Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 18, 2021

By David Owen

Broad sector PMI data for Australia show consumer services hard-hit by renewed lockdowns

Financials sector also suffers steep decline as business confidence fades

Technology industry bucks the trend to reach 35-month growth peak

Job creation slows but remains positive as firms predict swift recovery

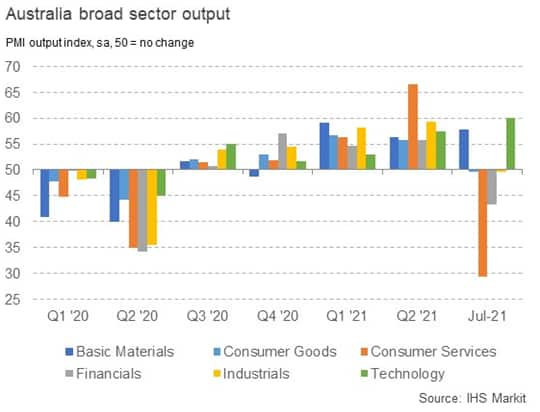

The spread of the COVID-19 Delta variant, and subsequent state capital lockdowns, fuelled a sharp decline in economic activity across Australia at the start of the second half of the year, according to IHS Markit's PMI survey data. Broad industry data showed that consumer services firms were particularly hamstrung by lockdown restrictions, while financial sector companies suffered from a loss of business and consumer spending.

More positively, technology firms have so far escaped the general business slowdown, in fact seeing output growth accelerate to the fastest in nearly three years. High global demand for raw materials meant that basic materials output also performed well. Hopes of a swift recovery from lockdown measures meanwhile meant firms kept hiring, albeit at a reduced rate.

Sector PMITM data from IHS Markit have been compiled for six broad industry sectors from our manufacturing and services survey panels in Australia to give a closer insight into the diverging trends on output, employment and other key indicators. These data have been particularly useful for exploring how different sectors have adapted to the pandemic and lockdown measures.

With several state capitals entering lockdowns in July to control the recent surge in COVID-19 cases, it was consumer-facing firms that suffered the steepest drop in demand and business activity. After the strongest quarterly performance on record (data began in 2016) during the second quarter of 2021, the Consumer Services PMI Output Index fell sharply below the 50.0 no-change mark to its lowest since May 2020.

The Financials sector also registered a sharp downturn in July, as lower spending and weaker confidence led to a steep pull-back in demand for financial services. However, the decline in activity was considerably softer than seen in the second quarter of 2020, when lockdown measures were also tightened.

The Consumer Goods PMI Output Index also dropped below the 50.0 threshold in July, but only slightly. Whilst firms reported that restrictions had led to lower production, overall new orders expanded as consumer spending was redirected towards food and household products. Industrials faced a similar situation in July, with output falling slightly but new orders continuing to rise.

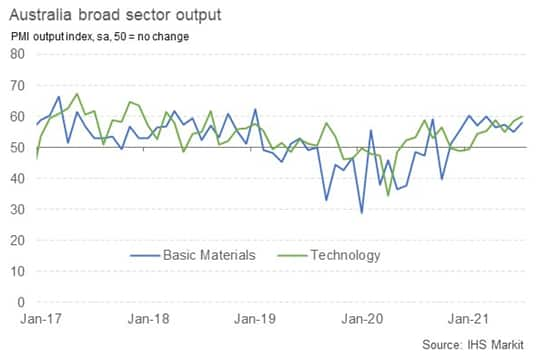

Two of the six broad sectors registered expansions in July, namely Technology and Basic Materials. In fact, output growth across the former quickened to the fastest in almost three years, reflecting strong demand for tech equipment in recent months. That said, demand momentum slipped to a seven-month low in July, suggesting the sector's output performance could begin to soften in the near future.

Basic Materials firms meanwhile capitalised on strong global demand for raw materials as manufacturers looked to build inventories and avoid supply shortages. In addition, fewer firms in this sector cited a negative impact from lockdown measures. Output growth picked up to the sharpest since March and was one of the strongest since the beginning of 2019.

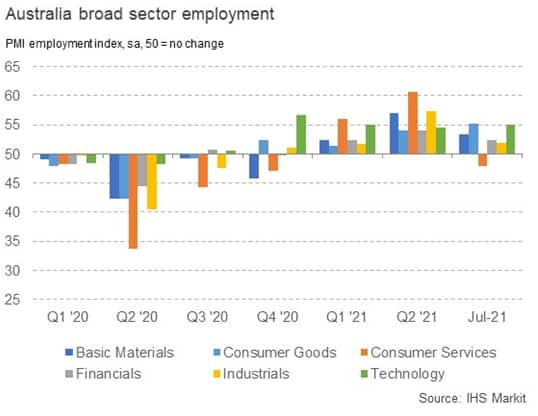

The return to lockdown restrictions led to a notable slump in employment growth in Australia during July, which slipped to the weakest for nine months. That said, efforts to build capacity and reduce backlogs kept overall hiring activity in positive territory, with five of the six broad industries registering an upturn.

Consumer services was the only sector to record a decline in employment levels, but even here the pace of reduction was modest and softer than that seen throughout much of 2020. Meanwhile, job creation accelerated in the Basic Materials and Technology sectors amid strong output growth.

The common view held by surveyed businesses in July was that lockdown restrictions will be short-lived, and that activity will grow over the coming 12 months. On average, approximately 56% of businesses gave a positive prediction for output, despite the overall level of optimism dropping to the weakest since May 2020.

However, with COVID-19 cases continuing to rise despite weeks of lockdown measures, businesses may be more likely to see spending and output drop off during August. Flash data released on 23rd August will give a further insight into how the Australian economy is coping with the escalating situation.

David Owen, Economist, IHS Markit

Tel: +44 2070 646 237

david.owen@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location