Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 May, 2022

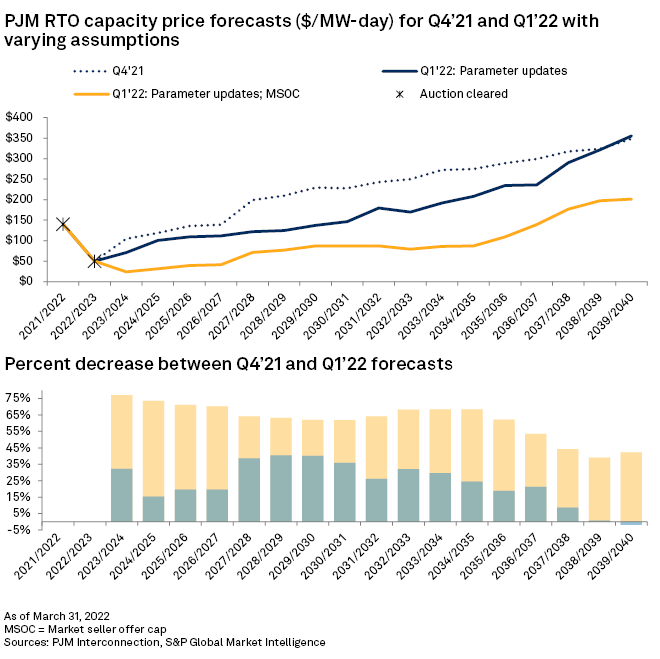

The PJM Interconnection released its annual load forecast update in January 2022, along with updated parameters including rates for the new Market Seller Offer Cap for the upcoming 2023-24 Base Residual Auction in June. Furthermore, in January, the Federal Energy Regulatory Commission ruled that PJM must remove a net energy and ancillary services adder in the demand curve, called the Variable Resource Requirement curve. On net, though the load is forecast to increase at 0.4% annually over the next 10 years, most changes acted to move the curve to the left, and the supply stack down, resulting in significantly lower capacity prices in the first-quarter 2022 Market Intelligence Power Forecast.

Ahead of the 2023-24 Base Residual Auction taking place in June, PJM published its updated load forecast and auction parameters, including the final rates for implementation of the impactful Market Seller Offer Cap. Lower peak demand, installed reserve margin requirement and forced outage rates, offset by a higher net cost of new entry, lowered forecast prices marginally, while the market seller offer cap significantly limits the bid potential for generators, resulting in 62%-77% lower forecast capacity prices in the next 10 years compared to previous forecasts.

Capacity market updates

In addition to the adjusted load forecast, PJM's update also modified several Base Residual Auction, or BRA, parameters for the 2023-24 delivery year. The most notable are the peak demand decreased by 763 MW, the installed reserve margin requirement decreased from 14.5% to 14.4%, the pool-wide equivalent forced outage decreased from 5.08% to 5.04% and the net cost of new entry slightly increased based on historical average net energy and ancillary services revenues. A 10% adder was previously added to the net energy and ancillary services offset but was removed in this forecast update due to the FERC ruling.

The 2023-24 BRA will also be the first auction to implement an Effective Load-Carrying Capability for variable generating resources. The amount of capacity that solar generators can offer into the capacity market decreases from 38% in 2022 to 0% in 2039. On the other hand, battery storage, which previously was granted only 40% of its capacity capability, will now be able to bid up to 80%.

Since the 2022-23 BRA, PJM has removed the expanded Minimum Offer Price Rule, or MOPR, which required new renewable generators accessing state subsidies to bid at their net CONE. This change was reflected in the third-quarter Market Intelligence Power Forecast update, after the only auction to include the MOPR cleared at only $50/MW-day.

The 2023-24 BRA will include a more restrictive Market Seller Offer Cap, or MSOC. The purpose of the MSOC is to remove the double-counting of any costs, such as large maintenance costs, that a generator includes in its energy market offer. The offer cap is based on the newly published default gross Avoidable Cost Rates for each asset class, with the option for a unit-specific offer cap with documentation of costs. Without knowledge of individual unit bidding behavior, the Market Intelligence Power Forecast assumes the net Avoidable Cost Rates as the cap for all units equally.

Capacity price forecast

Both BRA parameters and market changes have resulted in significantly lower capacity prices, even lower than the historically low 2022-23 price of $50/MW-day. From the forecast price of $105/MW-day for 2023-24 in the fourth-quarter 2021 forecast, the parameter updates alone reduced prices 32% to $71/MW-day. Data from the Market Intelligence Power Forecast shows that the new parameters produce a 20%-40% decrease in prices through the next decade, tapering off later in the forecast.

The MSOC compounds another 40% decrease in the 2023-24 forecast price to $25/MW-day. More than a 60% decrease in forecast capacity prices compared to fourth-quarter 2021 remains and only in the latest years of the forecast when hybrid battery storage units begin setting the capacity market margin.

The implementation of the MSOC is broad in the Market Intelligence Power Forecast. A significant uncertainty is how individual bidders will react to the new rule and pursue the unit-specific offer cap that may be higher than the default. Therefore, this forecast may be an aggressive implementation of the MSOC and prices may clear higher.

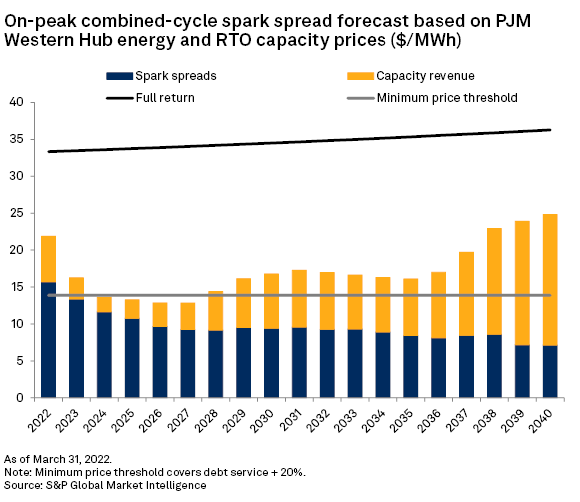

Impact on financial outlook for merchant combined cycle generation

Rising natural gas prices and high reserve margins result in lower spark spreads in the near term, putting pressure on combined cycle generators. While typically, capacity revenues would rise to offset reduced wholesale energy margins, the market changes in PJM, particularly the MSOC, limit these opportunities. The resulting financial outlook for combined cycle generators, even in the Marcellus shale region of western PJM, may become more challenging. Data from the Market Intelligence Power Forecast suggests that a new combined cycle plant would not be able to reach even its debt service threshold in the near term and is far from reaching full returns on equity throughout the forecast horizon.

RTO generation outlook

With renewable portfolio standards in place in nine of the 13 PJM states (including the District of Columbia) and a substantial pipeline of wind, solar and battery storage, the percentage of renewable generation continues to grow. Strained economics for gas and coal lead to projected retirements of 2 GW and 11 GW, respectively. The Market Intelligence Power Forecast estimates 67% of generation will come from clean energy sources by 2040, while coal and natural gas reduce their market shares by 50% and 47%, respectively, from 2022 forecast levels.

An S&P Global Market Intelligence webinar, scheduled for May 19, 2022, at 12 p.m. ET, covers this and other Power Forecast topics.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Chris Allen Villanueva contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.