Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Oct, 2017 | 15:30

By Eric Turner

Highlights

Loan management and servicing giant Navient Corp.'s agreement to purchase student-focused digital lender Earnest Operations LLC for $155 million in cash marks the first high-profile acquisition of a digital lending platform.

Loan management and servicing giant Navient Corp.'s agreement to purchase student-focused digital lender Earnest Operations LLC for $155 million in cash marks the first high-profile acquisition of a digital lending platform.

As the sector has been working to find itself and digital lending IPO activity has remained stagnant, the deal represents a win for all parties involved. Navient will be able to offer consumer-facing loan options built on advanced analytics, while Earnest will leverage the balance sheet of a much larger institution. Earnest's investors will also win to some degree, managing a small return on their original investments.

This type of deal could be the future for digital lending as platforms look to boost growth following a tough 2016 and financial institutions are hungry for the technology that these firms created.

One of a few

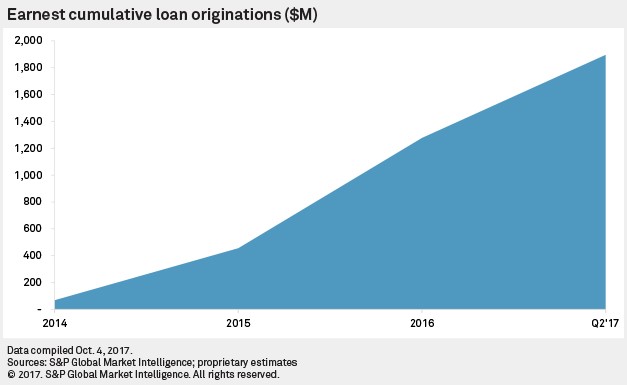

Earnest is one of the few student-focused digital lenders, alongside CommonBond Inc. and Social Finance Inc. While the company started as a platform for personal loans in 2014, the student loan refinance product added in 2015 became Earnest’s focus. Through the second quarter of 2017, Earnest had originated nearly $1.9 billion in loans since its founding, according to S&P Global Market Intelligence estimates.

Earnest’s student loan refinance product allows borrowers to repay higher-interest loans and consolidate debt into one monthly payment. It appears that while Earnest does offer a personal loan product, the majority of the business is focused on student loan refinance. This could mean that under Navient, Earnest will drop the personal lending business and instead focus on student loan refinance and perhaps a new in-school loan product.

Synergies immediately apparent

In Earnest, Navient has found a way to offer loans directly to borrowers. As of the end of the second quarter, the company held $110.55 billion of loans on its books. Earnest has, on the other hand, acted as an acquisition and underwriting platform focused on technology-enabled lending. Of its 113 employees, 34 are focused on data or engineering.

Building an advanced platform with name recognition would have been a difficult task for Navient, and few financial institutions have tried to compete directly with the technologies offered by digital lenders. Earnest borrowers also tend to be attractive from a risk perspective. Loans offered in a May 2017 securitization showed a weighted average credit score of 775 and a weighted average income of $135,595, according to a DBRS pre-sale report. According to that report, there had only been two charge-offs due to delinquency since the inception of the student loan refinance product.

Such high-quality borrowers could be attractive for Navient as it moves into the private student loan space following the expiration of a noncompete agreement with Sallie Mae in 2018.

For Earnest, the acquisition is a chance to scale its loan business and expand into new student-focused product lines. The struggle for many digital lenders has been access to capital in order to meet loan demand. As a direct lender, Earnest relies on balance sheet capital and securitizations to fund loans. Earlier this year, Bloomberg reported that Earnest had run into issues raising new capital and that the firm was looking to sell itself for $100 million. The company was able to complete a securitization later that month and continued to grow originations during the second quarter.

Navient has a well-funded balance sheet and deep experience in capital markets, often securitizing loans that it holds. The company had $1.15 billion in cash and equivalents on its balance sheet as of the end of the second quarter. With this cash and experience, Earnest can grow product offerings and gain access to more attractive capital funding options.

Investors get an exit; Navient gets a team

At a $155 million sale price, Earnest was by no means a blockbuster investment, but investors and shareholders should walk away with a small return. Once a hot space for venture capital, digital lending has cooled over the past few years following lackluster returns from publicly traded lenders and internal issues at some firms.

For Navient, the acquisition of Earnest appears to be driven by the need for technology and talent. Equity investments for digital lenders usually go toward hiring staff and developing the platform, while separate debt investments are used to fund loans. Earnest will remain a stand-alone platform, and the current team will stay on board.

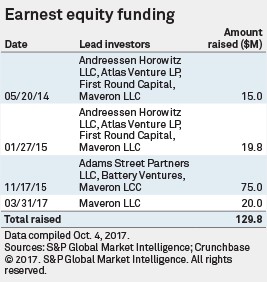

Earnest received $129.8 million in equity funding from a familiar set of lead investors over the last few years. While some earlier investors did not take a role in more recent funding rounds, consumer-focused venture capital firm Maveron LLC was a lead investor in all four rounds. The loss of big-name investors like Andreessen Horowitz after the first rounds and speculation that the company was looking to sell for as little as $100 million certainly added pressure for Earnest to find an exit.

Attractive acquisitions

At a time when many incumbent institutions have chosen to partner with lending platforms, an acquisition is unique. The costs associated with building a new product from scratch can be high, although some financial institutions, most notably Goldman Sachs Group Inc., have taken on the task. The idea of full control of a platform likely appeals to some incumbents, and an acquisition could represent a cost-effective way to integrate new technology into lending operations.

If Navient finds success with Earnest, the doors could open to more acquisitions in the digital lending space, something that is much needed after little M&A activity following the public offerings of LendingClub Corp. and On Deck Capital Inc. in 2014. This could spark the consolidation in the industry that many have been waiting for and benefit investors, incumbents and startups alike.