Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 Nov, 2021

By Ron Marcelo

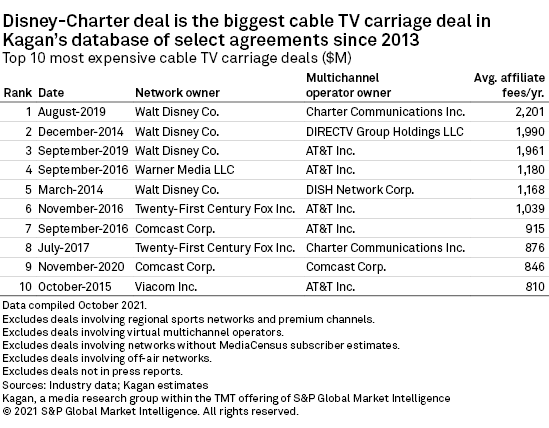

Affiliate fees from multichannel operators remain important to U.S. cable networks despite the prevalence of cord cutting and cord shaving. Kagan tracked 132 multiyear carriage agreements between cable network owners and traditional multichannel operators since 2013, with an aggregate value of $28.19 billion of affiliate revenues per year on average. The deals vary in length, with agreements lasting about two to 10 years.

Cable network owners transact on a license fee per subscriber basis, which adjusts depending on a multichannel operator's package. Big programmers typically need big penetration rates, so their license fee per subscriber increases significantly if they are on packages with low penetration. Comcast Corp.'s Xfinity, for example, recently removed Cartoon Network from its Expanded Basic package, making it only available on Digital Preferred. The deal might give AT&T Inc.'s Warner Media LLC leverage to transact at a higher rate. The difference in rates is a common clause included in most cable TV carriage agreements.

We used Kagan data in average license fee per subscriber per month and MediaCensus subscriber estimates to calculate affiliate fees associated with cable TV carriage deals. We excluded off-air networks, regional sports networks and premium channels in the analysis, as well as virtual multichannel deals and unannounced carriage agreements.

Due to the declining linear TV consumption, big programmers use their digital platforms as leverage in signing contracts, allowing cable operators to offer an all-in-one linear and on-demand entertainment solution. The programmers also collaborate with operators for advanced advertising targeting capabilities, and they also try to give operators exclusive content.

The biggest deal in Kagan's database was the August 2019 agreement between The Walt Disney Co. and Charter Communications Inc., which gave Disney networks about $2.20 billion of affiliate revenues per year on average. Kagan last tracked a Disney-Charter deal in December 2012, although it did not include the FOX networks, which Disney got only in March 2019. The new Disney-Charter deal allowed Spectrum to distribute Disney's direct-to-consumer offerings like Hulu LLC, ESPN+ and Disney+.

Kagan tracked five multiyear cable TV carriage agreements so far in 2021, the biggest of which was between NBCUniversal and Charter that involved 13 cable networks and brought the channels about $755.6 million of affiliate revenues per year on average. The deal also allows Spectrum to distribute NBCU's new direct-to-consumer service Peacock. Kagan last tracked a Comcast-Charter deal in January 2017 but not without a carriage dispute. Comcast and Charter extended negotiations that time, as they did not reach an agreement before their December 2016 deadline. The 2017 deal gave NBCU networks an estimated $792.4 million of annual affiliate revenues.

BLOG