Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2017 | 12:30

Highlights

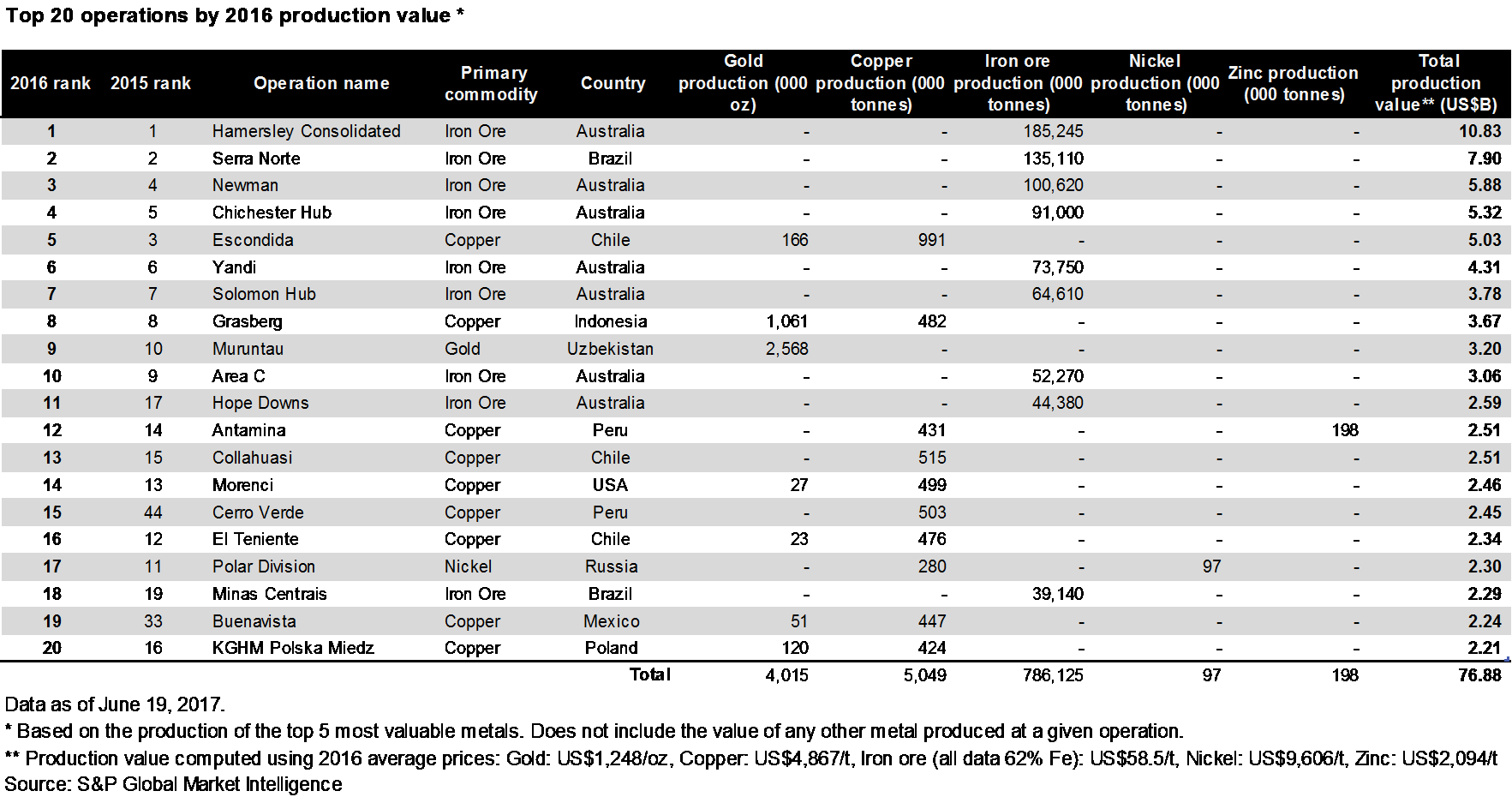

Iron ore and copper account for the lion's share of the world's largest metal mines, as measured by the extracted value.

Measured by the value of globally mined metals (excluding coal), gold and iron ore are the most important commodities, valued at around U.S.$120 billion each in 2016, followed by copper with almost U.S.$100 billion. Zinc and nickel are valued at less than U.S.$30 billion and U.S.$20 billion, respectively.

In a few different reports, we have ranked the world's mines that produce these five metals by production levels in 2016, and we have also ranked mines by their production value. This was done by taking last year's production for each of these five metals and multiplying by the corresponding annual average spot price.

The global mined production of saleable iron ore grew an estimated 1.3% last year to reach almost 2,100 Mt (dry). This was led by the 20 largest iron ore operations, which boosted output 2.9% year-on-year.

Despite the lower iron ore prices last year, Rio Tinto's Hamersley operation is the world's most valuable mining enterprise (although it actually comprises seven mines), and iron ore operations account for the top four places of the world's mines by value. Indeed, iron ore accounts for seven of the top ten operations across the five metals, and nine of the top 20 places. Because of its important iron ore mines, Australia accounted for six of the top ten operations by value.

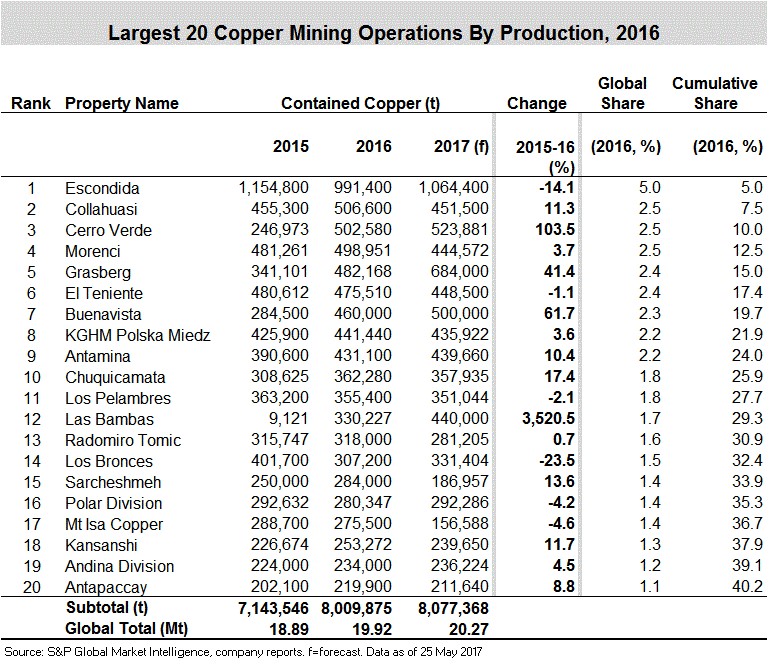

Global mined copper production grew 5.4% last year to reach over 19.9 Mt, led, like iron ore, by the largest 20 operations, which reported an 8.3% year-on-year increase in 2016. With copper prices holding up relatively well, copper operations accounted for nine of the top 20 mining operations by value.

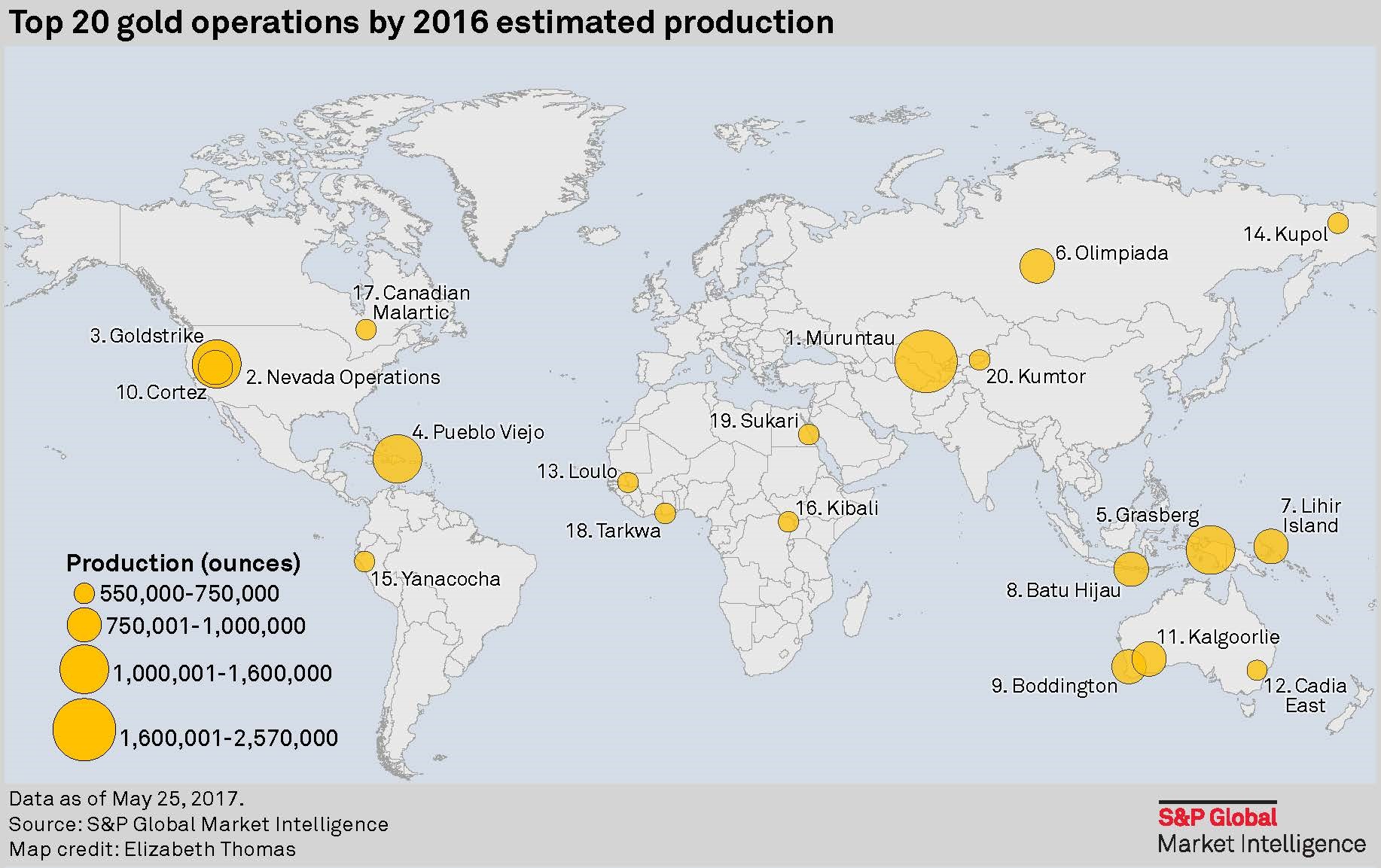

The dominance of iron ore and copper left only one gold mine, Navoi Mining's Muruntau, and one nickel operation. Norilsk's Polar Division, in the leading group of 20 most valuable mines. As for iron ore and copper, it was the biggest gold mines that reported the largest percentage increases in production last year. Although global mined gold production rose only 1% to 96.3 Moz in 2016, the top 20 mines recorded a 5.8% rise to 17.9 Moz.

Turn our mining analysis into strategic insights for your business. Learn more about our global metals & mining solution.