Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 03, 2025

By Ronald Cecil

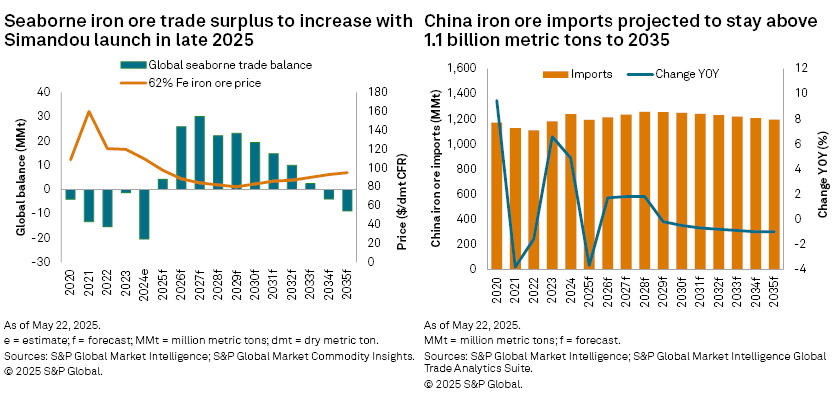

Iron ore prices are expected to decline gradually over the long term, falling from an estimated average of $97.20 per dry metric ton in 2025 to a forecast low of $80.00/dmt by 2029. This decline is largely attributed to a projected surplus in the global seaborne trade balance. However, prices are predicted to recover to $95.00/dmt by 2035 as the trade balance tightens.

China's iron ore imports are expected to experience significant volatility. We anticipate a notable drop of 45.8 million metric tons in 2025, reducing imports to 1,192 MMt and marking the first decline since 2022, primarily driven by an expected reduction in the country's steel production. However, by 2029, we expect a rebound in imports, reaching a projected peak of 1,254 MMt as domestic iron ore production declines. Looking ahead to 2035, imports are forecast to dip again to 1,194 MMt, influenced by the persistent decline in China's steel output, which will continue to suppress iron ore demand.

China's steel production peaked at 1,065 MMt in 2020, subsequently declining to 1,005 MMt in 2024 and is expected to fall below 900 MMt per year by 2035. Oversupply remains a feature of the country's steel market, negatively impacting profitability. Steel demand is subdued by a protracted slowdown in the domestic property sector, while rising trade tensions from US-China tariffs and the recent antidumping measures imposed by India and Southeast Asian countries are anticipated to restrict China's steel exports.

China's domestic iron ore production is projected to decrease in the long term. The country's iron ore supply is characterized by low quality and high production costs. Most domestic mines require iron ore prices to be at least $100/dmt to remain profitable. As prices decline, domestic miners will face pressure to close unprofitable mines, especially those located in regions where importing iron ore is easily accessible and competitive.

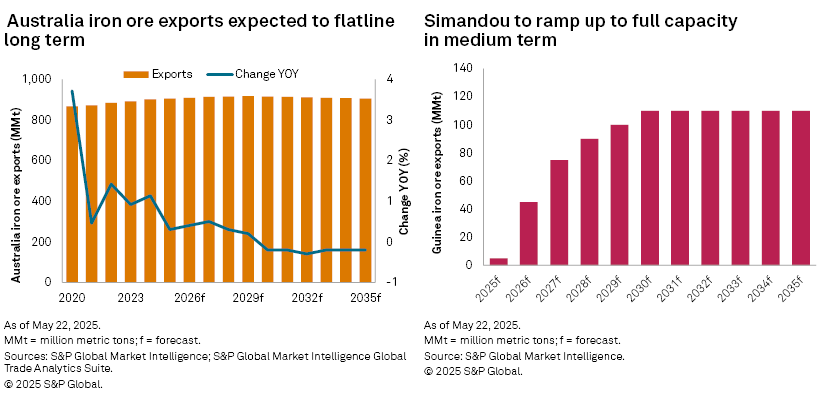

We expect significant seaborne iron ore trade surpluses to emerge from 2026, driven by the launch of the Simandou greenfield project in Guinea. The project is set to produce high-quality (65% Fe grade) iron ore suitable for blast furnaces (BF) and direct reduced iron (DRI) facilities, with a maximum potential output of 100-120 MMt/y once fully operational. However, due to substantial challenges associated with transportation infrastructure development, we have cautiously estimated that exports will reach 100 MMt only by 2029.

We anticipate that shipments from Australia, the world's largest iron ore exporter, will rise from an estimated 905 MMt in 2025 to 917 MMt by 2029. However, this increase is expected to be short-lived, with shipments projected to drop back to 905 MMt by 2035 due to mine depletion and declining ore grades. Rio Tinto Group has reportedly informed its customers that its flagship blended product will likely have a lower iron content in the future due to these challenges. In light of these developments, Platts has initiated a formal market consultation, which will run until May 30, to discuss potential adjustments to the specifications of the 62% Fe IODEX price benchmark, considering the quality deterioration in Western Australian iron ore fines. Platts is part of S&P Global Commodity Insights.

Furthermore, the high-grade iron ore project at Simandou may pose a competitive threat to Australia's miners with lower-grade products, especially as the steel industry moves toward decarbonization. To address this challenge, Rio Tinto — a significant stakeholder in the project — has indicated plans to blend some of the high-grade Simandou output with its Pilbara supply at ports in China.

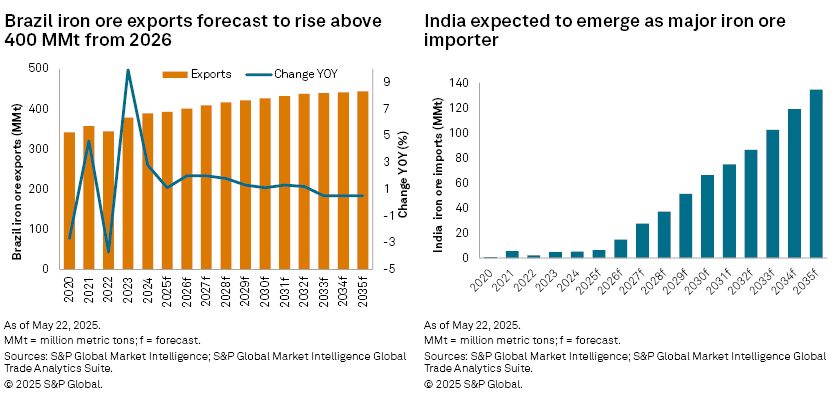

Brazil is expected to steadily grow in iron ore exports, rising from an estimated 393 MMt in 2025 to 444 MMt by 2035. This is supported by major investments at Vale SA's Carajas mines. Vale's production guidance for 2025 is set at 325-335 MMt, with an increase to 340-360 MMt in 2026. In December 2024, Vale's CEO highlighted the slow progress of decarbonization efforts in the global steel industry, leading the company to reduce its production expectations for agglomerates used in BF and direct reduction-based steelmaking processes to 60-70 MMt annually by 2030, down from an earlier expectation of 100 MMt. Brazil — alongside Russia, Ukraine and Sweden — is a key supplier of DR-grade iron ore and is well positioned to capitalize on growth in this sector.

India's status as a top iron ore exporter is expected to diminish in the near to medium term, driven by rising domestic consumption, a challenging mining taxation environment, and a decline in demand from China. At present, the majority of India's exports consist of low-grade iron ore (with iron content below 58%), which is likely to become less desirable over time due to increasing decarbonization pressures on steel manufacturers. As a result, we anticipate a drop in India's shipments from 35.9 MMt in 2024 to 10 MMt by 2027.

The recovery of Ukraine's iron ore exports has hit a standstill, with shipments declining 10.1% year over year in January–April. The ongoing conflict with Russia, combined with inflationary pressures and alterations in tax and energy policies, has resulted in a significant increase in production costs, which has adversely affected mining operations in Ukraine. The government has increased tariffs on gas and electricity, leading to the closure of Ingulets Mining in 2024. Additionally, Ferrexpo AG cut its iron ore pellet production by 26% year over year in the March quarter of 2025, operating just one of its four pellet lines as it implements cost-reduction strategies following the recent halt of value-added tax refunds. Given these challenges in Ukraine's mining sector, we anticipate an 11% decrease in total exports, projecting them to reach 30 MMt in 2025. By 2033, exports are expected to rise to 36 MMt, which remains below the prewar high of 46 MMt achieved in 2020, contingent upon a potential resolution of the ongoing conflict.

India, Southeast Asia and the Middle East are poised to be major contributors to the global seaborne iron ore import market in the long term, supporting the forecast increase in steel production in these regions. India is set to become a key importer of iron ore, with imports rising from approximately 5 MMt in 2024 to over 100 MMt annually by 2033 to sustain the significant expansion of its steel sector. Through its "National Steel Policy," India aims to achieve a production target of 300 MMt/y of crude steel by 2030. In Southeast Asia, the growth in steel capacity will be fueled by initiatives in Indonesia, Vietnam and Malaysia, which will utilize a combination of BF and DRI technologies.

As the steel industry faces increasing pressure to cut carbon emissions, the use of high-grade iron ore presents a viable solution to aid in decarbonization. Consequently, we expect the premium for high-grade iron ore (65% Fe) to increase in the long run. The DRI process, which employs natural gas and, more recently, hydrogen instead of coal, provides a cleaner alternative to the conventional BF-based steelmaking method, helping to lower emissions and promote decarbonization initiatives.

Europe's steel industry is poised to lead the shift away from BFs, transitioning to scrap-charged electric arc furnaces (EAF) and DRI modules. We project that DRI production in Europe will reach nearly 40 MMt by 2035. However, this growth will be overshadowed by a significant number of BF shutdowns across the region, leading to a decrease in overall iron ore demand, which we estimate will drop from 109 MMt in 2024 to 90 MMt by 2035. We expect similar trends in Japan, as the closure of BFs is expected to cause iron ore imports to decline from 96 MMt in 2024 to 79 MMt by 2035.

In the coming decades, recycling will play a vital role in the transition toward a low-carbon global economy. The increasing use of recycled steel scrap presents a significant challenge to the demand for iron ore. Europe is anticipated to experience the most substantial effects from the rising use of scrap in EAFs, especially as the traditional BF-basic oxygen furnace steelmaking method is gradually phased out. Additionally, China is likely to see the emergence of a growing scrap supply over the next 10 years. However, to address the country's currently low scrap recovery rate, increased investment in capital equipment and technology will be necessary, along with government support to maximize the sector's contribution to decarbonization.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.