Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jun, 2016 | 09:30

By Tom Manzella and Mark Ferguson

Highlights

Proposed modifications to Australian Securities Exchange listing requirements have the potential to affect over 200 companies that do not meet the revised criteria.

Precious metals-focused juniors are the largest group to fail the proposed higher thresholds, accounting for over 39% of the potentially affected companies.

Recently proposed changes to listing requirements for companies on the Australian Securities Exchange have the potential to significantly affect the junior mining sector in Australia. Although the changes are focused on initial public offerings and back-door listings, at least 212 ASX-listed junior miners would currently fail the revised "assets test" criteria.

As currently proposed, the new listing requirements pertaining to those entities applying under the "assets test" include increasing the minimum financial thresholds (net tangible assets greater than A$5 million or market cap greater than A$20 million) and having audited financial reports for the past three years. In addition, new listings would be required to have a larger free float (20%, up from 10%) and a different shareholder spread (100 shareholders each with at least A$5,000 in shares).

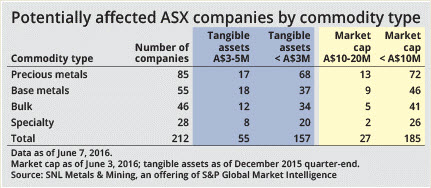

Based on the most recently reported net tangible assets and a market capitalization as of June 3, there are 212 ASX-listed companies that would not meet either of the newly proposed thresholds. Among these, 27 have a market capitalization of A$10 million to A$20 million, 55 have net tangible assets of A$3 million to A$5 million, and eight fall between the current and proposed figures in both categories. A total of 138 companies on the list also fail to meet the current assets test criteria (market capitalization less than A$10 million or net tangible assets below A$3 million).

Juniors such as Explaurum Ltd. and Canyon Resources Ltd. find themselves in the unique position of falling just short of both the new market capitalization requirements and the new tangible asset requirements. Explaurum reported tangible assets of A$4.7 million at the end of the December 2015 quarter and had a market value of A$15.4 million, while at the end of May, Canyon Resources reported A$4.4 million intangible assets and a value of A$19.4 million.

Precious metals-focused juniors are the largest group to fail the proposed higher thresholds, accounting for over 39% of the potentially affected companies. Base metals companies make up another 26%, while bulk and specialty commodity-focused juniors make up the remaining 35%.

So far in 2016, 35 mining companies have been used as shells by entities looking for back-door listings. The proposed changes will likely further complicate junior miners' ability to attract funding from companies interested in back-door listings via a listed junior. Many of the acquiring companies will now have to pass the new financial thresholds, while another proposed change will force the targeted juniors to be suspended from trading at the time of announcement, preventing both the junior and the acquirer from gauging the market's perception of the back-door listing's business model.

A recent SNL Metals & Mining publication found that 592 ASX-listed companies held an aggregate A$2.18 billion in cash at the end of the March 2016 quarter. The 212 companies profiled in this analysis account for only A$132.7 million, or 6%, of the total cash holdings, despite making up 36% of the total company list. Not surprisingly, the 212 companies have also been curtailing their exploration spending in recent quarters, reflecting their small cash holdings and low valuations. While ASX-listed explorers spent an aggregate A$161.5 million on exploration during the first quarter of 2016, the 212 juniors profiled in this analysis spent only A$18.6 million on exploration. These shortcomings highlight the challenges already facing the smallest junior miners; the proposed changes will only intensify their struggles by further limiting their options.