Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Aug, 2023

In the monthly Iron Ore Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the iron ore market within the broader macroeconomic environment and provides supply, demand and price forecasts for a rolling five-year period.

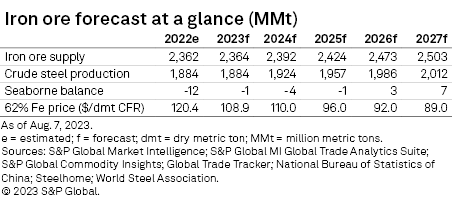

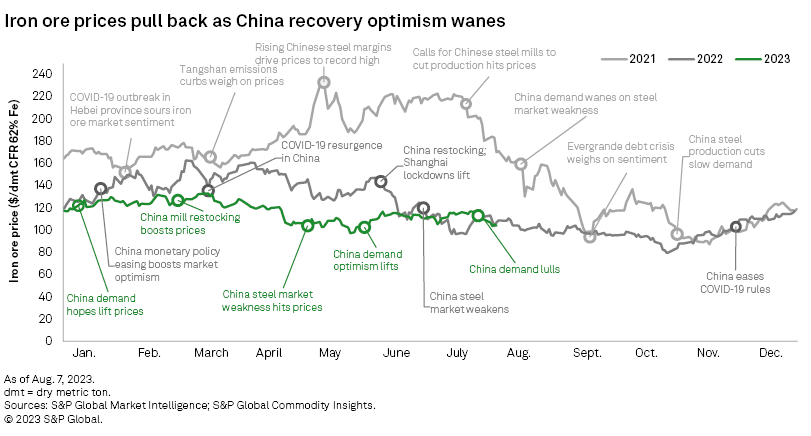

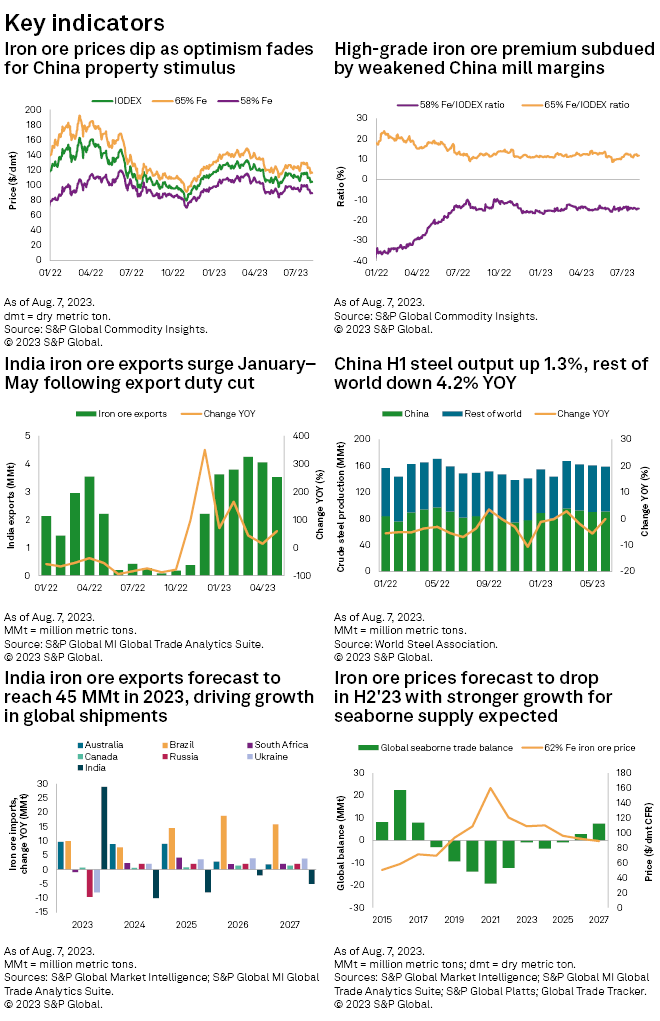

➤ The Platts IODEX 62% Fe iron ore price fell 11.1% from a three-month high July 25 to $103.75 per dry metric ton (dmt) Aug. 3 as the market was underwhelmed by the support announced for the domestic economy during China's July 23–24 politburo meeting.

➤ Steel mill margins in China moved back into negative territory in early August, helping to keep a lid on the premium from high-grade iron ore fines.

➤ Chinese demand for overseas iron ore held steady from late July into early August amid tightening domestic supply, although purchases from port stocks by mills are starting to wane as mills in Shandong province scale back their sintering operations.

➤ Seaborne iron ore supply came in above expectations in the first half, with year-over-year growth in shipments from Australia, Brazil and India, with India plugging the gap from lost supply from Russia and Ukraine.

➤ We forecast iron ore prices to trend down over the second half to average $105.00/dmt in the September quarter on steel production curbs to address emissions or oversupply in China and on weak demand elsewhere.

Analyst comment

Having hit a three-month high of $116.75/dmt July 25, the Platts IODEX 62% Fe iron ore price dropped to $104.80/dmt Aug. 8 on fading optimism around the outlook for China's economy. The iron ore market had been pinning hopes on further stimulus to boost China's flagging economic recovery ahead of the July 23–24 politburo meeting presided over by President Xi Jinping. While support for the economy was forthcoming, the scale of the stimulus was somewhat underwhelming, which weighed on iron ore and China's steel prices in early August.

The State Council cited boosting economywide consumption as a key lever for growth, following up with 20 detailed measures, including support for the domestic automotive market through easing of restrictions on vehicle purchases. Some observers were disappointed about most stimulus measures being aimed at subsidizing manufacturers rather than boosting domestic consumer purchasing power. China's manufacturing malaise meant that the country's key purchasing managers' indexes were in contractionary territory in July, weighed by sagging domestic consumer confidence.

The downturn in the property sector is a major drag on China's economy and shows few signs of abating anytime soon. With buyers remaining on the sidelines, new home sales by China's 100 largest property developers slumped 33% year over year in July, while the decline in property investment accelerated to 7.9% year over year in June. Government support for first-time home buyers was recently announced, although a city-based approach to target local property markets seems to be the preferred route. Support for the real estate sector is therefore not likely to translate into large-scale property development that will revive steel demand. The sector is estimated to account for about 40% of China's annual steel consumption. We forecast China's finished steel demand to fall 1.2% year over year in 2023, with consumption in the real estate sector expected to decline the most.

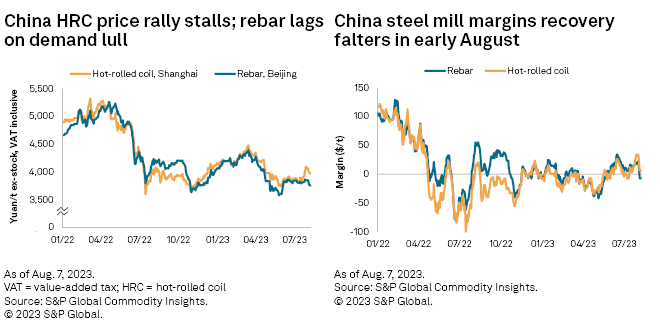

This steel demand weakness has helped halt the recovery in domestic steel prices, which have been falling since late July. A lull in exports is adding to the pressure on prices while the lifting of emissions-related curbs to production in Tangshan in early August will add further tonnage to the already oversupplied domestic market. China's steel production in the first half of 2023 rose 1.3% year over year to 535.6 million metric tons (MMt) while production in the rest of the world fell 4.2% as economic growth slowed.

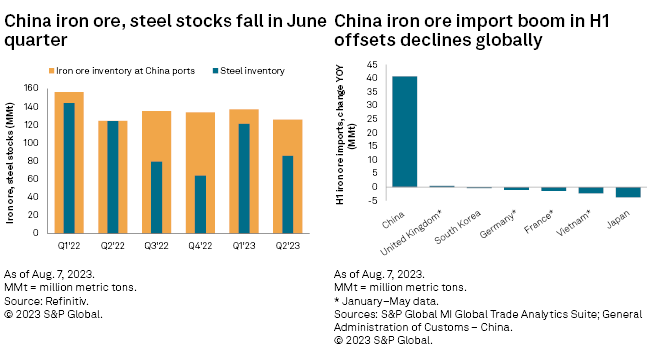

China's robust steel output growth fueled a 40.7-MMt year-over-year rise in first-half iron ore imports, while demand for overseas iron ore was reported to be holding steady late July and early August amid tightening domestic iron ore supply. The recent heavy rains and flooding in northern China negatively impacted transportation of domestic iron ore supplies and steel. Iron ore purchases from port stocks by mills have waned despite the Tangshan mill restarts, as mills in Shandong province have reportedly scaled back sintering operations. China steel mill margins moving back into negative territory in early August, however, helped keep a lid on the premium from high-grade iron ore fines.

Seaborne iron ore supply came in above expectations in the first half. Australia's exports rose 4.3% year over year in June to a monthly record of 81.4 MMt. This lifted first-half shipments by 13.1 MMt to 441 MMt, with China increasing its share of Australian trade to 85.2%. Despite falling 6.4% month over month in July, Brazil's exports edged up 0.7% year over year to 32.1 MMt, with January–July exports running 15.4 MMt higher year over year at 201.4 MMt. While the ongoing conflict has curtailed exports from Russia and Ukraine, India has helped to plug the gap, with exports surging 56.9% year over year to 19.2 MMt in January–May. Following India's strong start to the year, we have significantly upgraded our forecast for its iron ore exports to reach 45 MMt in 2023 from 16 MMt in 2022.

Outlook

We forecast iron ore prices to trend downward over the second half of 2023, averaging $105.00/dmt in the September quarter before dropping to $94.00/dmt in the December quarter. We anticipate curbs to steel production through the end of the year, whether to rein in emissions or to lower stocks in China and on the back of weak demand elsewhere in the world. As a result, the pace of China's iron ore imports is expected to slow in the second half amid the prospect of cuts in domestic steel production intensifying toward year-end, while strong growth is expected in shipments from Brazil, Australia and India through the second half of 2023 and into 2024.

Platts IODEX 62% Fe is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.