Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Aug, 2016 | 13:30

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

After a better-than-expected first quarter, broadcasters are becoming less certain about previous political forecasts as second-quarter revenue from the segment came in lower than anticipated for some.

After a better-than-expected first quarter, broadcasters are becoming less certain about previous political forecasts as second-quarter revenue from the segment came in lower than anticipated for some. The mixed political revenue results are an effect of late general election spending in addition to the Trump campaign's lack of TV advertising.

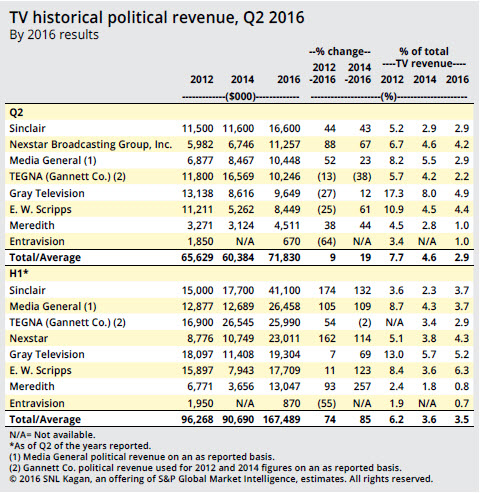

The Trump effect did not hit all eight public broadcasters in our analysis. The group was up 19.0% on average from the second quarter of 2014 and up 9% on average over the second quarter of 2012, the previous presidential election year. The overall outlook remains strong as the first half of 2016 is up 85.0% from nearly $90.7 million in the first half of 2014 to $167.5 million and up 74.0% from nearly $96.3 million in the first half of 2012.

In the first presidential election without an incumbent since the Supreme Court's landmark Citizens United decision in 2010, broadcasters projected a windfall of political spending that would surpass the 2012 TV total of $2.9 billion. We are holding strong on our already conservative projection of $3.3 billion on political for TV station groups as many station owners are confident the political revenue will ramp up regardless of presidential campaign tactics.

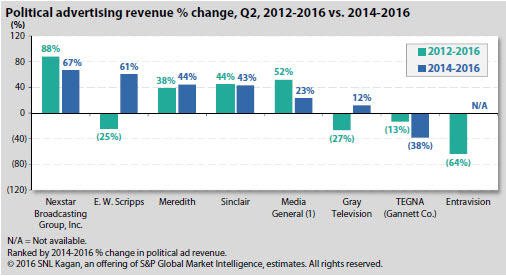

It was feast or famine for the groups in our analysis as many reported double-digit growth from 2014. Just one TV station owner reported a decrease: TEGNA Inc. reported a 38.0% drop from nearly $16.6 million in the second quarter of 2014 to nearly $10.3 million in the second quarter of 2016. The lull in spending was attributed to the fact that no significant primaries occurred in TEGNA's footprint in the second quarter. Another significant reason is that the presidential candidates were decided much later than in previous elections and so large spending on general elections started late, in June, which will be reflected in third-quarter earnings.

TEGNA President and CEO Gracia Martore talked about the political ad revenue outlook on the company's second-quarter earnings call. "We are confident that spending will continue to ramp up in the back half of the year, typically where about 80% to 85% of all the political dollars we get occur, especially during the five weeks or so between Labor Day and Election Day." She said TEGNA is well-positioned in key presidential swing states (Ohio, Florida, Virginia, North Carolina, Missouri and Arizona) as well as Senate and gubernatorial races.

David Lougee, president of media, talked on the call about the "Trump factor," saying Trump's funding is accelerating following the Republican National Convention and that donors are moving money to key Senate, House and gubernatorial seats where TEGNA's footprint is strong. He pointed to contested Senate races in Ohio, Florida, Missouri, North Carolina and Arizona. He said the number of buys for issue spending is "growing by the day."

In comparison to the 2012 presidential election year, half of the eight TV station groups experienced a decrease in political ad spending by double digits: TEGNA, Gray Television Inc., E.W. Scripps Co. and Entravision Communications Corp.

E.W. Scripps' second-quarter political was weaker than expected as the company reported the segment 25.0% lower than the $11.2 million in the second quarter of 2012, at nearly $8.5 million; however, the company is up 11.0% when comparing the first halves of those years.

On the company's second-quarter earnings call, Scripps CFO Timothy Wesolowski said: "Based on what we see today, we now believe the greater than $150 million we have been talking about is probably at the high end of our range and that there could be about 10% of risk to that number." Brian Lawlor, senior vice president of broadcast, said that originally the company modeled 10 swing states, where Scripps had six stations. That number had contracted, with traditionally competitive swing states like Colorado and Wisconsin playing a much smaller role, specifically the markets of Denver, Milwaukee and Green Bay.

Lawlor believes presidential and PAC spending should account for 30.0% of the company's total political revenue, with a significant portion coming from key U.S. Senate races in Arizona, Florida, Indiana, Nevada, Ohio and Wisconsin, as well as two open governor races in Indiana and Missouri.

Scripps President and CEO Richard Boehne was asked by an analyst on the second-quarter call if the political miss was geographic, to which he answered in the affirmative. He said that Scripps is in 24 markets and when polling changes arise, political ad revenue becomes a market-by-market revenue source. Full-year political revenue for Scripps is expected to be between $135 million and $150 million, with between $50 million and $57 million coming in the third quarter and $67.5 million to $75 million in the fourth quarter.

For Gray TV, political ad revenue was up 12% from $8.6 million in the second quarter of 2014 to $9.7 million in the second quarter of 2016, but the company was down from its second-quarter 2012 tally by 27.0% and is up just 7.0% when comparing the political revenue in the first halves of 2012 and 2016.

On the Gray TV second-quarter earnings call, Senior Vice President of business affairs Kevin Latek said Hillary Clinton super PACs have been active in about six Gray TV markets. He expects strong spending by the Clinton campaign, pro-Clinton PACs and super PACs, and some anti-Trump groups. Third-quarter political revenue is expected to be in the range of $40 million to $46 million, with the fourth quarter coming in between $80 million and $87 million.

Latek outlined heavy spending on political in 14 Gray markets compared to 15 in the 2012 presidential election. In terms of the House, he expects nine markets in seven states to see a portion of the spending with a handful of local races through the remainder of the year. Latek said the company has seen Senate and House candidates hold off on starting their general election spending so they can see what the Trump campaign does. "Once Donald breaks it down, the buys for all other races should begin in earnest. The cadence of political spending this year is clearly slower than what we saw in 2012, but is not necessarily exceptional," said Latek.

Sinclair Broadcast Group Inc. was the top TV station in terms of total political revenue in the second quarter, reporting 43.0% growth from $11.6 million in the second quarter of 2014 to $16.6 million in the second quarter of 2016. Sinclair also led all groups in first-half 2016 political revenue with growth of 174.0% from $15.0 million in the first half of 2012 to $41.1 million in the first half of 2016. The company is expecting $58 million to $68 million in political ad revenue in the third quarter with the full year expected to be between $260 million and $280 million.

The company's portfolio of stations is well-positioned for political ad spending in nine TV markets that include swing states such as Ohio and Florida. On the second-quarter earnings call, Sinclair Treasurer Lucy Rutishauser said that 61% to 62% of the total political guidance will fall in the fourth quarter, and she was confident that 2016 will be a record-breaking year for political ad revenue.

Nexstar Broadcasting Group Inc. political revenue is ahead of budget, with the company reporting a 67% increase from nearly $6.8 million in the second quarter of 2014 to nearly $11.3 million in the second quarter of 2016. Nexstar was up 88.0% over the nearly $6.0 million in the second quarter of 2012. Nexstar is up 162% from nearly $8.8 million in the first half of 2012 to $23.0 million in the first half of 2016.

Nexstar is on pace to reach record cash flow for the fifth year in a row with the help of this year's political and Olympic ad revenue. The company expects to exceed their initial guidance of $100.0 million in political ad revenue for the year.

On Nexstar's second-quarter earnings call, President and CEO Perry Sook announced that the company received an availability request from the Trump campaign for 17 states, with Nexstar TV stations in 13 of those states. Sook explained that the company is in 21 markets with Senate races and 12 markets with gubernatorial races. Sook believes displacement of core advertising will not be an issue until September.

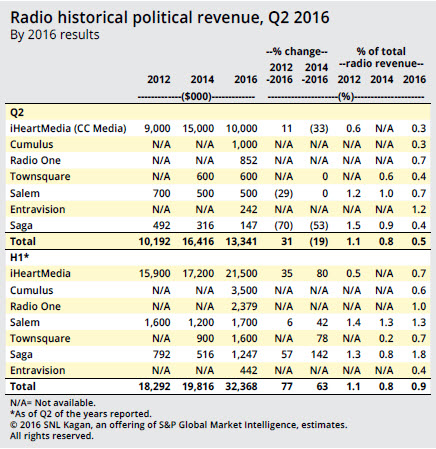

Political spending on the radio airwaves had benefited from a strong first quarter, with candidates in close primary races using radio to influence voters. The ability to quickly change messages gives radio a creative advantage, especially with a crowd of candidates vying for their message to be unique.

The seven public radio station groups reporting political ad revenue in our analysis were up 63.0% on average from $19.8 million in the first half of 2014 to $32.4 million in the first half of 2016.

IHeartMedia Inc. led all radio groups, reporting $10.0 million in political revenue including $3.0 million attributable to Katz Media Group. IHeartMedia COO and CFO Richard Bressler said on the company's second-quarter earnings call that the Washington, D.C.-based sales team has done a "great job" in leveraging local and national political ad campaigns and that iHeartMedia is "well-positioned" despite the unpredictable election cycle.

Cumulus Media Inc. reported political ad revenue of $1.0 million in the second quarter, bringing the total for the first half of 2016 to $3.5 million. On the company's second-quarter earnings call, Cumulus President and CEO Mary Berner said political advertising has been limited so far but is expected to ramp up as September approaches.

Berner addressed the shifting of ad spot inventory to free up space in high-demand areas producing incremental political ad dollars. Berner said political has historically been "slow to book" at this point in the cycle; however, in 2014, the company reported approximately $21 million in political ad spending and in 2012 about $25.5 million. "So I'd say, that said, you never know, if the tight races don't line up with our platform or if one candidate or another runs away with the national race early, there certainly is risk that the pace could slow. We just don't know," Berner said.

Townsquare Media Inc. reported $600,000 in political revenue in the second quarter of 2016 and $1.6 million in the first half. Net revenue for the second quarter increased 16.7% year over year with the increase partially driven by political ad revenue.

For Entravision, political ad revenue for radio was $242,000 in the second quarter, bringing the total for the first half of 2016 to $442,000. On the second-quarter earnings call Entravision Chairman and CEO Walter Ulloa said candidates could win or lose depending on support from the Latino electorate. He has seen several down-ticket campaigns reserve inventory in the third and fourth quarters, well in advance of what he normally sees in an election cycle.