Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Dec 12, 2024

By Tim Zawacki

Florida's residential and commercial property insurer of last resort on Dec. 4 will present a 2025 operating budget that suggests considerable progress toward shrinking its overall exposure, but not before its 2024 financial results show a significant impact from several landfall-making hurricanes.

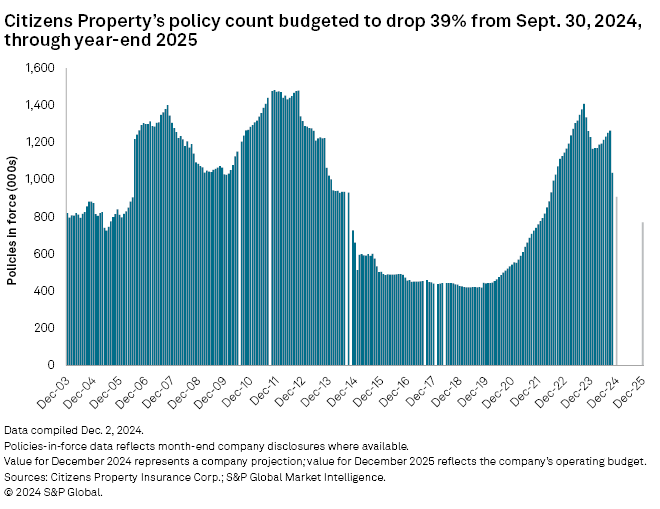

Policies in force and premium writings surged at Citizens Property Insurance Corp. in recent years due to a range of factors that included an inhospitable legal environment, tight reinsurance market capacity, statutory limitations on its ability to raise rates and reticence among private carriers to increase their property insurance writings in the volatile Florida market. Thanks to various legislative reforms and the resulting recent success of depopulation initiatives, Citizens' policy count plunged by 17.9% in October, and it is poised to drop below 1 million for the first time at a month's end since July 2022. By year-end 2025, the Citizens budget contemplates that policies in force will drop to 770,819, which would mark a four-year low and a decline of 45.2% from a cyclical peak count of more than 1.4 million policies as of Sept. 30, 2023.

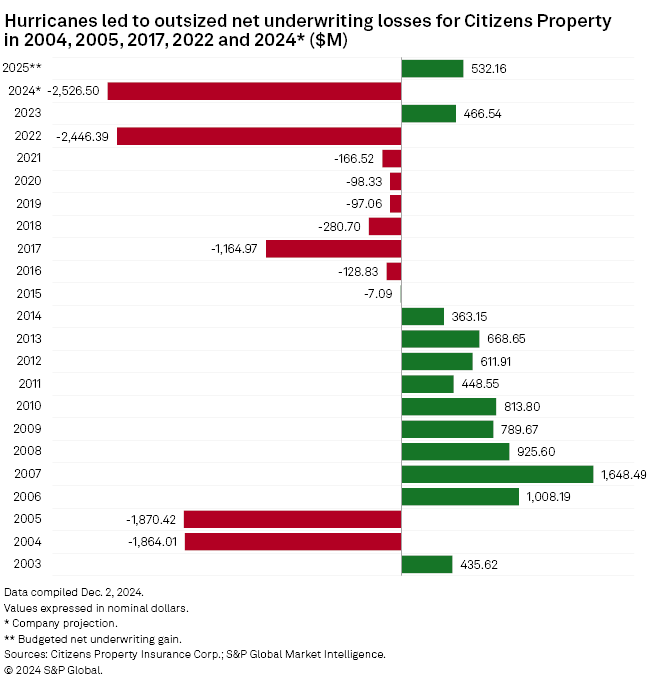

Hurricanes Helene and Milton, which struck Florida in September and October, respectively, served as a reminder of the risks associated with a state-operated insurer that is projected to generate $4.65 billion in direct premiums written in the homeowners, fire and allied lines in 2024. The new Citizens budget projects a net underwriting loss of nearly $2.53 billion for the calendar year as compared with a $466.5 million profit in 2023 and a $2.45 billion loss in 2022 when Hurricane Ian hit Florida. The 2022 result stood as Citizens' largest net underwriting loss on an absolute basis since its 2002 formation unadjusted for inflation, though it was smaller relative to the company's premium writings than billion-dollar underwriting losses produced in the especially severe hurricane years of 2004, 2005 and 2017.

The smaller Citizens would still face material risks, according to probable maximum loss scenarios displayed in the budget document. A one-in-100-year storm would threaten to wipe out the company's surplus while a one-in-25-year storm could send it to a net loss of more than $2 billion for what would be the third time in a four-year span. As always, Florida's fate will depend on how the wind blows next hurricane season.

Citizens' Florida market share in the combination of the homeowners, fire and allied lines spiked to a decadal high of 18.8% based on 2023 direct premiums written (note that this statistic is based on the fire and allied lines on stand-alone bases as opposed to S&P Global Market Intelligence's consolidation, which incorporates various other related lines). With the company's overall size in 2024 falling well short of levels it projected a year ago, we would anticipate Citizens' lead in those business lines over private carriers to narrow considerably by 2025 from the 13-percentage-point spread it maintained over second-place Universal Insurance Holdings Inc. in 2023. Other leading private carriers in those lines include State Farm Florida Insurance Co., Tower Hill Insurance Exchange, Florida Peninsula Insurance Co., First Protective Insurance Co., Chubb Ltd., The Progressive Corp., Slide Insurance Co. and the group led by United Services Automobile Association.

Momentum in depopulation initiatives represents a key driver of Citizens' contraction. Through the first 10 months of 2024, according to data presented by the company on Dec. 3, private carriers assumed 371,295 policies, representing combined exposure of $170.4 billion, up from 270,751 policies and $111.3 billion in exposure for all of 2023. Citizens forecast a full-year 2024 tally of 490,513 policies and $225.2 billion in exposure removed, including rounds of depopulation in November and December. Slide, American Integrity Insurance Co. of Florida Inc. and Florida Peninsula have been the most active participants in the 2024 depopulation, combining to account for 59.4% of the policies removed through October. Most of that activity stemmed from Citizens' Oct. 22 depopulation round where private carriers took out a total of 237,323 policies.

The 2025 budget calls for the depopulation tally to decline by 39.6% to 296,024 policies, but Citizens expects other factors to contribute to a net decline in policy count. It has budgeted for the number of new policies written to fall to 276,000 in 2025 from 369,000 in 2024 and for renewals to tumble to 751,000 policies from just over 1 million.

Ultimately, Citizens has budgeted for its total exposure to fall to $326.38 billion by the end of 2025 from $533.23 billion as of Sept. 30, 2024, around the time that Helene and Milton made landfall on Florida's Gulf Coast.

In a review of third-quarter results, Citizens attributed ultimate losses and loss adjustment expenses (LAE) of $67.9 million to August's Hurricane Debby and $426.6 million to Helene. A comparison of the company's projected full-year 2024 net losses and LAE with its actual result through the first nine months of the year implies that Hurricane Milton will be significantly more costly. The full-year projection of $4.95 billion in net losses and LAE implies that $3.31 billion will hit the books in the fourth quarter. Citizens absorbed $2.47 billion in net incurred losses and LAE from Hurricane Ian, but its impact came against a smaller book of business as measured by written and earned premiums. Citizens' projected 2024 net premiums earned of $3.11 billion, for example, would be 64.0% greater than its 2022 tally while its projected 2024 losses and LAE would be 27.5% higher.

Citizens has budgeted for net premiums earned of $2.29 billion, losses and LAE of $1.14 billion and year-end policyholders' surplus of $3.72 billion in 2025. The latter two figures will depend heavily on the severity of hurricane season..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.