Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 12 Jan, 2022

The shifting competitive landscape for broadband is expected to drive near-term capital spending for U.S. cable operators, with increases in spending on plant upgrades and elevated investment for line extensions alongside reduced outlays for set-top boxes.

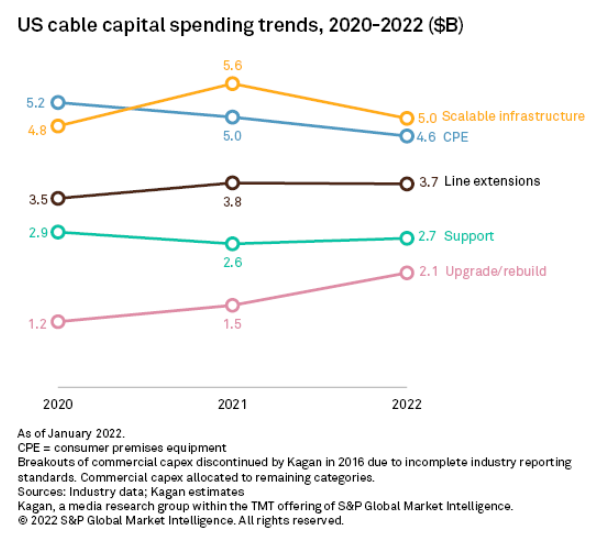

We estimate total capex reached $18.50 billion in 2021, up 5.0% from 2020, largely on the effort to beef up scalable infrastructure to meet pandemic-driven demand.

While annual totals are expected to remain in the recent historical range through our forecast, albeit at the lower end, allocations are shifting away from set-top boxes in the consumer premises equipment, or CPE, category in favor of physical plant investments. Our upgrade models are driven by enhancements to accommodate DOCSIS 4.0 as well as a heightened willingness to take the leap to fiber to the home, or FTTH, in response to increased telco upgrades.