Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Aug, 2016 | 09:00

Highlights

Major themes of the SNL Power Forecast for the second quarter of 2016

The following post outlines major themes of our Q2 2016 Power Forecast. For more information on this analysis, please request a call.

The ongoing economic struggles of nuclear plants came into sharp focus during the first half of 2016, with several owners opting to permanently retire plants rather than continue to operate in an environment of low power prices and weak demand growth.

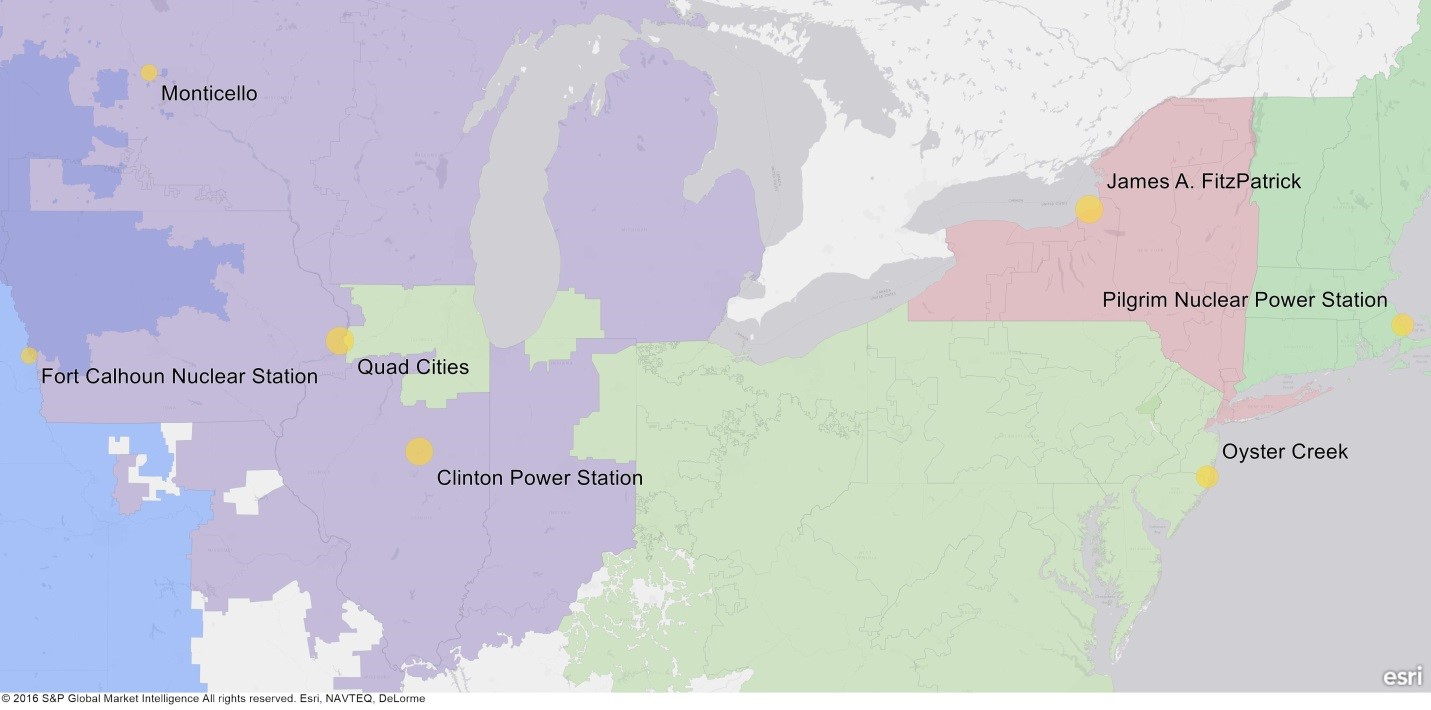

The map below shows the current expected retirement plans of nuclear plants in the eastern interconnect based on recent announcements and research by S&P Global Market Intelligence.

Of the plants shown, the owners of Fort Calhoun, Quad Cities, Clinton Power Station, Fitzpatrick, and Pilgrim all announced plans to retire within the last 9 months. The loss of baseload capacity can be expected to affect power prices and reserve margins in the Southwest Power Pool, Midwest ISO, the PJM Interconnection, the New York ISO, and ISO New England, respectively. It is a broad result that will impact market prospects for generation owners and developers in several regions, as well as impact greenhouse gas emissions policy. Given the implications, news around these power plants is evolving rapidly, with New York pursuing subsidies to reverse the retirement of Fitzpatrick and other nuclear plants in New York. A similar effort to gain subsidies for the Illinois plants Clinton and Quad Cities was unsuccessful. Finally, California is contemplating retirement of its last nuclear plant before 2025.

The struggles of nuclear plants owe a lot to the competitiveness of natural gas in wholesale power generation, but ironically that may be changing. A combination of producer cutbacks, increased gas burn by power generators and more normal weather helped drive natural gas futures up by $1/mmBtu, or over 30%, over the last six weeks. With natural gas now more expensive, coal burn has picked up, offering some relief to the beleaguered coal sector. With coal taking more generation market share, the rally in natural gas has topped out just shy of the $3/mmBtu mark. The abrupt halt to the rise in natural gas prices indicates that competition for generation by coal and natural gas will remain tight and hard-fought for the foreseeable future.