Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2021

By Raghu Ramachandran and Anurag John

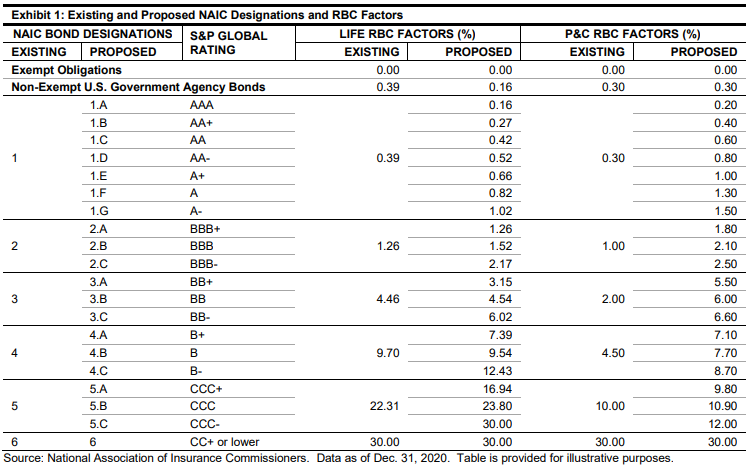

The National Association of Insurance Commissioners (NAIC) regularly updates its regulations. In 2020, the NAIC proposed a more granular set of designations for bonds. The proposed regulations expanded the number of designations from 6 to 20. These proposed designations align closely with the ratings provided by nationally recognized statistical ratings organizations, such as S&P Global Ratings (see Exhibit 1). The proposed expanded factors also add more transparency to the varying degrees of risk within insurers' fixed income securities.

However, the NAIC did not update the risk-based capital (RBC) factors for the proposed designations. Thus, while companies reported the proposed NAIC designations in their 2020 Schedule D filings, the RBC factors remained the same as those in the existing system. The RBC factors will remain the same until the NAIC completes its impact study and releases the final RBC factors for the proposed designations.

When released, the proposed RBC factors will vary for Life and non-Life insurers due to the different statutory and tax accounting treatments. Separate NAIC RBC Working Groups have been working to finalize and assess the RBC factors for their respective segments. A draft set of proposed factors has been released, but the NAIC has yet to formally adopt them (see Appendix). The NAIC plans to implement the proposed RBC factors for 2021 RBC filings.

Using S&P Global Market Intelligence's RBC templates, we assessed the potential impact of the proposed RBC risk factors on the insurance industry. We analyzed the impact of the proposed factors on the asset-level capital charge (R1 for Property & Casualty [P&C] and C-1o for Life) and at the authorized control level (ACL).

The Life industry has been the primary focus of the 20-designation project, given the contribution bond risk to Life insurers' overall RBC profile. Within individual designations, the impact of the proposed factors would be broad. The reduction in AAA/Fannie/Freddie RBC charge would lower the industry level charge by 60%. At the other end, the increase in the NAIC 1.G factor would increase this capital charge by 160% (see Exhibit 2). Overall, the after-tax C-1o charge would only increase by 11.25%—from USD 55.6 billion to USD 61.9 billion. However, the ACL ratio would decrease by 37.3%—from 970.89% to 933.59%. Although the overall impact on industry-level RBC ratios is not material, scenarios at the individual company level could cause the changes to be more than superficial in certain instances.

Download the full report