Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 08, 2022

By Chris Williamson and Jingyi Pan

The following is an extract from IHS Markit's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

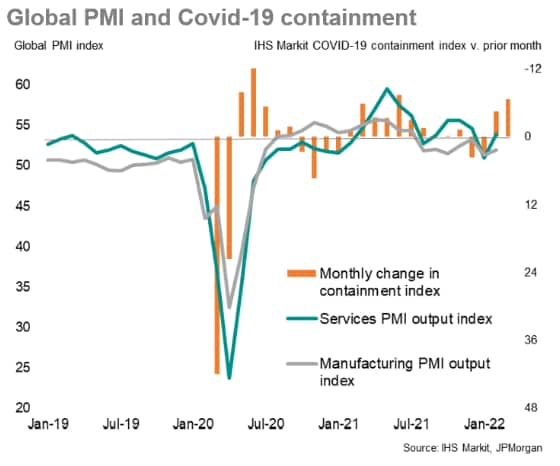

The global economy expanded for a twentieth straight month in February, according to the JPMorgan Global PMI™ (compiled by IHS Markit), with the rate of expansion accelerating from January's 18-month low as the COVID-19 Omicron wave showed signs of easing.

Both manufacturing and services growth improved in February. Services led the rebound with the strongest overall rate of expansion being in businesses services, followed by consumer services. Developed world output growth surpassed that of emerging markets, once again underpinned by services activity expansion. Fewer restrictions across Western economies such as the US, UK and eurozone supported the recovery in developed market output growth.

On manufacturing performance, global manufacturing growth picked up from the one-and-a-half year low in January although the overall rate of expansion continued to be constrained by supply chain delays and manpower shortages. Prior to the eruption of the Ukraine crisis in late February, the PMI data also reflected persistent inflationary pressures faced by firms. These pressures may well be exacerbated by the latest Ukraine crisis through multiple channels - such as upon energy prices, supply chain disruptions, the building of safety stocks and confidence - which we will be closely watching with the March PMI figures.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.