Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 23, 2023

By Jingyi Pan

Following the strong official Q1 GDP and April inflation readings, May flash PMI data indicated growth continuing at the fastest rate since October 2013 while inflation remained broadly elevated across Japan's private sector.

Meanwhile, despite the difference in manufacturing and service sectors performances remaining marked in May, manufacturing output expanded for the first time in almost a year with renewed demand growth invigorating the goods producing sector. Improvements in supply chain conditions also supported manufacturing production.

The broad optimism across the private sector further hinted at likelihood for the ongoing robust expansion of the Japanese economy to continue in the near-term.

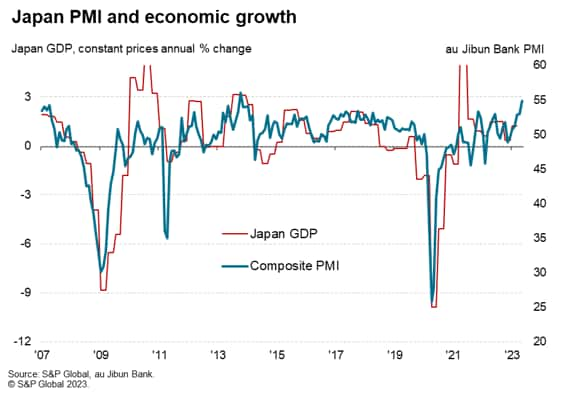

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 54.9 in May from a final reading of 52.9 in April. Posting above the 50.0 no change mark for the fifth straight month, the PMI indicated growth sustaining for Japan's private sector since the easing of COVID-19 related border restrictions in late 2022.

Furthermore, the pace of growth was the fastest since October 2013 and was supported by both manufacturing and services expansion for the first time since June 2022. The latest reading is broadly consistent with GDP growing at an annual rate of around 2%.

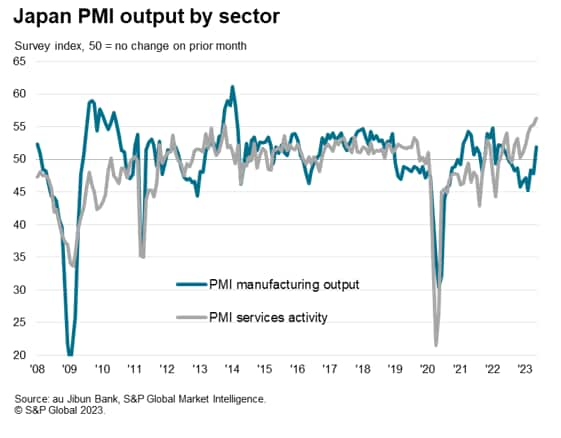

To a large extent, Japan's growth remains buoyed by service sector outperformance in May. Services activity expanded at a fresh record rate for the survey in May, reflecting sustained improvements in private consumption and international tourism amid further dissipation of COVID-19 related disruptions. Despite the peak of the 2023 cherry blossom season having passed in May, the latest PMI data indicated that service activity, including travel, recreation and transportation, continues to fare strongly and has yet to reach the end of the current boom cycle. Employment levels within Japan's service sector also expanded at the second fastest pace on record, just behind the rate of expansion recorded pre-pandemic in April 2019.

Manufacturing output, in contrast, expanded at a much slower pace compared to services in May. The latest reading nevertheless marked the first month of growth for the export-dependent factory economy. Helping to reverse the production trend into growth had been a renewed expansion in new orders for Japanese manufactured goods in May, although this appears to be domestic driven with new export orders remaining in contraction territory despite the weak yen situation. Simultaneously, the Suppliers' Delivery Times Index signalled a marginal improvement in lead times, the first since a brief respite observed in January 2020, enabling better production efficiencies.

While the gap between manufacturing and service performance remains marked midway into the second quarter, the latest data showed a narrowing of the gap to the slightest since last December. PMI data in the coming months remain necessary to draw further conclusions of any reconvergence between manufacturing and service sector performances.

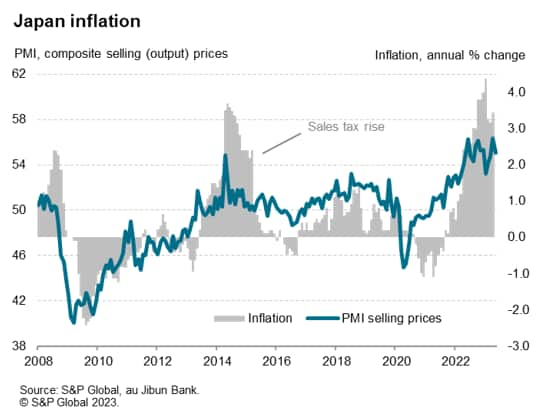

The latest au Jibun Bank Flash Composite PMI price indices meanwhile suggest that, while inflationary pressures eased from April, they remained broadly elevated in May.

Pent-up demand from consumers continued to drive up input costs for service providers which led firms to share these cost burdens at a heated rate with their clients. Manufacturing input cost inflation eased more quickly in May, however, unsurprisingly with the easing of supply chain stress for Japanese manufacturers. Consequently, goods producers raised their charges at the slowest rate for 17 months in May, in part with hopes to increase sales.

On a composite level, input cost inflation rose at its slowest rate for 17 months, but still running well above the average level in May. Output price inflation meanwhile descended to match its 12-month average but remained consistent with Japan's CPI staying elevated in mid-year.

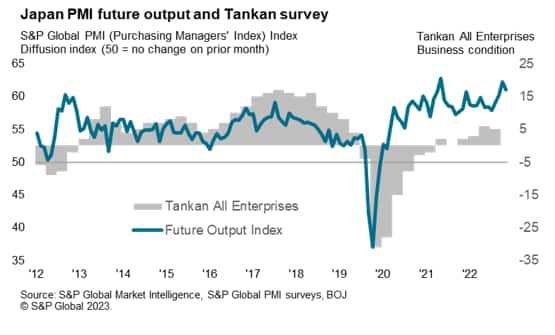

The latest flash PMI data for May hint at the likelihood of persistent growth midway into the second quarter. The PMI future output index, the only sentiment-based sub-index, further adds to the odds that we will see robust growth sustained in the coming months. Posting monthly data in advance of the quarterly Tankan survey, the strong positive correlation of the future output index with the Tankan's all-enterprises' business conditions index further indicates that we may continue to find see positive readings from the closely watched Bank of Japan survey.

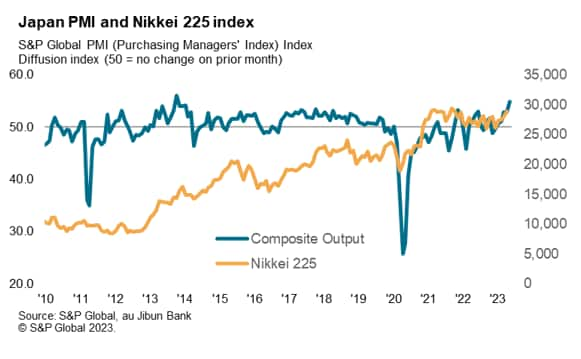

Additionally, strong positive correlations found between the Japan composite PMI and the Nikkei 225 index offer some support for the Japan equity index, which touched a 33-year high recently. Although the weaker domestic currency has a part to play, the outperformance of the Japanese economy, according to the flash PMI data, backs the optimism in the equity space.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location