Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2024

By Russell Ernst

There is considerable disagreement among the parties to a proceeding in which American Electric Power Co. Inc. subsidiary Ohio Power Co. seeks to implement new tariffs for datacenters, which are among the company's most energy-intensive customers (Case 24-0508-EL-ATA).

➤ Recognizing the adverse impact that datacenter expansions could have on electric capacity in its service area, Ohio Power proposed two new tariffs earlier this year that are designed to mitigate the impact on the utility's risk profile as it embarks on the accompanying transmission buildout.

➤ A settlement recently proposed by potential energy-intensive users outlines certain tariff provisions that differ markedly from those put forth by the company, and the company issued a statement urging the PUC to reject the settlement.

➤ In addition to the company, the staff of the Public Utilities Commission of Ohio and the Ohio Consumers' Counsel have declined to sign the settlement, and it remains to be seen whether the commission will be receptive to the settlement.

➤ The settlement includes provisions that address contractual term lengths, minimum demand thresholds and collateral obligations.

➤ S&P Global Commodity Insights has highlighted the current and projected energy demand in concentrated datacenter markets and how mounting grid constraints in these regions are making access to energy the most important consideration for new datacenter construction. Ohio Power's service territory has been identified as one that is ripe for datacenter facility expansions.

➤ Regulatory Research Associates accords the Ohio energy regulatory environment an Average/2 ranking. This controversy comes at a time when Ohio has an active agenda, with several rate cases pending.

A hearing regarding the settlement is scheduled for Oct. 28.

The parties to the non-unanimous settlement include prominent companies in the datacenter business — Amazon Data Services Inc., Google LLC, Microsoft Corp. and an affiliate of Meta Platforms Inc.

The settlement calls for the creation of a new tariff that would apply to customers with monthly demand of at least 50 MW at a single location if Ohio Power were to provide proof that a transmission capacity constraint exists in the service area. The stipulated tariff would not be "limited in its application to specific customer types, industries, businesses or operational profiles."

Customers would be allowed to choose one of the contract term lengths listed below.

– Term A would equal the "load ramp period," which would be no greater than four years, plus an additional eight years, with an option to exit after year five, with a one-year exit fee.

– Term B would equal the load ramp period plus an additional 10 years, with an option to exit after year seven, with no exit fee.

– Term C would equal the load ramp period plus an additional 12 years, with an option to exit after year nine, with no exit fee.

Customers obtaining service pursuant to the new tariff with monthly demand of less than 75 MW at a single location would be subject to collateral requirements identical to those that apply to existing general service customers. Customers with demand of 75 MW or more at a single location would be subject to the collateral requirements initially proposed by Ohio Power if the customer does not meet certain credit criteria. These customers would also be billed for their respective minimum demand according to a predefined formula that would apparently result in demand charges lower than those proposed by Ohio Power.

Customers served under the new tariff would not be eligible for the standard service offer (SSO) auction process for procuring default electric supply. Instead, these customers would be subject to a yet-to-be-determined process in which competitive suppliers would provide electric supply based on real-time energy and a pass-through of capacity, plus an adder for ancillary costs.

The settlement includes other provisions pertaining to the ability of these customers to interconnect behind-the-meter generation and/or colocated load, load studies, construction and energization time frames, and capacity assignments to other entities.

The settlement also calls for the PUC to conduct an investigation of "opportunities that could positively impact near-term transmission capacity constraint issues" on Ohio Power's system, including utility data transparency, operational efficiencies, reconductoring and "market-driven opportunities," such as battery storage and "virtual power plants."

In a statement issued shortly after the settlement was filed, Ohio Power said, "What has been proposed by the partial settlement fails to adequately address the main issues expressed in [the company's] application. It's unprecedented to present a 'settlement' ... that isn't supported by the [PUC] staff or the utility that initially raised the concern. The [PUC] should reject it. [The company] remains committed to finding a solution that balances the infrastructure investment needed to meet extreme power demands of data centers with protections for Ohio consumers."

Ohio Power tariff proposal

On May 13, Ohio Power filed for approval of tariffs that would apply to two new categories of customers. Specifically, a tariff would apply to new datacenter customers with monthly demand of at least 25 MW at a single location and another tariff would apply to new mobile datacenter customers (cryptocurrency miners) with monthly demand of at least 1 MW at a single location. Datacenter and cryptocurrency mining customers that have existing agreements with Ohio Power would continue to be served under the general service tariff until their appropriate classification could be considered in a future proceeding.

The datacenter tariff would utilize a minimum billing demand of at least 90% of the greater of the customer's contract capacity or its highest previously established monthly transmission billing demand for the prior 11 months. For mobile datacenter customers, a 95% minimum demand charge would be used in this formula. Both tariffs would require contracts to be executed for terms of at least 10 years and would include an exit fee if the customer were to leave the system prior to the end of the contracted period. The contracted time period could also include a three-year load ramp period if that is ultimately agreed to by the company. Ohio Power would be allowed to determine any security and collateral provisions.

"[The company is] resolute and unwavering in its conclusion that an updated set of terms and conditions for retail service to data center customers is needed in order to move forward with capacity expansion plans on a just and reasonable basis." - Ohio Power, on its capacity expansion concerns, in Case 24-0508-EL-ATA

The base rate and rider rates charged to these customers would be identical to those that apply to existing general service customers.

Datacenter customers receiving service under the proposed tariffs would be permitted to obtain their electric supply from a competitive retail electric service provider or through the SSO process. Ohio Power would conduct a separate SSO auction for these customers because including their load in the regular SSO auction undertaken for other customers "could add unacceptable risk and complications for participating suppliers, thus increasing prices for all SSO customers."

Both of the new tariffs would include a long-term capacity commitment intended to ensure the capacity expansion is needed at the level requested. Ohio Power said datacenter customers are distinguishable from other commercial and industrial customers because "they require high levels of demand — operating 24 hours a day, 7 days a week, 365 days a year with no natural cycling." The company said these customers typically have load factors above 95%.

Ohio Power said there have been more than 50 customers at roughly 90 locations that have tendered requests to reserve capacity for new or expanded load that would total at least 30,000 MW. The company is filing the instant request "to balance the interests of data center customers and other current and future customers."

The company said American Electric Power's Central Ohio transmission system currently serves about 600 MW of datacenter load, all of which was installed since 2017. The company has signed agreements that would add approximately 4,400 MW of load in Central Ohio by 2030.

Ohio Power said mobile datacenter customers are more "transient" in nature but still have enormous electricity needs. The company noted that mobile datacenters often operate out of shipping containers or other minimal structures, and even those that have more permanent physical structures have minimal capital investment compared to other commercial and industrial customers, including traditional datacenters. As a result, mobile datacenter customers can easily relocate without much "stranded investment" on their side of the meter. Nevertheless, the company said, these customers also often have high load factors.

"[The company] can import enough power over the [existing] transmission system to serve ... [up to] approximately 5,000 MW of data center load by 2030. But to serve more data centers will likely require new ... transmission lines to import large amounts of additional energy to Central Ohio." - Ohio Power, regarding future capacity constraints.

Ohio Power said it has signed electric service agreements (ESAs) with datacenter customers that will more than double central Ohio's load by 2030. This is attributable to increased load from existing datacenter customers that are expected to expand their current operations and the impact of new datacenter customers. However, in March 2023, Ohio Power implemented a moratorium on accepting new service requests from these customers to allow American Electric Power's transmission planning group time to evaluate the impacts that the datacenter load requests would have on the company's system. The company said it is "resolute and unwavering in its conclusion that an updated set of terms and conditions for retail service to data center customers is needed in order to move forward with capacity expansion plans on a just and reasonable basis."

Ohio Power said, "There is no [regional transmission organization] controlled generation in Central Ohio. This means that [the company] must rely on the extra-high-voltage (EHV) transmission system to import power from generators located elsewhere. ... [The company] can import enough power over the EHV backbone transmission system to serve the new data centers that have signed ESAs to bring approximately 5,000 MW of data center load by 2030. But to serve more data centers will likely require new EHV transmission lines to import large amounts of additional energy to Central Ohio."

"Ohio law does not require [the company] to extend service to customers in a way that would be unreasonable or impose unjust risks for [it] and its other customers," Ohio Power said. "Based on the existing circumstances, [the company] is unable to continue making commitments to serve additional data center load without resolution of the underlying regulatory issues."

The company said that without additional capacity, "even just the future load growth that is under contract will leave minimal amounts of reserve capacity for additional (non-data center) load growth for all existing and future customers in central Ohio." Ohio Power expects its five largest customers in 2030 to be in the datacenter business.

The company concluded: "If left unresolved, these demands could constrain development of all types of future load, including natural growth of residential load as well as non-residential load especially in Central Ohio."

The company has begun to include the potential capacity impact from the executed agreements in the load forecast it provides to PJM Interconnection LLC, but said "this is a fraction of what investments would be required to accommodate the more than 30,000 MW of requested load that has not been included in any PJM forecasts."

Datacenters amp up utility growth

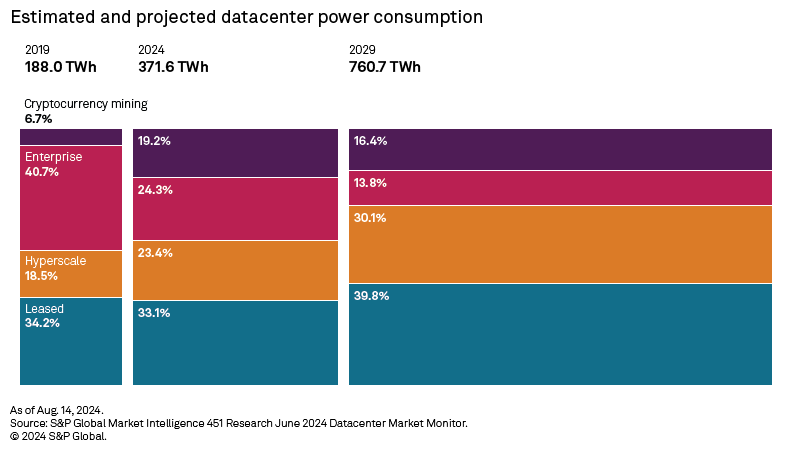

Energy appetites of datacenter owners and hyperscalers, including Amazon, Google, Meta and Microsoft, are rising, with this demand still largely concentrated in handful of markets across the US. Complicating matters is these companies' desire for carbon-free generation in hopes of meeting aggressive sustainability targets. Wind, solar and battery storage dominate this energy segment currently, but the intermittent nature of wind and solar and duration ceilings for current storage technologies are hindering the decarbonization of regional energy grids.

In its US Datacenters and Energy 101 Report, S&P Global Commodity Insights examines the conflict between demand for around-the-clock electricity to power datacenters and the non-dispatchable fleet of current clean energy generation technologies. With this energy demand skyrocketing due to increasing use of cloud services and AI-related computing power, utilities are reconsidering coal plant retirement timelines and the addition of natural gas generation to maintain grid reliability. As a result, the decarbonization targets of hyperscalers and datacenter owners could be put on hold.

This report is a follow-up to the US Datacenters and Energy Report, which highlighted the current and projected energy demand in concentrated datacenter markets. The report showed how mounting grid constraints in these regions are forcing companies to explore nontraditional markets and making access to energy — particularly clean energy — one of the most important considerations for new datacenter construction.

The report noted that Ohio Power, which serves much of the Columbus area, where Amazon is leading the datacenter development charge, is expected to have 2,800 MW of power demand from datacenters by 2028.

Ohio's crowded regulatory agenda

FirstEnergy Corp.'s Ohio electric distribution utilities — Ohio Edison Co., The Cleveland Electric Illuminating Co. and The Toledo Edison Co. — are seeking a $93.6 million base rate increase premised upon a 10.80% ROE, net of amounts that would be transferred from existing riders to base rates (Case 24-0468-EL-AIR). This marks the company's first traditional electric base rate case in 15 years. The PUC could issue a final order in July 2025.

A settlement pending PUC consideration in Case 22-0704-EL-UNC and several consolidated proceedings resolves outstanding issues pertaining to the second phase of Ohio Edison, Cleveland Electric Illuminating and Toledo Edison's distribution system grid modernization plan. The companies would be permitted to install up to about 1.4 million advanced meters and the supporting communications infrastructure for a total estimated cost of about $418 million.

The East Ohio Gas Co. — The Enbridge Inc. subsidiary filed for a gas distribution rate increase of $212 million in Case 23-0894-GA-AIR. The requested increase is premised upon a 10.40% return on equity (60.33% of capital) and a 7.53% return on a $4.573 billion rate base. The staff recommended a base rate reduction in the range of $225.2 million to $251.3 million, premised upon an ROE in a range of 9.03% to 10.04%, a capital structure that includes a 51.87% common equity component and an overall return in a range of 6.21% to 6.73%. The rate base recommended by the staff was $3.966 billion. The commission could issue an order in December.

CenterPoint Energy Inc. subsidiary Vectren Energy Delivery of Ohio Inc. is poised to file a gas distribution base rate adjustment proposal in Case 24-0832-GA-AIR in the near future.

Electric security plans (ESPs) were adopted in April for Ohio Power, in May for FirstEnergy's Ohio utilities and in August 2023 for AES Corp. subsidiary The Dayton Power and Light Co. Duke Energy Corp. subsidiary Duke Energy Ohio Inc.'s ESP is due to expire May 31, 2025, and in Case 24-278-EL-SSO, the company seeks permission to establish a new ESP for a three-year term.

The other large utility under the PUC's purview is NiSource Inc. subsidiary Columbia Gas of Ohio Inc.

RRA view on Ohio regulatory climate

From an investor perspective, Ohio's energy regulatory climate is historically balanced; RRA accords it with an Average/2 ranking.

ESPs allow for the use of riders for various initiatives; these riders incorporate ROEs that were above the prevailing average of the equity returns accorded electric utilities nationwide when they were established. For the gas utilities, retail supplier choice programs have been available to the customers of Ohio's largest distribution companies for several years, and for the most part, customers who do not choose a competitive supplier are randomly assigned to competitive suppliers. In addition, the PUC has approved SFV pricing plans for each gas utility that provide increased cost recovery certainty for shareholders.

In 2020, RRA lowered its ranking of the state's regulatory environment to reflect the impact of legal developments associated with the 2019 enactment of power plant subsidization legislation. The legislation was subsequently repealed, and the matter cast a spotlight on Ohio's energy utility regulatory practices for a while afterward. In late 2023, RRA raised its ranking from Average/3 to Average/2 to reflect a transition to more sustainable regulatory practices.

For additional information concerning RRA's regulatory rankings, refer to the latest "State Regulatory Evaluations Quarterly Report."

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location