Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Jun, 2022

Just 26% of the 9,940 wireless subscribers who participated in the U.S. MediaCensus survey conducted in February 2022 added an additional mobile-connected device to their wireless plan in the past year, according to the results of the study.

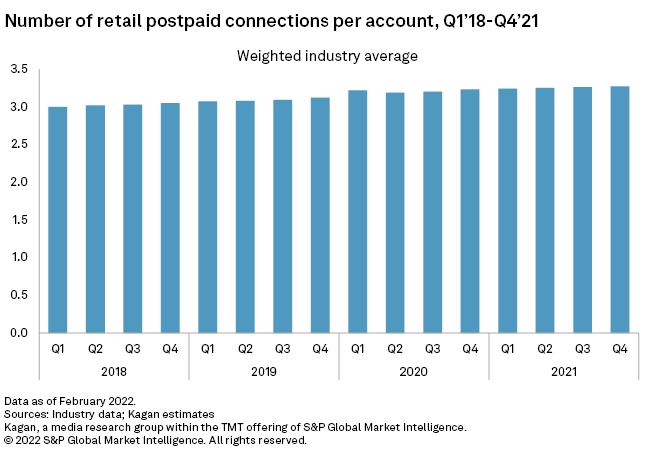

For the four public carriers that Kagan tracks, the number of retail postpaid connections per account averaged 3.3 in the fourth quarter of 2021, growing incrementally quarter over quarter since the first quarter of 2018 when that number reached 3. While more devices per account reduces churn, some of these devices, such as tablets and smartwatches, drag down average revenue per user because they have a lower monthly recurring charge than phones. Margins per non-phone device, despite lower monthly revenue, are similar to or better than monthly phone service margins.

Rather, what we have witnessed among the big three nationwide operators — Verizon Communications Inc., T-Mobile US Inc. and AT&T Inc. — throughout 2021 and into 2022 is a concentrated focus on getting existing subscribers to adopt higher-end unlimited plans in order to drive revenue. As such, carriers are not necessarily adding more users to a plan but locking existing users into high-end plans using smartphones as levers and tying subscribers into long device-installment agreements.

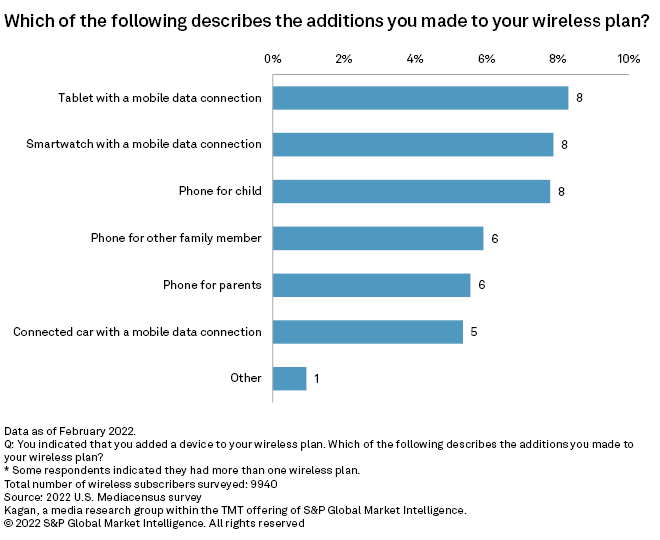

For those respondents representing the public carriers and who added an additional device to the fold, tablets and smartwatches ranked high, each with 8% of participants adding them to their accounts. This is not unusual, as carriers roll out short-term deals throughout the year on these devices. Connected cars ranked lower at 5%.

But the phone reigned supreme, as those who added traditional phones represented 20% of respondents when combining results for a new phone for a child (8%), parent (6%) or another family member (6%).

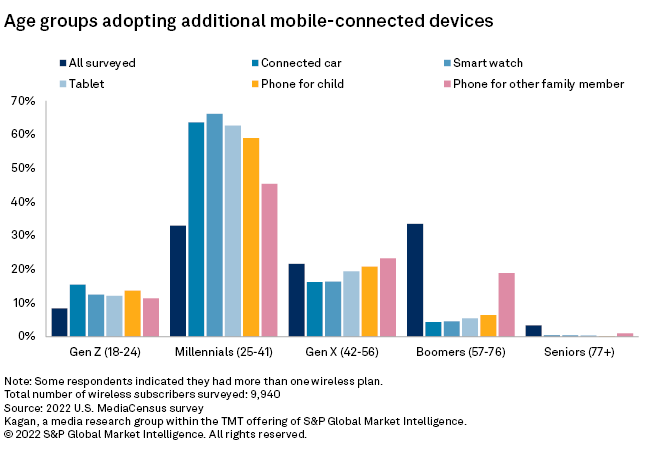

The data also points to ways carriers can segment the market for connected devices. According to the survey results, millennials (aged 25-41) are the largest consumers of connected devices and additional phones. For instance, while millennials made up about 33% of the entire survey base, they made up 66% of those who added a smartwatch, followed by connected car devices (64%) and tablets (63%). Gen X (aged 42-56) respondents were the second-largest group of purchasers, with 19% buying tablets. Smartwatches and connected car devices accounted for 16% each for Gen X.

With only 26% of survey respondents indicating they added an additional device to their plans, there is ample opportunity for carriers to market these offerings. Many consumers still do not understand the value proposition associated with connected devices. Moreover, the U.S. wireless carrier market is still heavily focused on selling higher-margin products, which dominate retail space.

More sophisticated capabilities are coming from 5G, giving way to a greater breadth of connected devices such as virtual reality glasses. Carriers will be challenged to bundle the hardware in compelling ways or offer attractive financing.

Wireless Investor is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.