Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 24, 2023

The real asset sector plays a unique role in the sustainable investment landscape, and private investors are important and dynamic players in the asset class. With new regulations related to sustainability-related targets (under various labels including net-zero and ESG) and evolving investor expectations on environmental impact, fund managers must navigate a market poised for significant change.

On behalf of S&P Global Market Intelligence, Mergermarket interviewed 30 senior executives from private equity firms focused on real assets, with respondents split equally between the United States and Europe. The questions explored the state of private investment in sustainable infrastructure and real estate and the outlook for sustainability-focused investments.

The results of the survey, summarized below, shine a light on areas of opportunity, operational challenges, and ways to incentivize further growth in the sector. Download the report to read the full results.

Poised for growth

Existing and forthcoming regulations have already touched a significant portion of the market. A large majority of the respondents reported that their firms already operate funds classified under the European Union's Sustainable Finance Disclosure Regulation (SFDR), with only 27% saying they do not operate a fund classified under Articles 8 or 9 standards for sustainable investing. Furthermore, 73% of respondents said they already have tracking for some elements of ESG (environmental, social, and governance) metrics for all their investments.

Private fund managers see opportunity on the horizon in a diverse array of investment types. In the short term, the largest share of respondents (57%) said power system and energy-related investments will see the most significant growth, driven in part by renewed concerns about energy security. Over the five- and ten-year horizon, however, digital infrastructure and transportation are seen as important areas for investment growth.

Data collection challenges

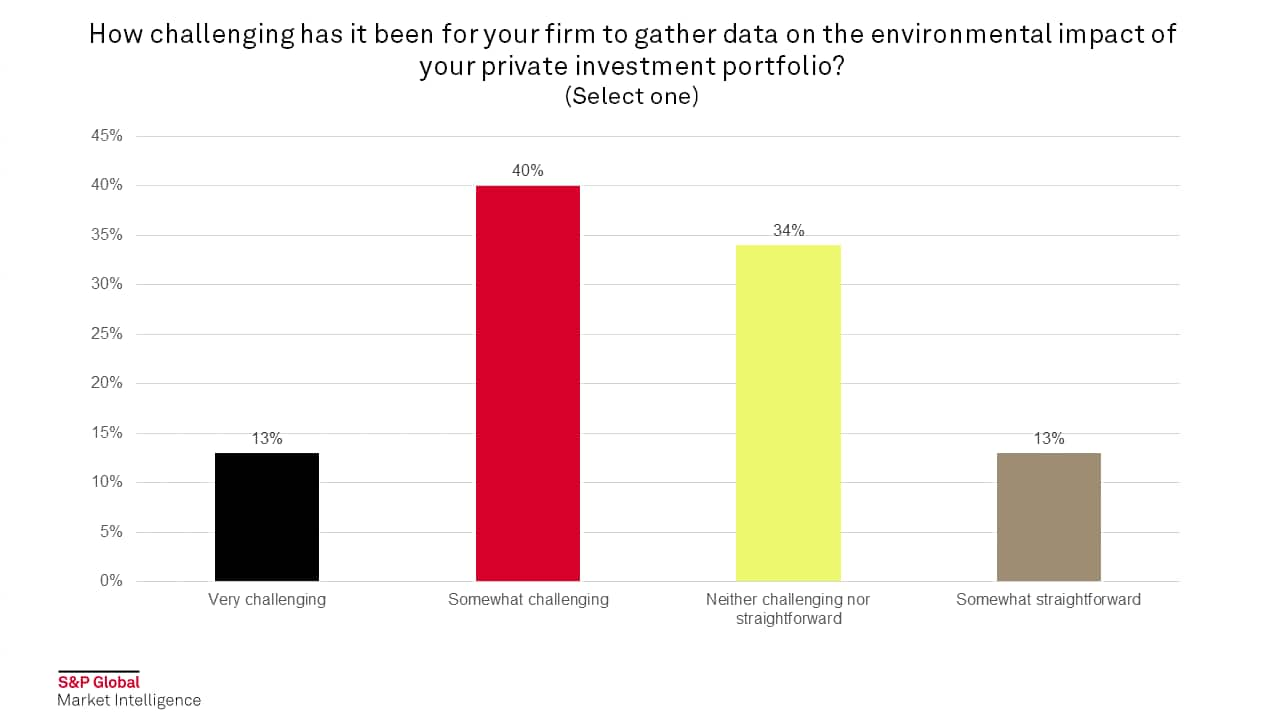

Even as more firms adopt an explicit focus on sustainability in their investment approach, identifying and tracking data to measure impact remains a key hurdle for real asset investors.

Inconsistencies between different projects and portfolio companies is a basic challenge requiring work-intensive standardization processes across the portfolio. One respondent from a US-based real estate firm said, "It is very challenging to gather information because of different reporting structures and the ways that companies maintain their ESG information. There are many manual procedures involved here."

Even in cases where historical data is available, bringing it together and mapping it to reporting frameworks is not a straightforward task. A senior leader at a French investment firm explained: "One of the main challenges is the unstructured data that is available with different businesses. They have been storing data in an unstructured manner for a very long time."

Paving the way for more investment

Some governments and regulators are eager to incentivize new investment in sustainable infrastructure from all sources, including private equity. Survey respondents offered a "wish list" of changes they felt would increase the inflows of private capital into the sector.

Among the factors rated as most important were reforms of public-private partnership (PPP or P3) frameworks, generally higher levels of regulatory stability, and subsidies or incentives for sustainable investment. On the second point, one respondent noted, "Many net-zero projects will run over the long-term. There are potential threats of policies changing and new governments introducing more stringent policies. Steps to mitigate these risks for investors would be nice."

Read more and access the data in the full report.

S&P Global Market Intelligence offers comprehensive sustainability data collection, analysis, and reporting for private equity and infrastructure investment firms. Learn more about our solutions.