Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

PUBLICATION — May 10, 2021

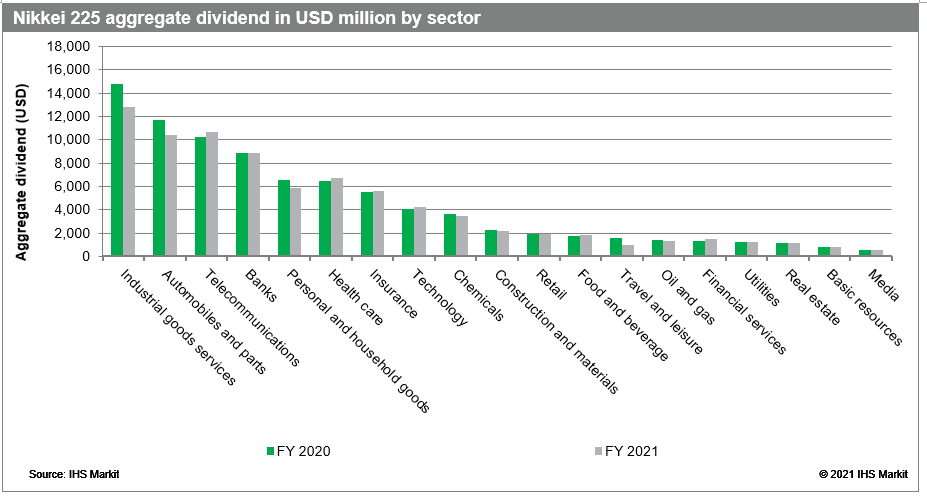

Japanese equities have invariably surpassed their developed and emerging market counterparts in Asia Pacific as far as stability in the dividends' trajectory is concerned. As often cited by the management, improving shareholders' value is of paramount importance, which in turn is observable in the market's historical payout trends with steady payout increases. However, ever since the onset of the COVID-19 pandemic, even Japan, the most durable market felt the wrath of the virus and struggled to abide by its primary goal of shareholder return.

For more information, please contact DividendsAPAC@ihsmarkit.com

Posted 10 May 2021 by JaeHee Lim, Senior Product Management Analyst, IHS Markit and

Suhit Saxena, Research Analyst I, S&P Global Market Intelligence and

Tanisha Bhardwaj, Reseach Analyst I, Equities, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.