Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 05, 2023

The U.S. Department of the Treasury and the IRS released proposed regulations for tax reporting for cryptocurrency, non-fungible tokens, and other digital assets on August 25, 2023. Originally contemplated as part of the Infrastructure Investment and Jobs Act (IIJA) in 2021, the long-awaited proposed regulations provide a framework on information reporting requirements for digital assets. As the regulations are still not final, the Treasury and IRS have extended a public commentary period until October 30, 2023, and will hold public hearings on the proposal in early November of this year.

Key Points

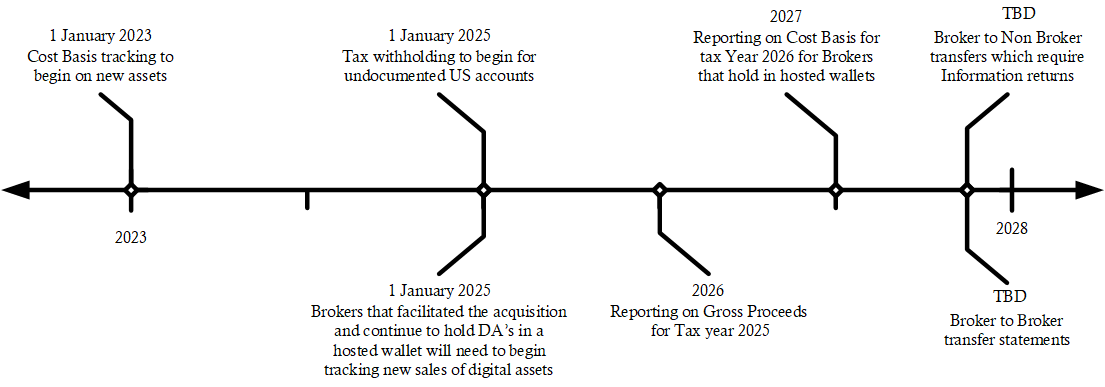

Proposed Timelines

NOTE: Due to the remediation effort required, it will make sense if brokers begin solicitation efforts immediately to collect certified TINs on a Form W-9

"Brokers" In Scope

The proposed regulations refer to a "digital asset middleman" under proposed §1.6045-1(a)(10)(i)(D) and as a result, the following entity types are generally in scope for broker reporting:

Out of Scope

The proposed regulations also exclude several types of participants from the broker reporting requirements. These include miners, stakers, and wallet software providers. Also excluded are merchants that accept digital assets directly on the sale of their own goods or services and NFT (non-fungible tokens) creators that sell their own NFTs. The IRS highlights that they did not exclude wallet software providers where that software also provides direct access to a trading platform. They are soliciting comments to better understand if this or any other activities would rise to the level of a facilitative service and thus be in scope for reporting.

Cost Basis

Cost basis reporting, including any gain or loss, would be required for digital assets for sales occurring on or after January 1, 2026. Cost basis reporting will be required for digital assets that are "covered securities" for sales occurring on or after January 1, 2026. A covered security is limited to assets acquired on or after January 1, 2023, for cash, stored value cards, broker services, or other property and maintained in a broker custodial account from the acquisition date to the date of sale.

The proposed cost basis rules are similar to those for traditional financial products. The cost basis of a digital asset includes the amount originally paid and increased by any commissions, transfer taxes, or digital asset transaction costs related to the initial acquisition. These fees will generally reduce the proceeds on the sale. However, an interesting twist is when a digital asset is exchanged for a materially different digital asset. In this situation, the proposed regulations provide that half of the digital asset transaction costs are allocated to the sale side and the other half of the digital asset transaction costs are allocated to the acquisition side. This is a new requirement and will undoubtedly require the development of existing or new solutions to avoid errors in the calculations.

Form 1099 Reporting

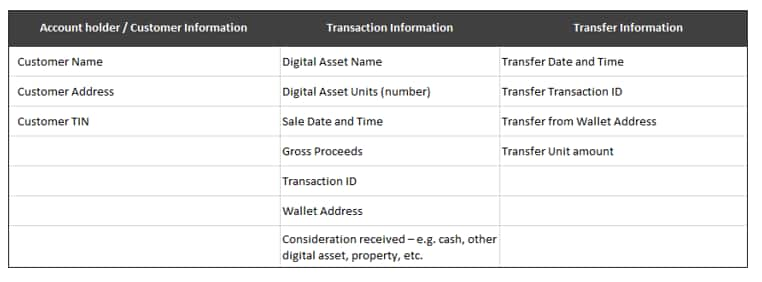

The proposed regulations provide a specific set of data points to be reported by brokers with respect to reportable transactions. These rules apply to applicable digital asset sales occurring on or after January 1, 2025. Digital asset reporting will require a broker to include the following pieces of information for each transaction and in the case of a transfer to another broker, there are specific data elements also required.

Crypto Asset Reporting Framework (CARF)

The preamble states that the Treasury Department and the IRS are currently considering how the U.S. could implement the Organisation for Economic Cooperation and Development (OECD) initiative for the CARF. The IRS has indicated that there is a benefit for them to receive information on sales effected for U.S. taxpayers by non-U.S. brokers through an automatic exchange of information with other countries under CARF. However, it is anticipated that implementation of CARF by the United States would require the modification of the proposed regulations to ensure that U.S. brokers collect the information required to be exchanged under the framework, to the extent that the collection of that information is permitted under U.S. law.

Tax Documentation and Onboarding

The proposed §1.6045-1(a)(21)(ii)(A) provides that name, address, and TIN will be required in advance of any sale for both brokers and payment processors. The regulations specifically state that "to meet their information reporting obligation" "they will need to ensure that they obtain the required personal identifying information (that is, name, address, and tax identification number) from the customer (that is, the party making the payment in digital assets) in advance of these transactions." Under the section for Rules for U.S. Digital Asset Brokers; a payment by a U.S. digital asset broker that is reportable under section 6045 may also be subject to backup withholding under section 3406 when the broker has failed to obtain a valid Form W-9 for a customer.

The proposed regulations also provide that in order to treat a customer as an exempt foreign person, unless there is an applicable presumption rule that allows that treatment under proposed §1.6045-1(g)(4)(vi)(A)(2), a U.S. digital asset broker must obtain from the customer a valid beneficial owner withholding certificate described in §1.1441-1(e)(2)(i) and (ii), such as a Form W-8BEN for a customer who is an individual, and must apply the reliance rules under proposed §1.6045-1(g)(4)(vi) with respect to the beneficial owner withholding certificate.

So, What's Next?

The Treasury and the IRS have requested industry feedback on the proposed regulations. The due date for submission of comments is October 30, 2023. Within the proposed regulations there is a list of over 50 questions the IRS is looking for specific feedback and comments. Comments are due by October 28, 2023. A public hearing on the comments and proposed regulations is scheduled for November 7 and 8, 2023.

In the meantime, as the industry begins an internal scoping exercise to determine their existing operational tax capabilities, brokers can determine if they will require any system enhancements, review policies, and procedures, and determine if their existing infrastructure can support the required changes.

Further, brokers can also determine if their Form W-9 validation process is in place to collect certified TINs and perform a TIN matching against the IRS site to avoid any future B-Notices. Additionally, brokers can also assess their process for documenting their noon-US account. And in the case of undocumented accounts, brokers can assess their ability to properly withhold on gross proceeds and whether they have the capability to remit the tax to the IRS in a timely manner.

How S&P Global Market Intelligence Tax Solutions Can Help

S&P Global Market Intelligence has applied its extensive knowledge and experience to the crypto space, creating end-to-end solutions that help brokers navigate the ever-changing regulatory landscape. Specifically, Tax Solutions by S&P Global Market Intelligence was designed by a team of leading industry experts to deliver comprehensive technology solutions for the global marketplace. Our team has a long history in the information reporting and withholding space, providing streamlined and cost-efficient solutions, tailored to the specific requirements of each client.

We provide our clients with a full end-to-end solution for information reporting, withholding, and due diligence. We offer an integrated tax onboarding and due diligence platform that includes automated, real-time IRS TIN matching. The due diligence solutions are fully integrated into our tax reporting application, which empowers our clients to perform real-time TIN matching as part of their solicitation and onboarding ahead of Form 1099 reporting, reducing the likelihood of TIN mismatches. Our comprehensive ecosystem also provides a highly automated cost-basis solution with real-time processing. Through a highly configurable platform, we streamline tax information reporting and withholding by integrating with our form validation solutions and cost basis engine to maintain, manage, and report, as necessary.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.