Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 02, 2021

The new release of the GTA Forecasting model from May 2021 accommodates the most recent macroeconomic forecasts, all available by-now historical data for 2020 from the Global Trade Atlas (GTA) and updated COVID-response factors.

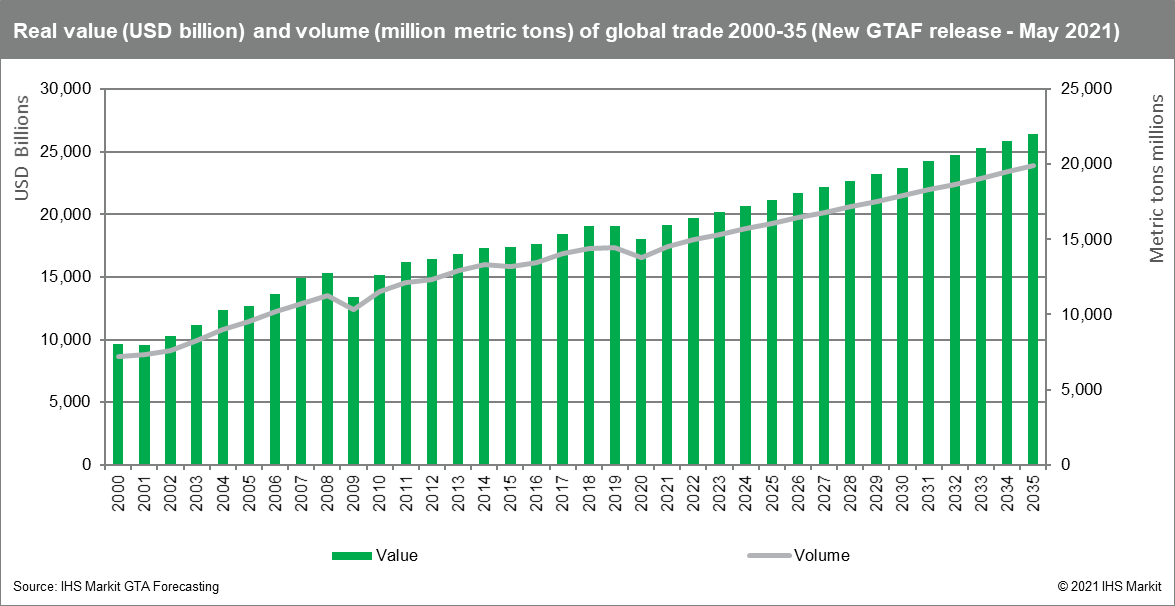

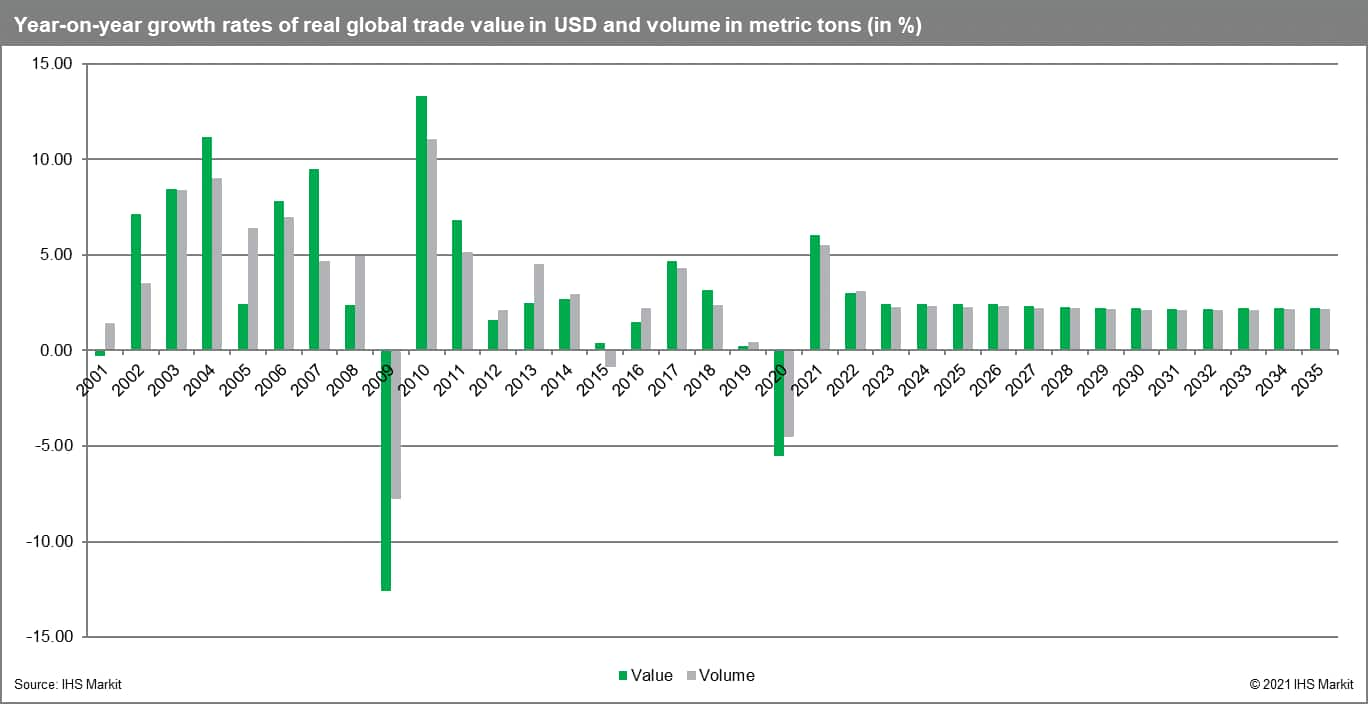

GTA Forecasting model estimates a contraction of global merchandise trade in 2020 to USD 18,163 billion or -5.5% year-on-year (it represents a slight upward adjustment from the values predicted in the February release).

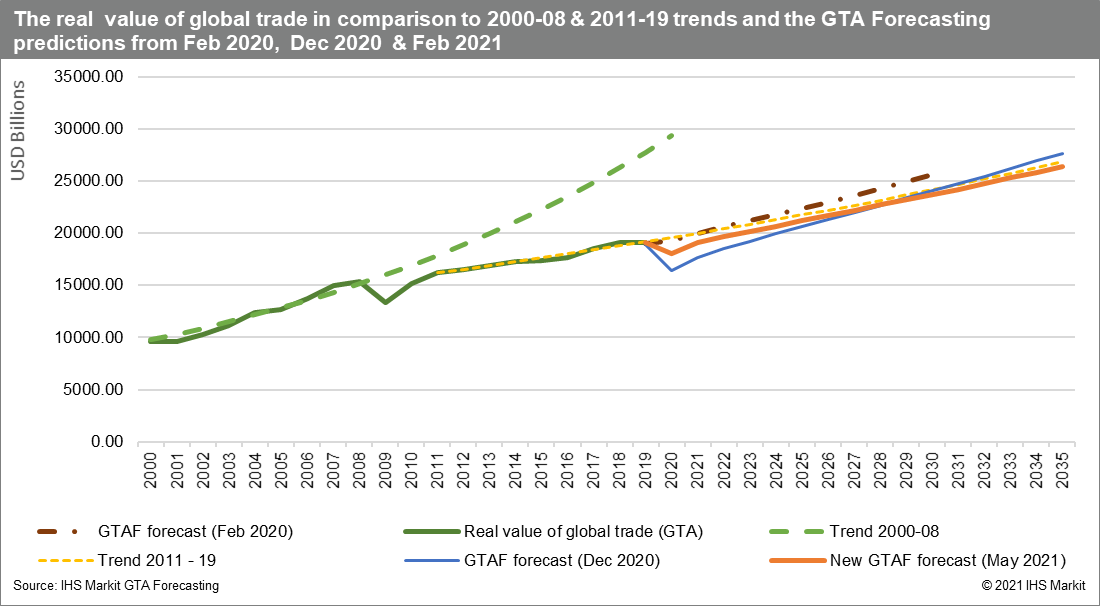

We now predict the real value of global trade to go up to USD 19,247 billion in 2021 and USD 19,824 billion in 2022. Therefore, we now predict a year-on-year increase in the real value of global trade by 6.0% in 2021 and 3.0% in 2022. It accommodates the recovery in global GDP in 2021 and a particularly strong growth impulse in the present quarter. The predicted CAGR for the period 2021-2030 equals 2.4%, and for 2021-2035 equals 2.3%. It represents a downward adjustment in CAGR compared to the prior release, mostly driven by downward adjustments of GDP forecasts in the GLM model and qualitative adjustments in our forecasting methodology (a shift in modeling series with a sideways trend in the historical data).

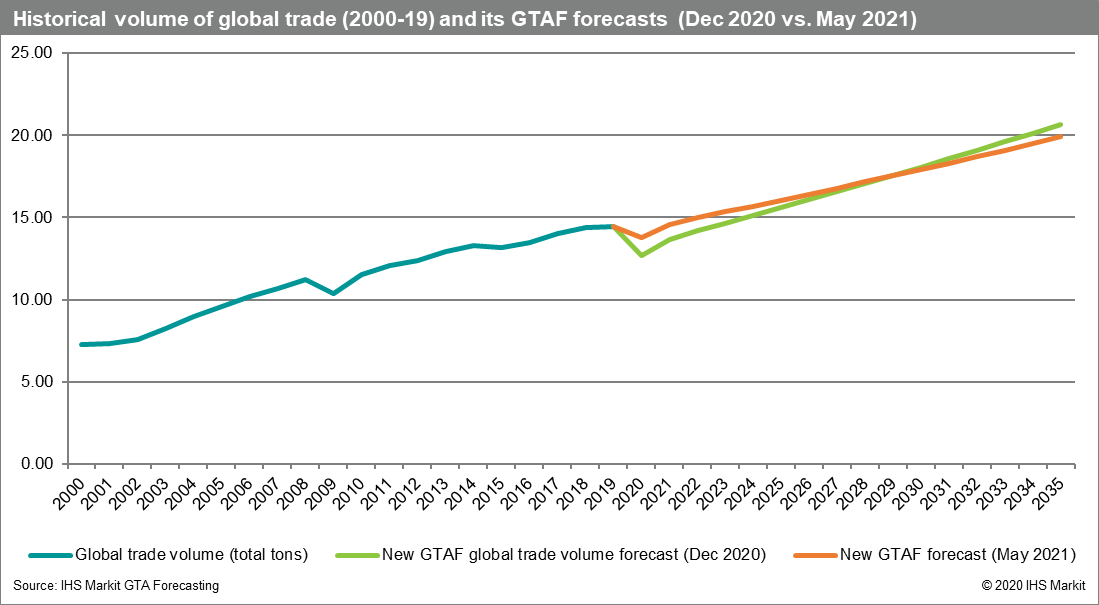

In terms of volumes, we estimate a contraction of global trade in 2020 to 14.0 billion metric tons or by -4.4% year-on-year.

We forecast the global merchandise trade volume to grow to 14.7 billion metric tons in 2021 and 15.2 billion metric tons in 2022. It points to a recovery in the forthcoming years with year-on-year growth rates of 5.3% in 2021 and 3.1% in 2022.

The forecasted CAGR for global trade volume stands at 2.3% in 2021-30 and at 2.2% over 2021-35.

For comparison, the CAGR averaged 3.6% in the period 2000-19 and an impressive 5.6% in the period 2000-08 preceding the global financial crisis. The CAGR for the period 2011-19 was 2.1%. Therefore, the predicted growth rates over 2021-2030(5) are faster than CAGR over the period 2011-19 predating the pandemic but significantly lower than the growth rates in trade preceding the financial crisis.

The estimated contraction in global trade volume in 2020 (-4.4%) is lower than the contraction in the global financial crisis (-7.7%).

The estimated recovery is strong enough to allow a trade to reach its pre-pandemic levels already in 2021 but presently predicted slower CAGR over the period 2021-2035 is not enough for global trade to reach the path of the pre-pandemic trend (2011-2019) within the forecasted time horizon.

The reaction in trade in 2020 was consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it. The overall impact of COVID-19 on global trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and associated severity of containment efforts taken by individual states.

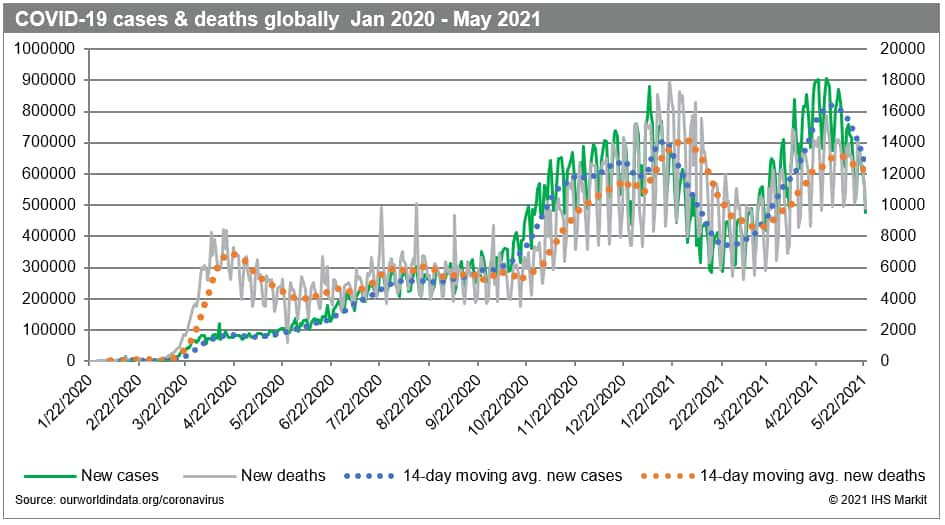

The cumulative number of confirmed cases of COVID-19 globally by 23 May 2021 reached 166.7 million and 3.45 million deaths. The cumulative number of cases is currently the largest in Asia (48.9 million), Europe (46.7 million), North America (38.6 million), and South America (27.6 million); Asia becomes a global leader in reported cases due to the rapid spread of the pandemic in India within a month overtaking Europe and North America.

Looking from the individual country perspective, the cumulative number of cases is the highest in the US (33.1 million), India (26.5 million), Brazil (16.0 million), followed by France (6.0 million), Turkey (5.2 million), Russia (4.9 million), the UK (4.5 million), & Italy (4.2 million). Sixteen countries so far have registered more than 2 million cases of COVID-19 & 28 countries have registered more than 1 million cases. The top five countries account for half of the global cases of COVID-19 since the outbreak, with the US alone accounting for 19.9%, followed by India with 15.9%.

In April-May 2021, COVID19 was spreading the fastest in India (14.5 million cases), Brazil (3.3 million cases), the USA (2.7 million cases), and Turkey (1.9 million cases). The top 10 countries affected included France, Argentina, Iran, Columbia, Germany, Italy, and Poland; the highest death toll in April - May 2021, in turn, was observed in India, Brazil, the USA, Columbia, and Poland.

The 2-week moving averages of global new cases and deaths started falling with the vicious variants spreading fast in Brazil and India; the COVID-19 pandemic is, however, ongoing.

By the end of May 2021, the reported number of vaccinations globally reached 1.9 billion, with 426 million people fully vaccinated, which is equivalent to 5.5% of the global population only.

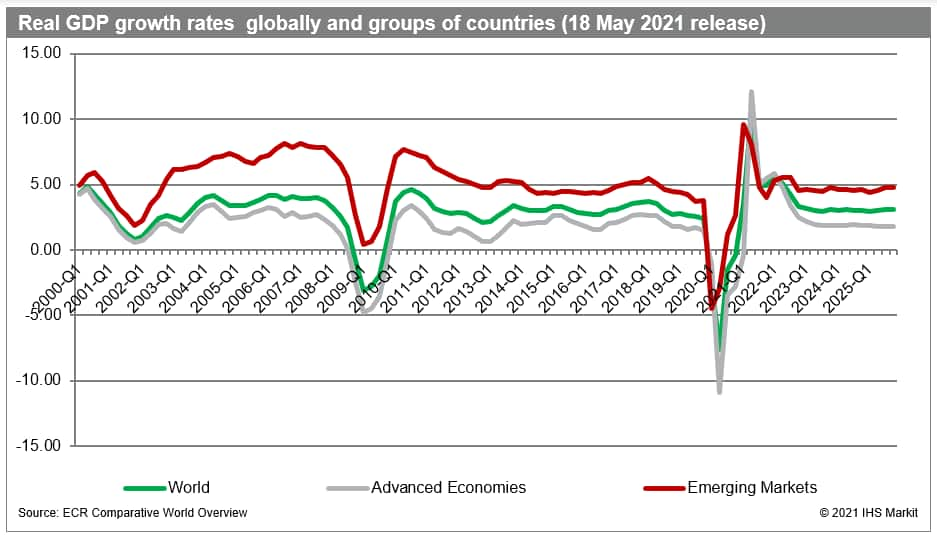

The most recent real GDP growth forecasts from IHS Markit were published on 18 May 2021. The forecast includes the baseline scenario of the impact of COVID-19 on the global economy and individual states.

We now estimate the contraction of global GDP by 3.6% in 2020, varying between -4.6% for advanced, -1.7% for emerging, and -5.5% for developing economies.

We foresee a global recovery in 2021, with year-on-year real GDP growth rates predicted to reach 5.7% (4.5% in 2022). The growth rates are predicted to vary between 5.3% (4.1% in 2022) for advanced, 6.3% (5.2%) for emerging, and 5.0% (4.7%) for developing states.

From a quarterly perspective, both Q3 (-1.5%) and Q4 2020 (-0.4%) proved to bring a continuing global recession in 2020. We predict a global recovery to have taken place already in the Q1 of 2021 (+3.6%), driven mostly by emerging states with the stronger hike in the current Q2 of 2021 (+10.5%). The predicted growth in Q3 & Q4 2021 is equal to 4.9%.

Recovery in China started in Q2 of 2020 following the COVID-19 related contraction in the first quarter. Apart from China (+18.7%), four other economies out of the top 10 largest economies group are now estimated to have grown in real terms in the first quarter of 2021. These are Brazil (+0.4%), Canada (+0.5%), South Korea (+1.7%), and the US (+0.4%).

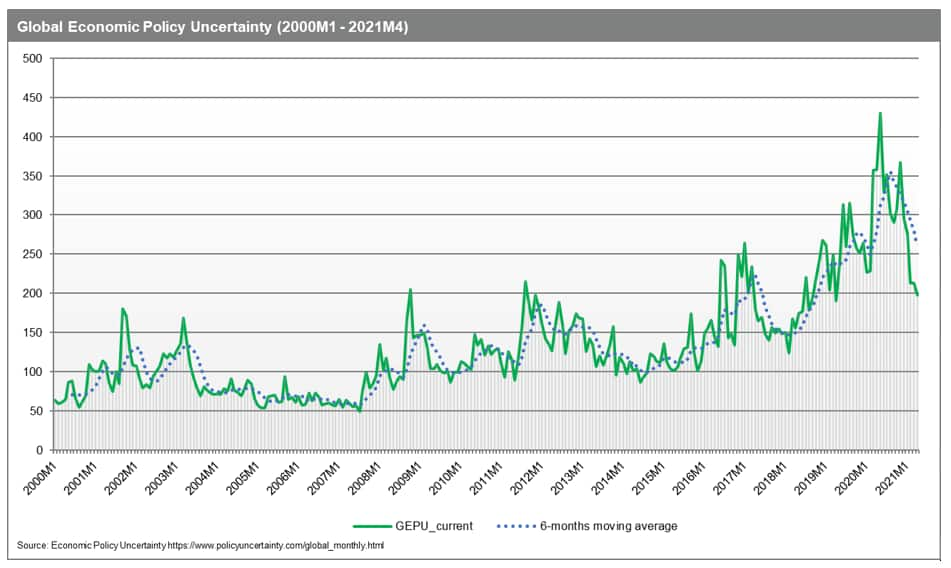

The index of Global Economic Policy Uncertainty (www.policyuncertainty.com/global_monthly.html) is significantly declining after reaching its historically highest levels in 2020. The two hikes in 2020 can be associated with two waves of the COVID-19 pandemic.

PMI New Export Orders (adjusted) by IHS Markit is a very good predictor of trade in the coming quarter. The 50.0 points is a benchmark value with a value above pointing to recovery and below indicative of contraction. The analyses performed show a high correlation between PMI NExO and changes in GTA monthly data reported by states over the coming quarter (mostly the next and the following month).

The adjusted PMI new exports orders (PMI NExO) readouts for the global manufacturing industry in April 2021 were above the benchmark value of 50.0 points (54.67, a rise of +1.20 points on March 2021 readout, and the 3rd month of continuous growth).

As can be seen, both PMI NExO for manufacturing and services suffered a severe downturn, with readouts for March and April 2020 significantly worse than in the 2008-09 global financial crises. Nonetheless, they followed a V-shape recovery in the latter part of 2020. From September onwards, the PMI for the global manufacturing trade is above the benchmark value. The readouts for services are for the first time above 50.0 points benchmark since July 2019 and equal to 50.42 (!!!), indicating recovery in global services.

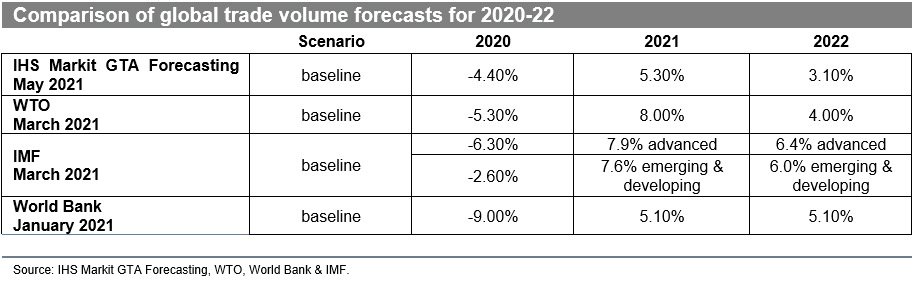

The recent predictions for global trade volume growth rates differ between the most recent reports by WTO, IMF, the World Bank and differ from our forecasts. Due to uncertainty, the other organizations provided scenarios. To make it simpler in the table, we compare the baseline scenarios.

With the inclusion of new historical data, we now estimate the contraction of global trade volumes in 2020 to be much shallower than initially expected (mainly due to steeper recovery in the second half of the year and quicker than priorly expected development of the vaccines) and equal to -4.4% (WTO estimates it at -5.3%).

As to the prospects for global trade volumes in 2021 and 2022, we now predict it at 5.5% and 3.5% and then moderate growth below the pre-pandemic trend of 2.3%.

WTO predicts higher growth rates at 8.0% in 2021 and 4.0% in 2022 in the baseline scenario, with predictions varying between +10.5% in the upside scenario to +6.0% in the downside scenario. Our predictions are thus more conservative.

IMF predicts the volume to go up similarly to WTO baseline scenario 7.9% for advanced states in 2021 and be higher in 2022 - 6.4% for advanced and 6.0% for emerging states.

World Bank's baseline scenario is the closest to our new forecasts, with trade volume going up by 5.1% in 2021 and 2022 (+7.0%) in the upside scenarios.

Thus, our global trade volume growth forecast for 2021 is more conservative than projections by other organizations. Taking into account the still high global uncertainty, the forecasts should be treated with caution.

This column is based on IHS Markit Maritime & Trade GTA Forecasting (new May release of our database & model), other resources of IHS Markit (e.g., PMI, ECR's Comparative World Overview, GLM), as well as external resources.

For more details about GTA Forecasting (GTA), please visit our product page

https://ihsmarkit.com/products/gta-forecasting.html

The full version of the article is available on the Connect platform for IHS Markit clients with a GTA/GTA Forecasting subscription.

How can our products help you?