Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Dec 06, 2022

Research Signals - November 2022

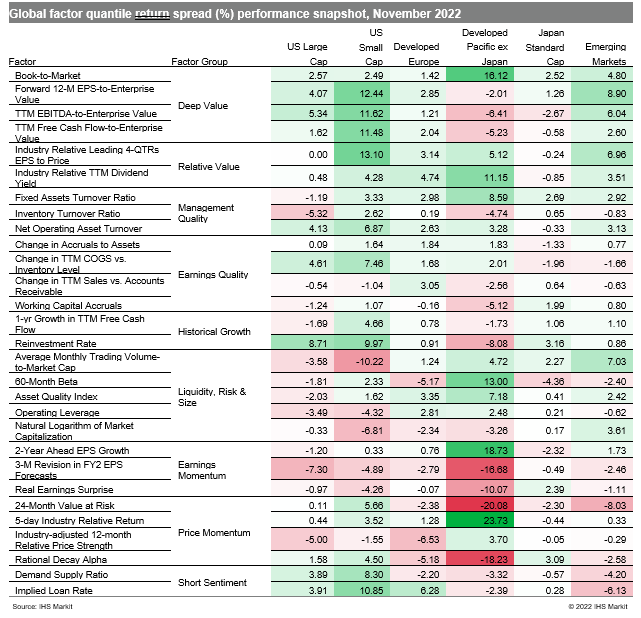

Investors across major regional markets continued to bid up stocks last month in hopes of a pivot in central bank policy towards a less aggressive pace in rate hikes given weaker economic data points. Supporting this thesis, the November J.P.Morgan Global Manufacturing PMI™ fell to a 29-month low, with 23 of the 31 nations with available data in contraction territory, including China, the US, the euro area and Japan. The extension of the upward trend in stocks carried over to a continuation in outperformance from value factors (Table 1).

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.