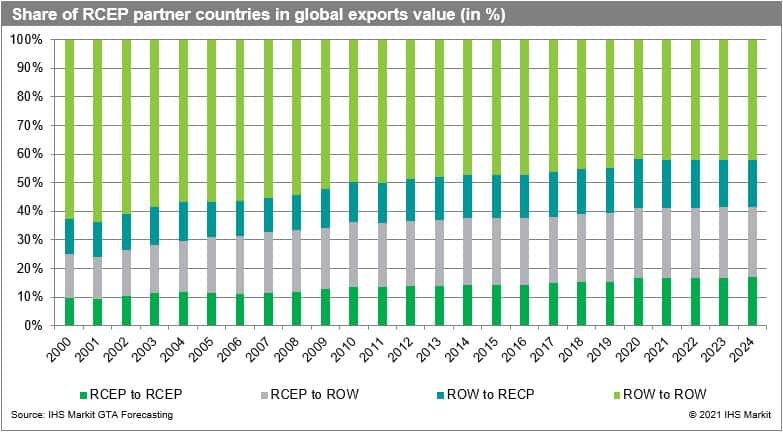

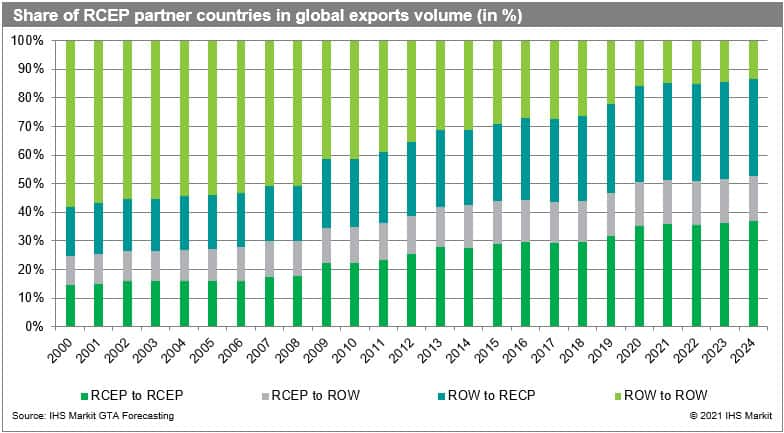

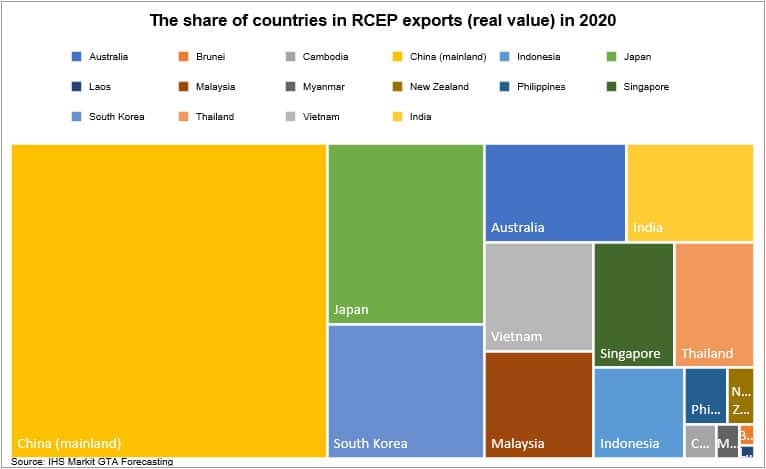

The IHS Markit GTA Forecasting data shows clearly that RCEP countries play a significant role in global trade already. RCEP countries trade intensely with each other but also play a crucial role in exports to the rest of the world. It is worth stressing that the significance of RCEP in global exports is significantly larger in volumes than in the real value. Thus, the RCEP plays and will play an increasingly influential role in global transport networks, in particular maritime transports.

Due to RCEP, the trade within the region is likely to grow faster than trade with other parts of the world - thus the significance of the region's value chain for RCEP countries will increase but also the significance of RCEP globally will grow.

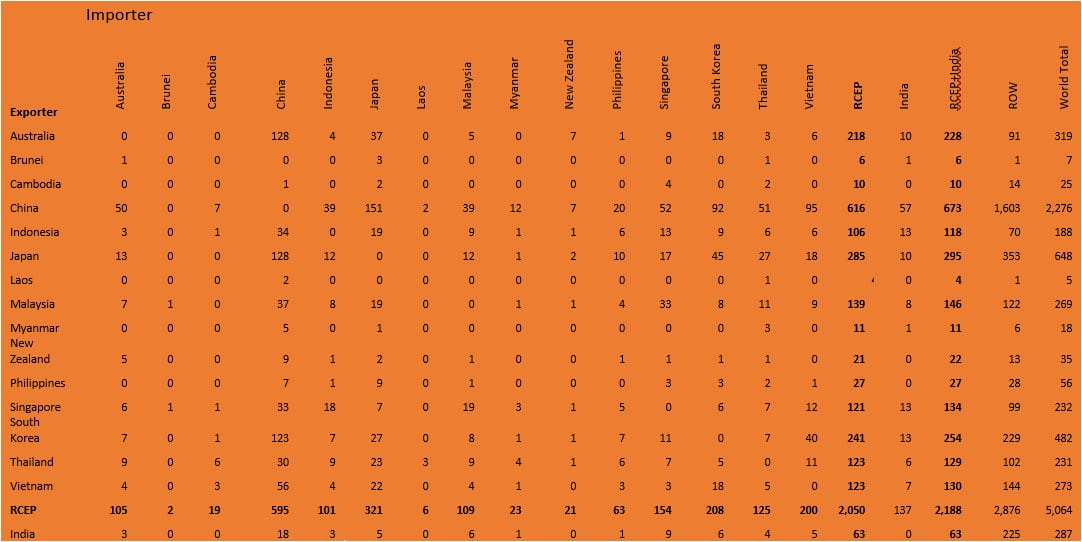

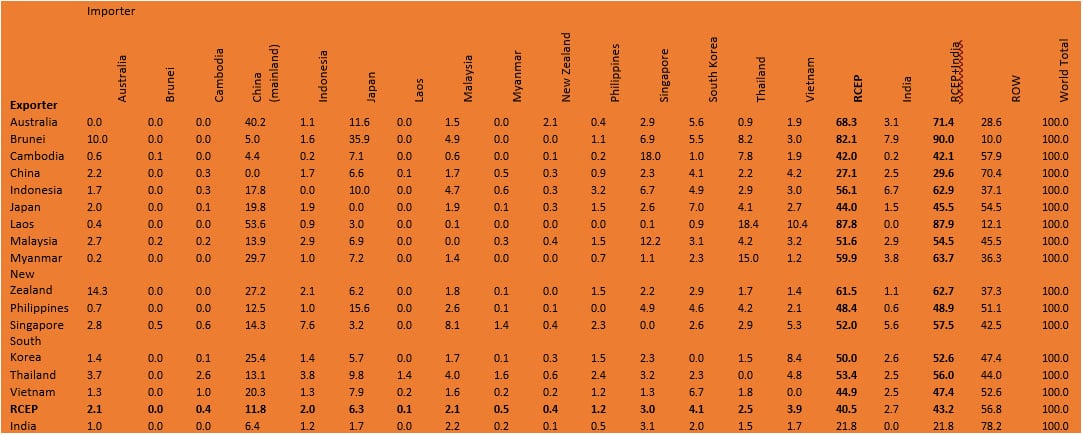

The significance of RCEP countries in terms of the value of their exports in 2020 varies from 27.1% in the case of China to 87.8% in the case of Laos. It's equal to 44.0% for Japan, 50.0% for South Korea, 61.5% for New Zealand, and 68.3% for Australia. It's below 50% for Cambodia (42.0%), Vietnam (44.9%), and the Philippines (48.4%). For India, the share of RCEP is only 21.8% - so it is lower than for China (mainland).

The intra-RCEP-region merchandise exports amounted to USD 2.05 trillion in 2020.

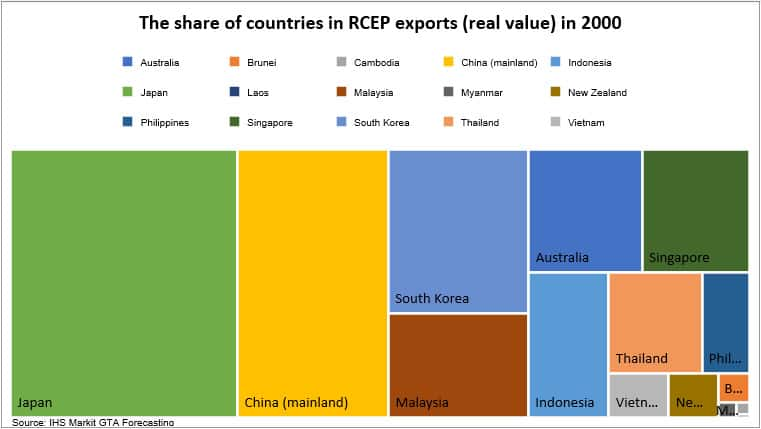

It is also important to note that the significance of RCEP is particularly strong as it includes for the first time China (mainland) as a part of the multilateral regional trade agreement. China is a rapidly growing global player as can be seen in the following two graphs depicting the share of countries in RCEP exports (within and outside of RCEP) in 2000 and 2020.

Source: IHS Markit GTA Forecasting database.

Source: IHS Markit GTA Forecasting database.

Conclusions

Upon entry into force, RCEP will be the world's largest regional trade agreement in terms of GDP & population. The Agreement extends beyond the typical FTA in trade in goods extending to trade in services and investments. RCEP could potentially widen (extend to other countries such as India) and deepen (similarly to processes observed in the case of EEC/EU or MERCOSUR). From a geopolitical perspective, it constitutes the first case in which China enters a multilateral regional trade agreement.

RCEP will enter into force in 2021 unless there are any significant problems with ratification (please note the recent trade tensions between China and Australia). Asia's trade policy landscape is set for a major change.

RCEP can thus due to its size and intended scope create significant quantitative and qualitative effects regionally and globally both in the short and the long run (significant static, as well as dynamic effects, are very likely). It could strengthen the economic position of the region as the main focus of economic activity spurring the growth of the region but also globally which could be a crucial element of recovery from COVID-19. RCEP increases the likelihood of establishment of the world's largest regional value chain with the growing role of intra-regional economic activity.

The cultural, social, economic, and political heterogeneity of the block will be a challenge to its functioning and progress will depend on the balance of costs-and-benefits for all participating states.Realizing the potential benefits of this mega-regional FTA will crucially depend on addressing the major challenges in particular divergent political and economic interests of this diverse group.

It is worth looking at RCEP from a broader perspective though. Over several decades, the global trade system itself is likely to develop into a system of several large RIAs or mega-regional trade agreements (e.g. European, Pan-American & Asian) with a significant role in the global trading system and potentially large tensions between them. The development of RCEP can be considered a significant step in this process. This could speed up the process of emergence of the so-called FTA of Americas and puts extra pressure on the European Union significantly weakened due to Brexit.

The current UK-EU post-Brexit trade agreement is likely to be only a temporary solution and the UK taking into account the balance of benefits and costs of Brexit and the terms of the current agreement with the EU from a perspective of several years could reconsider it by renegotiating its terms and potentially consider the re-entry into the EU within the next decade. Taking all the above into account RCEP can constitute a potential game-changer for the global economy in the post-COVID-19 world.

It will also be interesting to observe the impact of RCEP and its trade rules on the multilateral system and the potential erosion of the WTO dominance in global trade governance despite the statements made on the complementarity of both systems.

The real value of merchandise exports in 2020 (GTA Forecasting, USD billion)

Source: IHS Markit GTA Forecasting database.

The share of RCEP countries of merchandise exports in 2020 (GTA Forecasting, %)

Source: IHS Markit GTA Forecasting database.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

How can our products help you?