Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 09, 2023

By David Owen

South African companies struggled with multiple headwinds at the start of the second quarter. Load shedding in particular, related input shortages and longer lead times each acted to limit business capacity and drive another solid drop in output. Supply side challenges have also underlined rapid increases in input prices over recent months and meant that companies were unable to fully respond to an improved demand picture in April. A renewed rise in new business thus largely translated into a pile-up in backlogs of work that was the sharpest since last August.

The data therefore suggests that firms are poorly positioned to respond to a recovery in demand at this time, with heightened costs largely constraining decisions over activity, spending and prices. Furthermore, the bleaker outlook from Eskom in recent weeks regarding electricity supply adds to signs that business conditions could remain subdued in the near term.

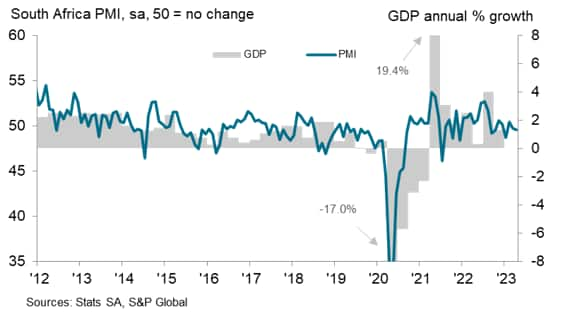

The headline South Africa PMI ticked slightly down to 49.6 in April, from 49.7 in March, to signal a contraction in operating conditions across the private sector economy for the second consecutive month. Historically, a neutral PMI reading of 50.0 has been broadly consistent with annual GDP growth of approximately 1.5%.

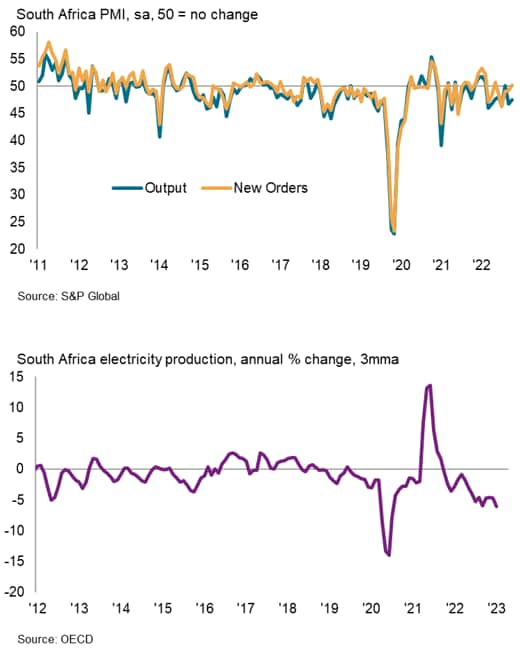

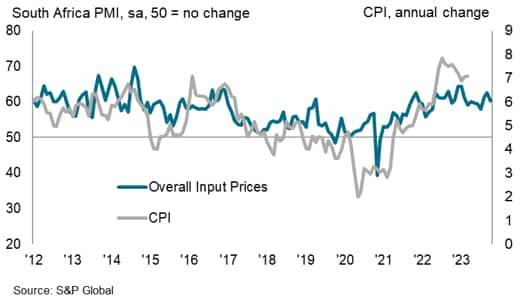

Surveyed businesses signalled that a decline in output was the main driver of the contraction in operating conditions in April. Activity levels fell solidly and for the seventh time in the past eight months. Where a downturn was noted, respondents largely attributed this to load shedding and its impact on capacity, as Eskom continued to schedule power cuts to reduce demand on the energy network. Latest data from the OECD points to a 6% annual drop in electricity production at the start of 2023, which has often meant that industrial and client-facing businesses have worked fewer hours to compensate for reduced electricity provision.

On the flip side, demand conditions improved in April and led to an increase in new business intakes. The upturn was only slight, but nevertheless ended a four-month sequence of decline. That said, sector data showed that the expansion was centred on the service economy. In contrast, weak demand in industry, construction and wholesale & retail continued to weigh on the overall health of the private sector, as rising prices were again cited as dampening client spending.

Consumer price inflation rose to 7.1% in March, up from 7.0% in February and a recent low of 6.9% in January, to indicate that the slowdown in inflation seen over the second half of 2022 has possibly run its course. The uptick was backed up by our survey data which signals that businesses are continuing to raise their charges sharply to pass through marked increases in their input costs. April data saw nearly 27% of companies report an uptick in their expenses over the month, with many signalling that load shedding added to material supply issues and forced some firms to use costly backup generators.

Furthermore, the cost-of-living crisis led a greater number of businesses to raise their salaries to retain staff. Wage costs notably increased at the fastest rate in almost two years during April. The net uplift in input costs was marked and signalled that consumer prices could keep rising at an elevated pace for some time.

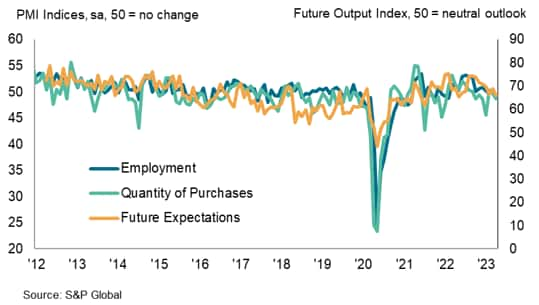

Business confidence in the year-ahead outlook for activity dropped for the sixth time in the past seven months in April, with worries about high inflation, disruption from load shedding and the resulting impact on economic conditions continuing to weigh on sentiment. Indeed, the net positivity level was the lowest for almost a year. This contributed to a reduction in headcounts for the second time in the past three months, as a softer demand outlook meant that firms expect to require fewer staff. Input buying activity also decreased, marking the sixth contraction in seven months.

Alongside lower staffing and reduced input spending, firms found that load shedding, material shortages and longer lead times led to a renewed increase in backlogs of work, which was modest but the fastest since last August. The rise in incomplete work suggested that capacity limits had often left businesses unable to respond to a partial uplift in customer demand.

Near-term projections for 2023 illustrate the overwhelming impact that load shedding may have on the South African economy this year. Revisions to the energy outlook from Eskom in recent weeks add to concerns that infrastructure challenges will continue to plague economic activity for some time. The National Rationalised Specifications (NRS) Association of South Africa have also recently announced that guidelines on load shedding beyond its current upper limit of stage 8 are almost complete.

Here at S&P Global Markit Intelligence, we have lowered our growth estimate for South Africa to 0.6% in 2023, from 1.1% previously, and expect the country to experience at least 200 days of load shedding over the year, mostly to the same degree as that seen over most of April.

The South Africa PMI offers the first gauge as to how load shedding and other economic challenges are affecting the private sector, marking its importance as a key economic indicator. The South Africa PMI is usually released on the third working day of the month, with May data scheduled for release on the 5th of June.

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

david.owen@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location